- USDC has seen elevated swaps as extra Bitcoin leaves exchanges.

- BTC quantity reaches nearly a three-month excessive as transactions go up.

Worry, uncertainty, and doubt (FUD) about Bitcoin stemming from the collapse of a single financial institution contributed to its downward development earlier this week.

But, the failure of yet one more financial institution could have reversed the general public’s opinion and introduced again help for the king coin. Nevertheless, Bitcoin could have been affected otherwise by the Silicon Valley financial institution run that triggered a drop in USDC.

Learn Bitcoin (BTC) Value Prediction 2023-24

The Silicon Valley Financial institution run

The California Monetary Establishments Management Board closed Silicon Valley Financial institution, a big financial institution for startups with enterprise capital backing. It was the primary financial institution insured by the FDIC to go bankrupt in 2023.

The California regulator has designated the FDIC because the receiver to safeguard insured financial savings, though the explanation for the shutdown is unknown. SVB, one of many 20 largest banks within the U.S. by whole belongings, financed a number of startups specializing in cryptocurrencies.

Individuals’s reactions to the SVB failure recommend uncertainty is the present prevalent temper. The method of withdrawing belongings for patrons with $250,000 or extra has sparked discussions based mostly on a thread by Mark Cuban (an American businessman) and the next feedback.

As well as, Circle introduced in a press release that over $3 billion of its $40 billion was held by SVB. One other damaging response has been the flight of USDC holders exchanging their holdings for different stablecoins and Bitcoin.

Bitcoin sharks and whales step up accumulation

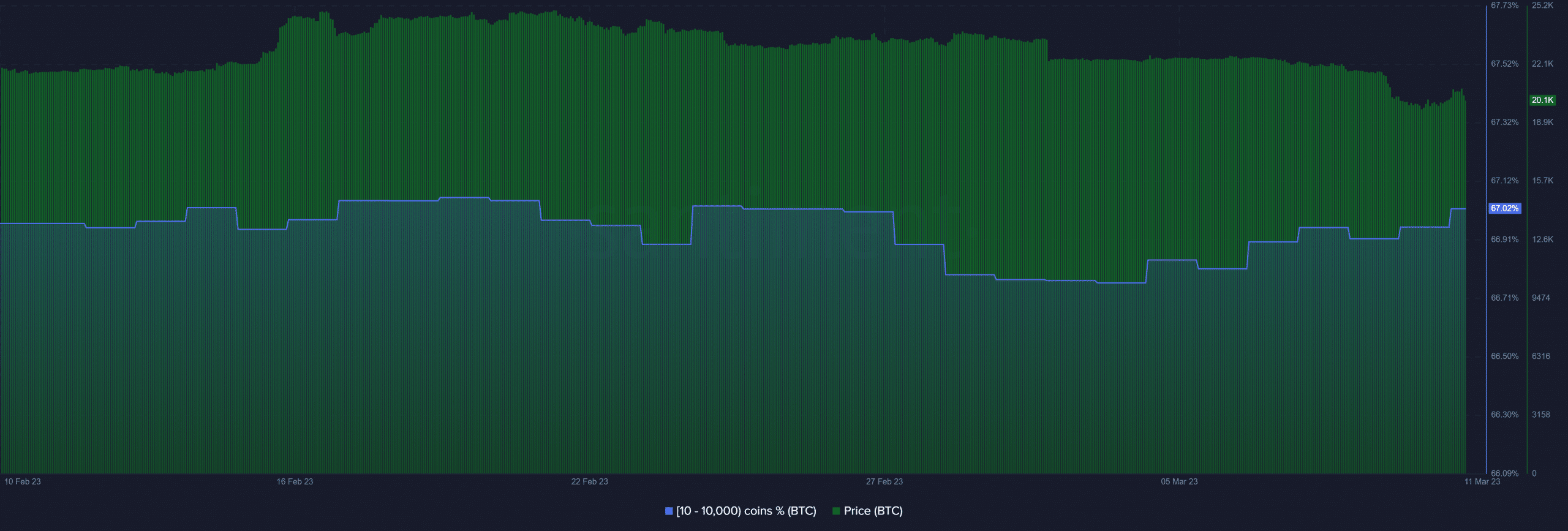

In response to Santiment statistics, the buildup of whales and sharks continued regardless of the FUD that was attributable to the Silvergate crash.

As of this writing, addresses with 10-10,000 BTC had risen to over 67%. Wanting on the knowledge, it’s clear that on 11 March, there was an upswing in whale and shark accumulation, coinciding with the time that USDC was experiencing a capital flight.

