On-chain knowledge exhibits that Bitcoin miners have been depositing giant quantities to exchanges. Right here’s what this might imply for the asset’s value.

Bitcoin Miners Have Been Depositing Massive To Exchanges Not too long ago

An analyst in a CryptoQuant post identified that BTC miners have been transferring cash out of their wallets not too long ago. The related indicator right here is the “miner outflow,” which measures the entire quantity of Bitcoin miners withdraw from their mixed provide.

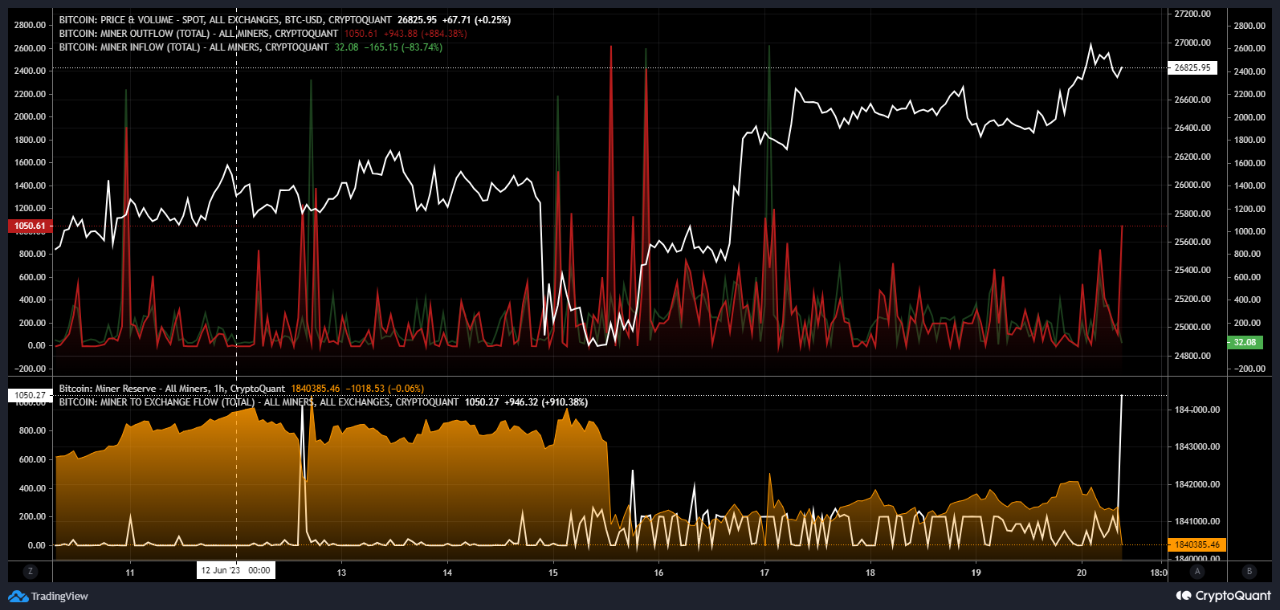

The counterpart metric, the “miner influx,” naturally retains observe of the reverse circulation of cash. Here’s a chart that exhibits the development in each the Bitcoin miner outflow and the influx over the previous few days:

Seems like the worth of one of many metrics has been elevated in current days | Supply: CryptoQuant

The above graph exhibits that the Bitcoin miner outflow has noticed a spike in the course of the previous day, whereas the influx has remained comparatively low. This is able to indicate that the miners have transferred a internet quantity of cash from their wallets on this interval.

Typically, every time miners withdraw cash from their wallets, there’s all the time a danger that they’re doing so to promote mentioned cash. Such promoting can naturally have a bearish impact on the cryptocurrency’s worth.

One technique to higher guess the intent behind these withdrawals is by checking whether or not the vacation spot of the cash is a centralized trade platform.

The chart additionally exhibits the info for the Bitcoin miner to trade circulation. This indicator particularly retains observe of the cash flowing from these chain validators’ holdings to trade wallets.

This indicator has additionally seen a pointy spike similtaneously the miner outflow surge. The magnitude of each spikes can also be just about the identical; each are barely above 1,000 BTC. Thus, nearly all of the outflows from the previous day seem to have headed towards exchanges.

Figuring out that there have been deposits to exchanges solely tells us part of the story, nevertheless, because the indicator used right here doesn’t specify which sort of platforms the inflows have been in direction of.

