Bitcoin (BTC), the oldest and largest cryptocurrency community, is coping with a controversial new function that’s dividing neighborhood opinion. Launched in January 2023, the Bitcoin Ordinals protocol has brought on a rise in transactions on Bitcoin. Described by some as Bitcoin NFTs, Ordinals convey a brand new sort of utility to the Bitcoin community that has instantly resonated with customers. It has, nevertheless, courted controversy as a result of it’s each resulting in congestion on the community and isn’t designed to be a fee resolution (verify World Coin Stats for up to date knowledge and efficiency metrics on Bitcoin, in addition to different cryptocurrencies).

Bitcoin is a decentralized, encrypted decentralized digital forex switch community. Utilizing blockchain expertise, it permits for permissionless peer-to-peer transactions without having to make use of intermediaries. It was created in 2008 by pseudonymous creator Satoshi Nakamoto and was launched in 2009 as open-source software program.

The Bitcoin community has utility as a medium to facilitate non-public transactions. It has been used for peer-to-peer funds, POS service provider gross sales, and on-line funds. Additionally it is used for investments. The asset powering the community, bitcoin or BTC, has a digital gold-like worth proposition. It has a restricted provide of 21 million cash, so it has shortage. Additionally it is extremely safe and has a hard-coded emission launch schedule.

What Is A Bitcoin Sat?

Ordinals principle powers the controversial new Ordinals protocol. Ordinals principle defines satoshis (sats) as an atomic unit that may be recognized and traded individually on the Bitcoin community. There are 100 million sats that make-up 1 Bitcoin. Bitcoin sats are ordered based mostly on their sequence of mining, and this ordering quantity which uniquely identifies a satoshi, is the ordinal quantity.

These sats are uniquely identifiable, and may subsequently be inscribed with digital content material. This functionality is the core of the Ordinals mannequin. As soon as inscribed, an Ordinal-powered sat can turn out to be an immutable digital collectible. It may be connected to pictures, textual content, and a wide range of different property.

Ordinals had been enabled by November 2022’s Taproot improve. Taproot enabled the Ordinals protocols and has opened the door for fungible or non-fungible tokens to be issued on the Bitcoin community.

There are a selection of various use circumstances Ordinals can energy. They’ve primarily been used to create non-fungible tokens (NFTs) however they’re now gaining recognition as a strategy to difficulty fungible tokens. Ordinals energy the BRC-20 normal which resembles Ethereum’s widespread ERC-20 normal.