Supply: Santiment

BTC quantity goes up a notch

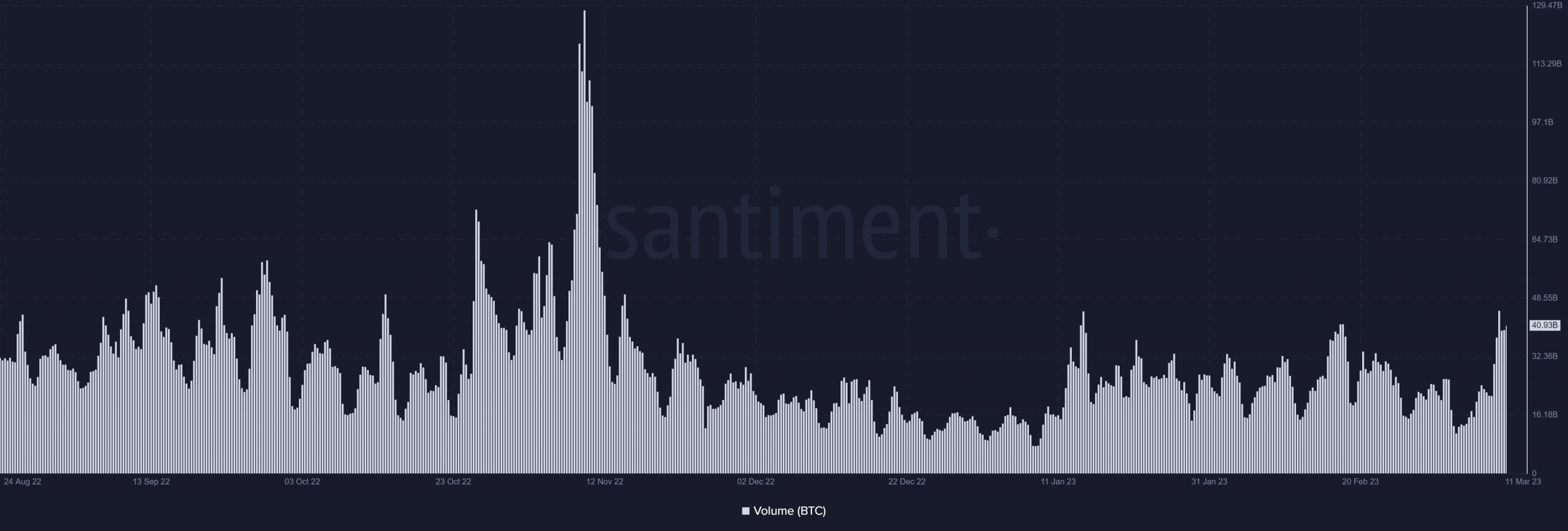

As well as, the quantity metric on Santiment revealed some intriguing actions. By 9 a.m. UTC on March 11, BTC quantity had already reached 45 billion, and by 17:00 UTC, it had reached 35 billion.

This quantity is notable as a result of it’s the highest Bitcoin has seen since December. There may be little doubt that this can be a signal of an increase in enterprise exercise. There have been greater than 39 billion as of this writing.