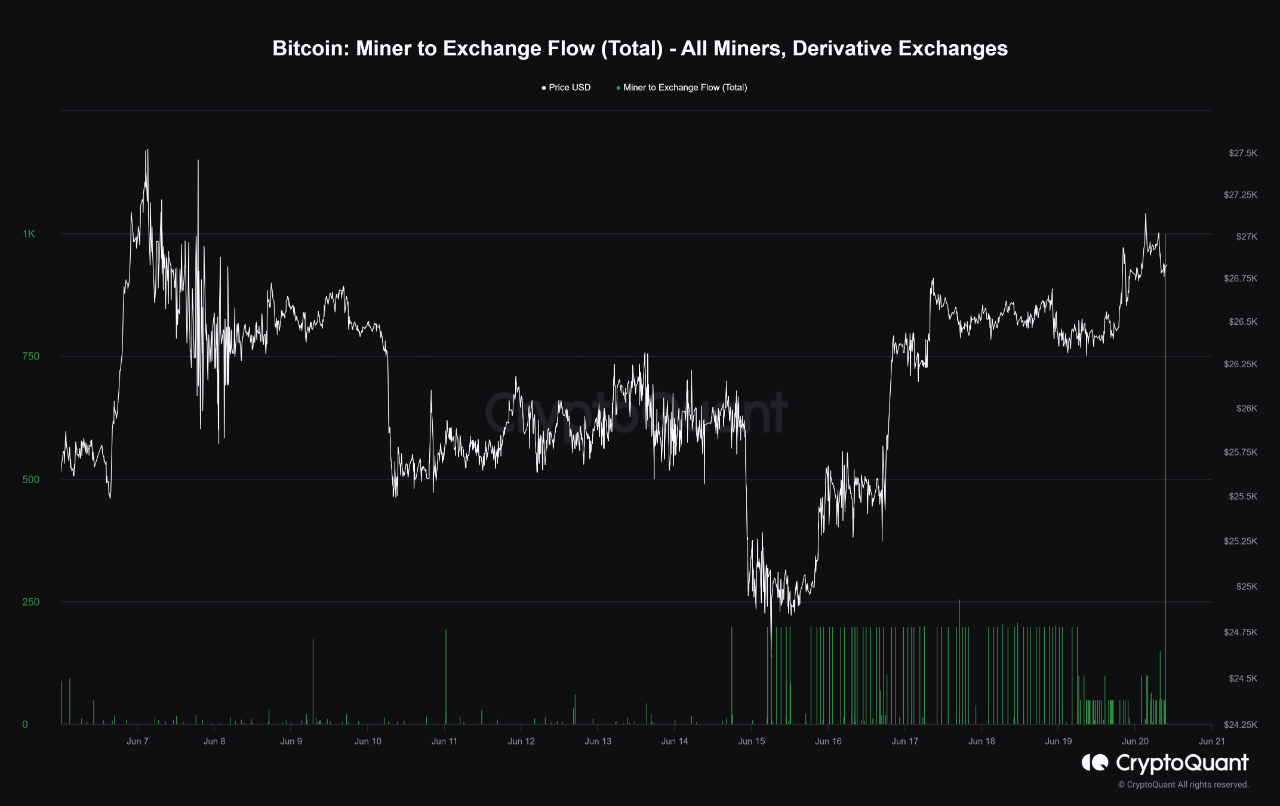

A modified model of the indicator, which solely tracks deposits to by-product exchanges, reveals that the transfers have been nearly fully towards the by-product platforms.

The worth of the metric appears to have spiked not too long ago | Supply: CryptoQuant

When miners plan to promote their cash, they make deposits to identify exchanges. Since they’ve despatched their Bitcoin to by-product platforms as a substitute this time, it could appear possible that the intent behind their transfers might not have been promoting in spite of everything.

As for what impact this might need in the marketplace; often extra by-product positions being opened often ends in greater value volatility. Nonetheless, this volatility can go both bullish or bearish, relying on the broader sentiment.

BTC Worth

On the time of writing, Bitcoin is buying and selling round $27,400, up 6% within the final week.

BTC has noticed an uplift at present | Supply: BTCUSD on TradingView

Featured picture from Michael Förtsch on Unsplash.com, charts from TradingView.com, CryptoQuant.com