- Bitcoin HODLing endures amid rising hopes of a long-term rally.

- Issues might prove even higher for BTC HODLers in 2024

Bitcoin [BTC] holders are over the moon, so to talk, or a minimum of hoping that the most recent rally will rocket to the moon. A typical phrase used for max positive factors. The rally is a refreshing flip of occasions contemplating that bulls have struggled to make sense of the marketplace for roughly three months.

How a lot are 1,10,100 BTCs value right now?

Again with a bang!!!

The BTC bulls are again in full swing. And the proof for this was the king coin’s sturdy upside. The subsequent few months, particularly 2024 might prove attention-grabbing. Thus, you will need to assess how BTC is laying the groundwork for that future.

A latest Glassnode evaluation of the state of Bitcoin revealed that HODLing is intensifying. Greater than 600,000 BTC has remained dormant for the final 10 years. That is essential as a result of it’s a increased quantity than the BTC that’s accessible on exchanges. The implications of that final result are clear.

Based on Glassnode, there are actually 600,000+ extra Bitcoin that haven’t moved in 10+ years than there are on exchanges. pic.twitter.com/KCuOwF32C5

— Will Clemente (@WClementeIII) October 25, 2023

The truth that there was a decrease variety of BTCs in exchanges meant that the cryptocurrency’s ground worth was rising. It additionally meant that the value was changing into extra delicate to liquidity flows. This can be a state of affairs that might lend itself to a bullish spiral.

Particularly if we contemplate exterior developments equivalent to inflation and the specter of financial collapse which make BTC extra related than ever as a substitute.

Bulls usher in greed as traders amid rising hopes of the following main rally

The rising optimism for Bitcoin was particularly evident now that 2023 has about two months earlier than its conclusion. Many merchants are conscious that 2024 might be the 12 months that Bitcoin actually takes off notably as a consequence of ETFs and the following halving.

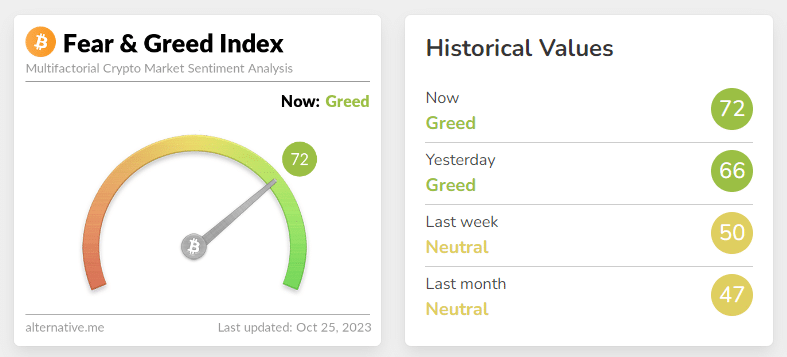

A convergence of occasions might be the rationale for the increase within the present confidence stage as seen in Bitcoin’s concern and greed index.

Supply: Various.me

Whereas the rising confidence might be taken as a great factor, it was additionally value noting that the market nonetheless stays topic to the throws of volatility. Sudden pullbacks are certain to happen alongside the best way.

Whereas the hopes of restoration stay excessive, the state of the normal finance phase might additionally define BTC’s sturdy future. Proper now the world is fighting inflation and the West is struggling to maintain the financial system afloat.

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Extra persons are changing into conscious of the possibly darkish financial instances forward as confidence in TradFi diminishes. Due to this, many individuals are embracing Bitcoin as a secure haven for when TradFi lastly breaks.