Supply: Santiment

Bitcoin Outflow turns into dominant

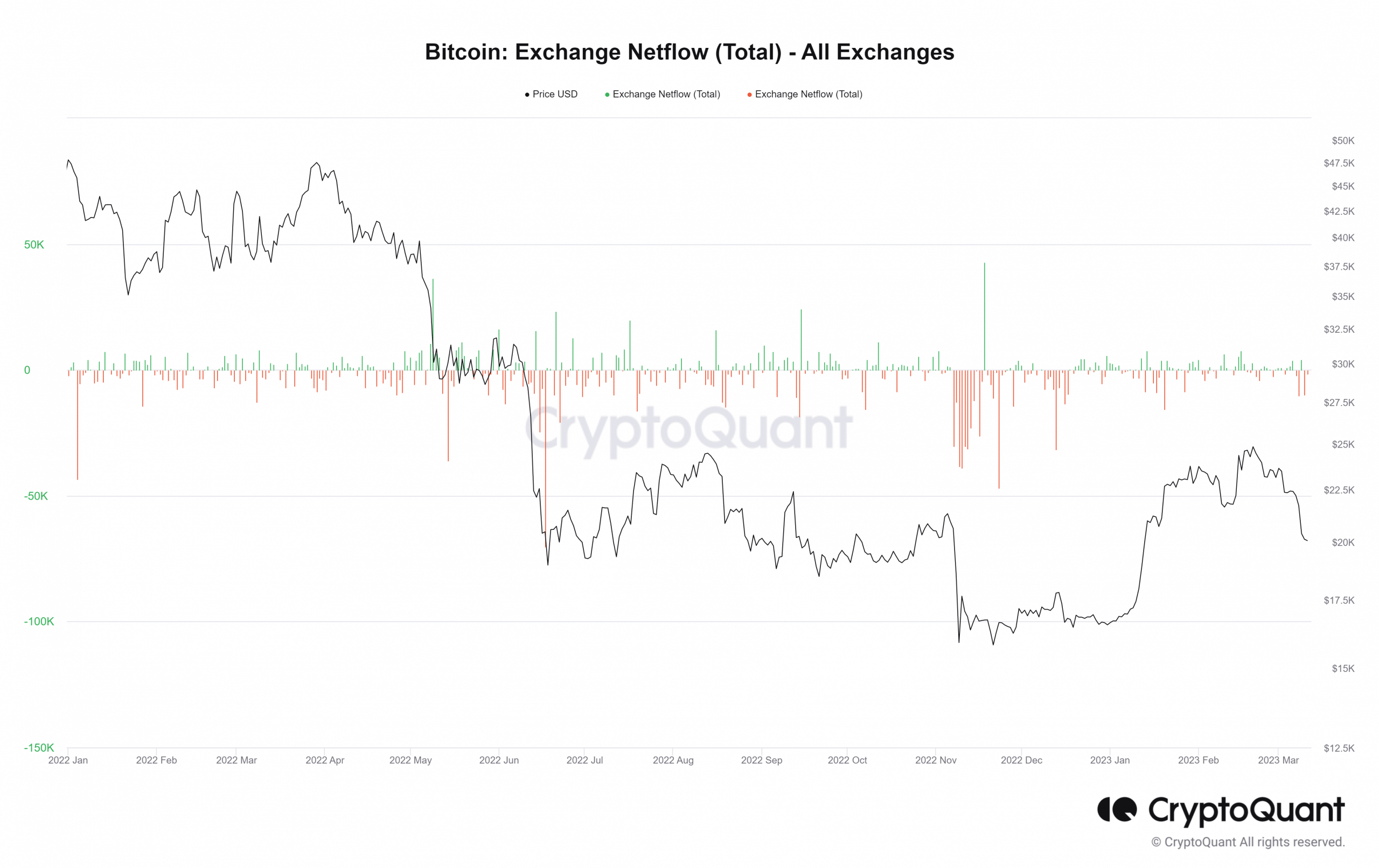

Even when the quantity of trades has elevated, most tokens have left exchanges. Increasingly Bitcoin (BTC) holders are transferring their cash off exchanges due to the persevering with swap with USDC.

CryptoQuant’s Netflow measure exhibits that on 10 March, extra BTC left the system than entered; this development persevered as of this writing.

Supply: CryptoQuant

A story of two costs

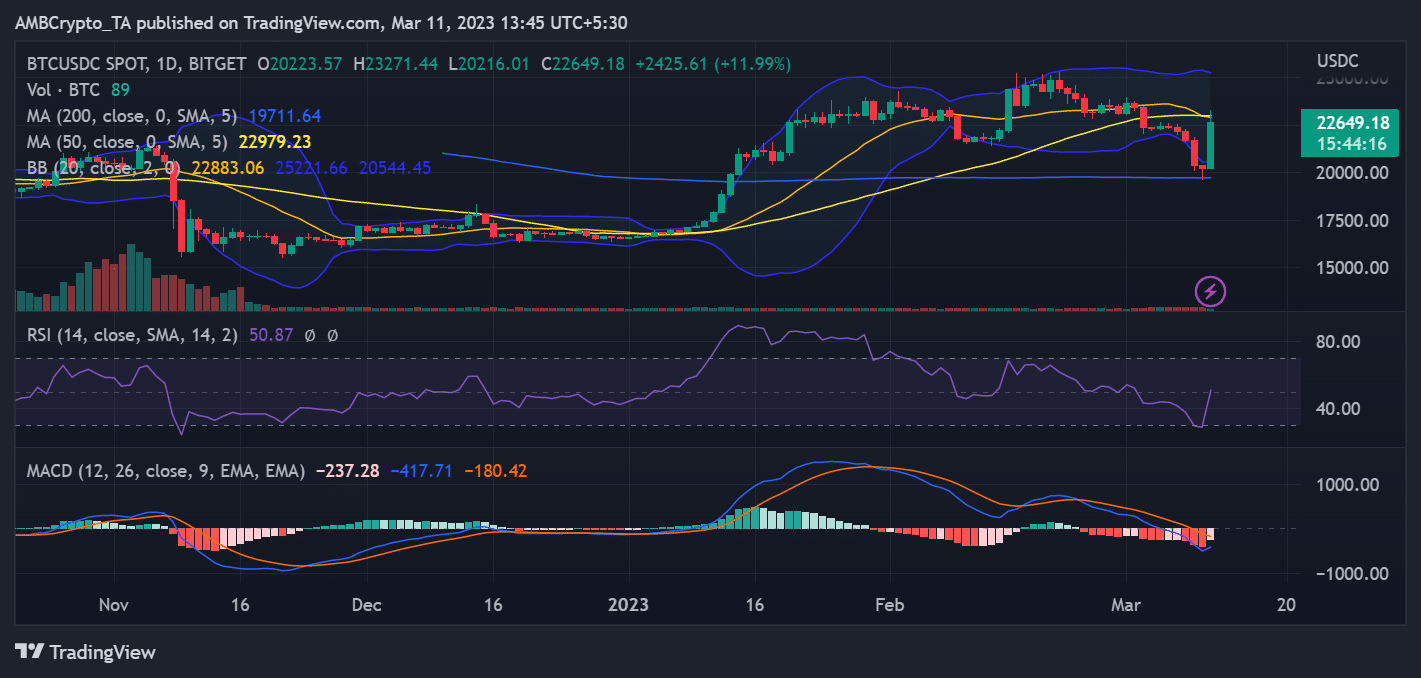

Wanting on the spot value of BTC/USDC on the time of writing, we will see that BTC has elevated in worth by greater than 11% on a each day timeframe. On the time of writing, one Bitcoin was price roughly $22,600 on the present USDC trade fee.

Supply: TradingView

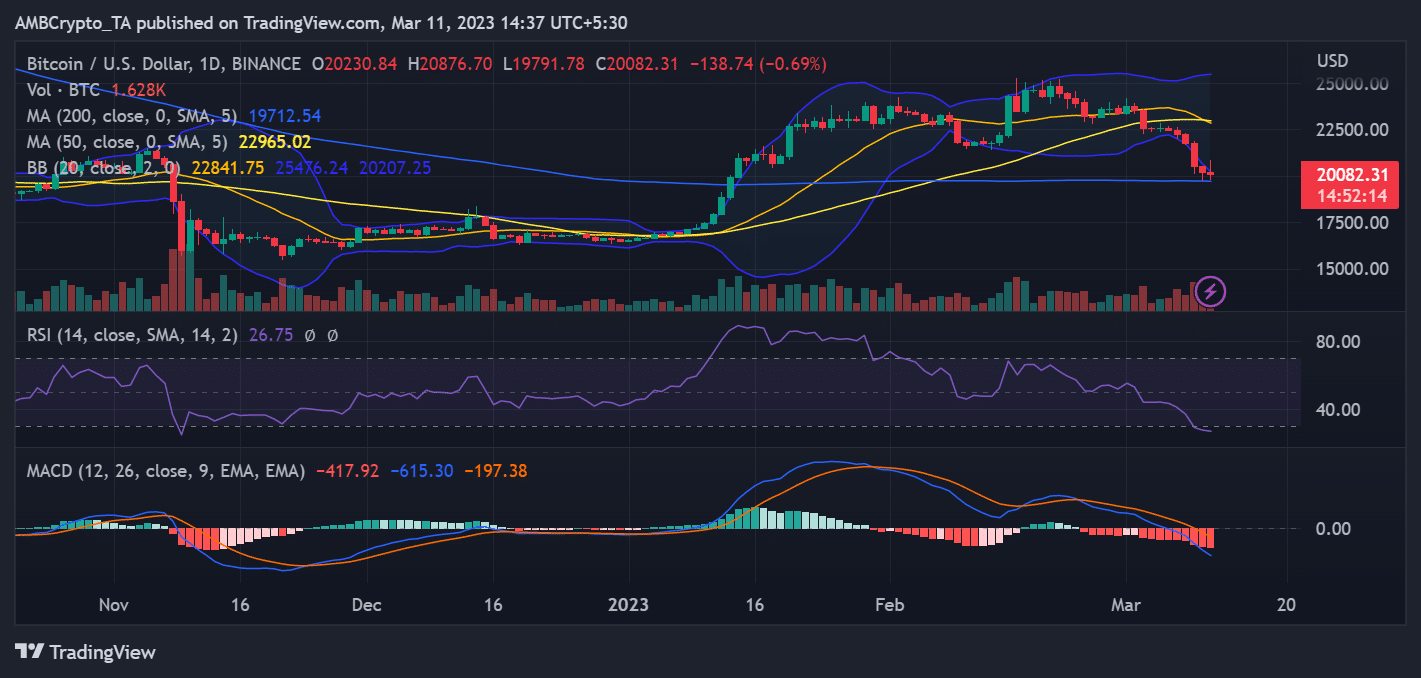

But, on a each day timeframe, the BTC/USD spot value confirmed that it had misplaced nearly 1% of its worth, buying and selling at round $19,900 and $20,000.

Supply: TradingView

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

A potential indicator of the diploma of interdependence between typical finance and cryptocurrency is the general public’s response to the SVB failure, which was centered on Bitcoin and stablecoins.

Even so, Bitcoin confirmed that, regardless of its volatility, it might be a viable different retailer of wealth.