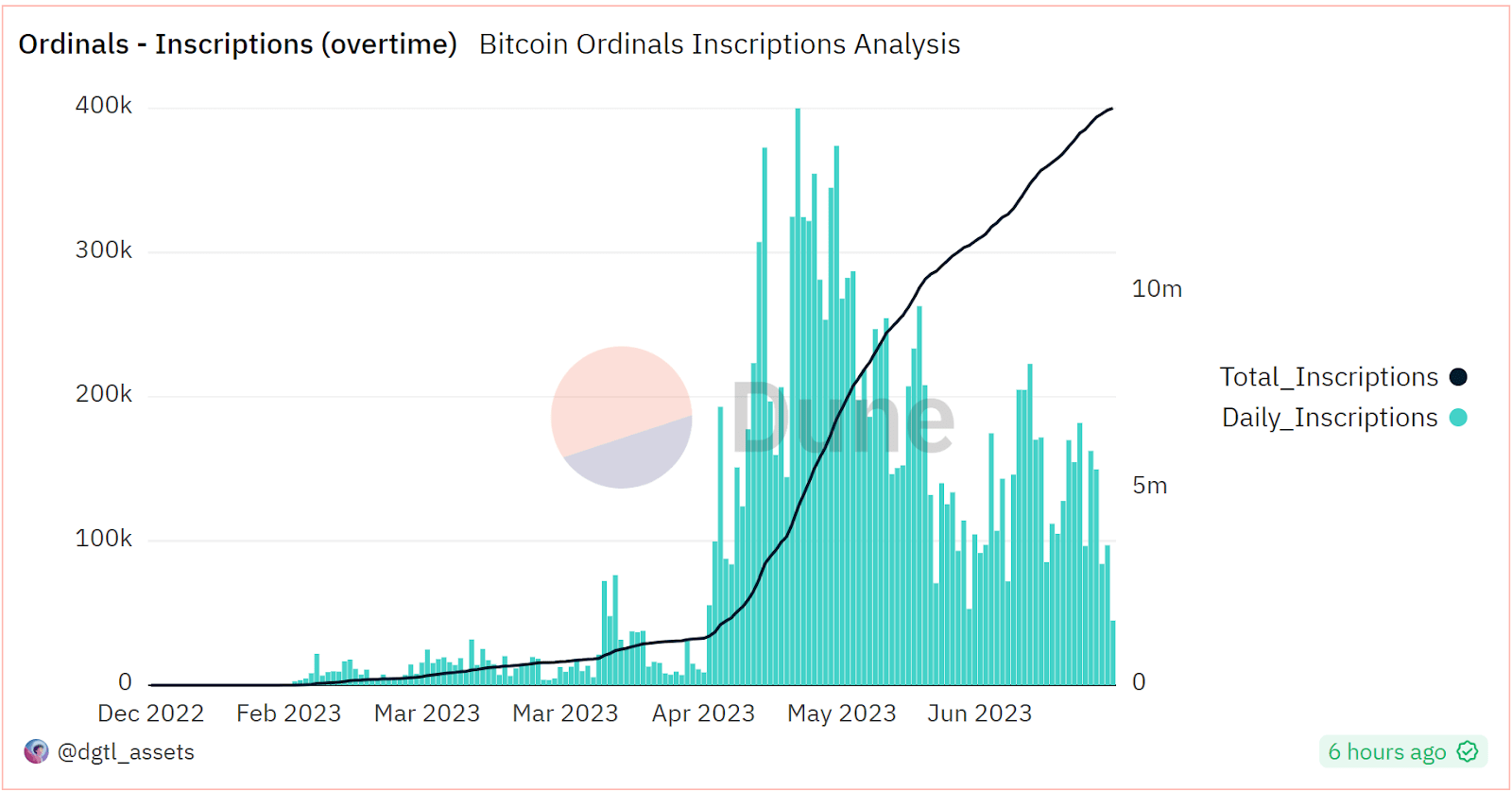

*Supply: Dune Analytics, @dgtl_assets*

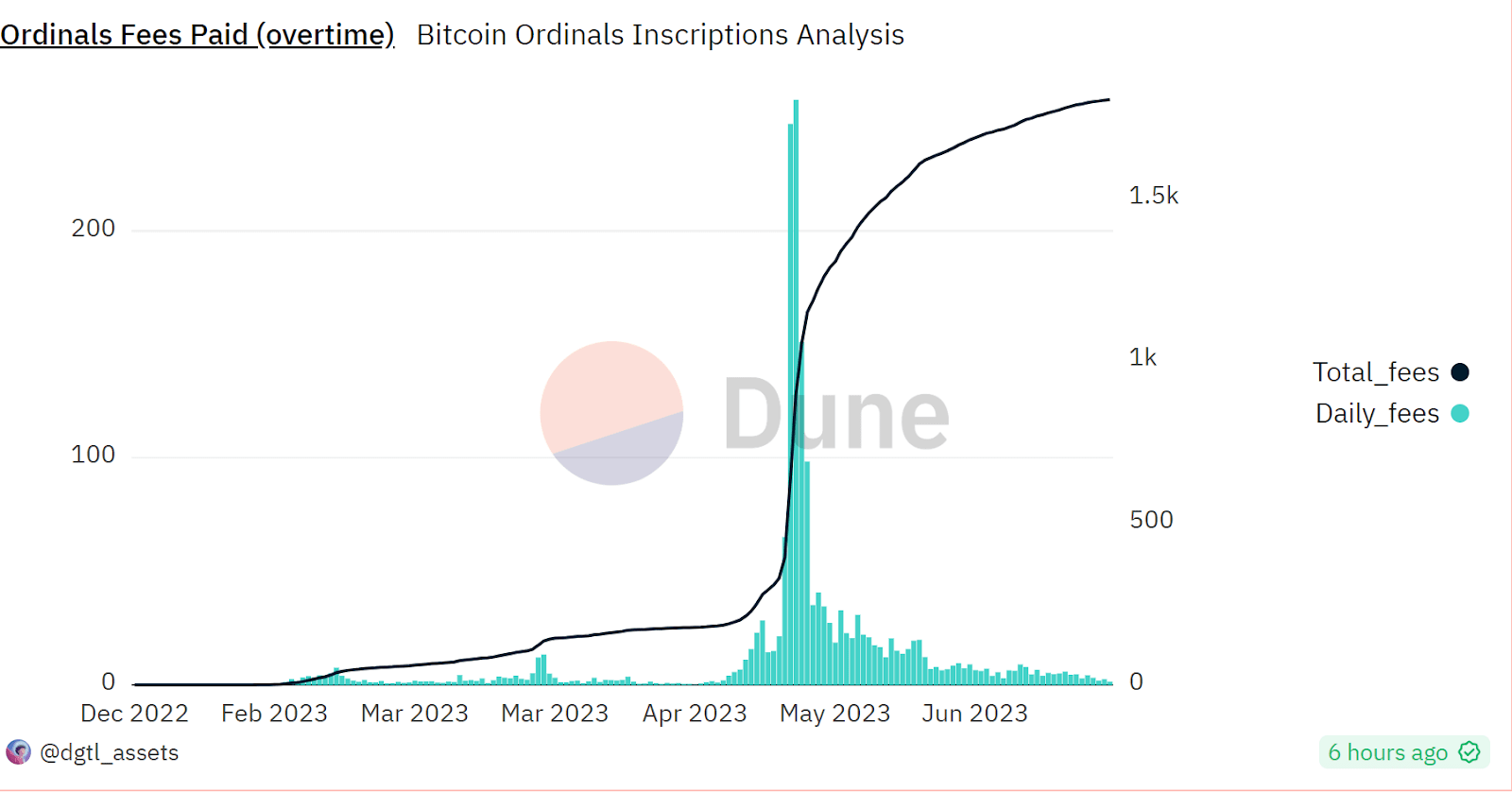

*Supply: Dune Analytics, @dgtl_assets*

The full variety of Ordinals inscriptions has exploded for the reason that third week of April. There are usually round 100,000-200,000 new Ordinal inscriptions being made every single day and there are actually over 14 million inscriptions within the wild. This quantity has greater than doubled since Could fifteenth.

Significantly by way of charges being generated, the momentum of Ordinals has dropped off significantly for the reason that mid-Could peaks. Ordinals are not at all lifeless, nevertheless, and are nonetheless being activlely created on a regular basis.

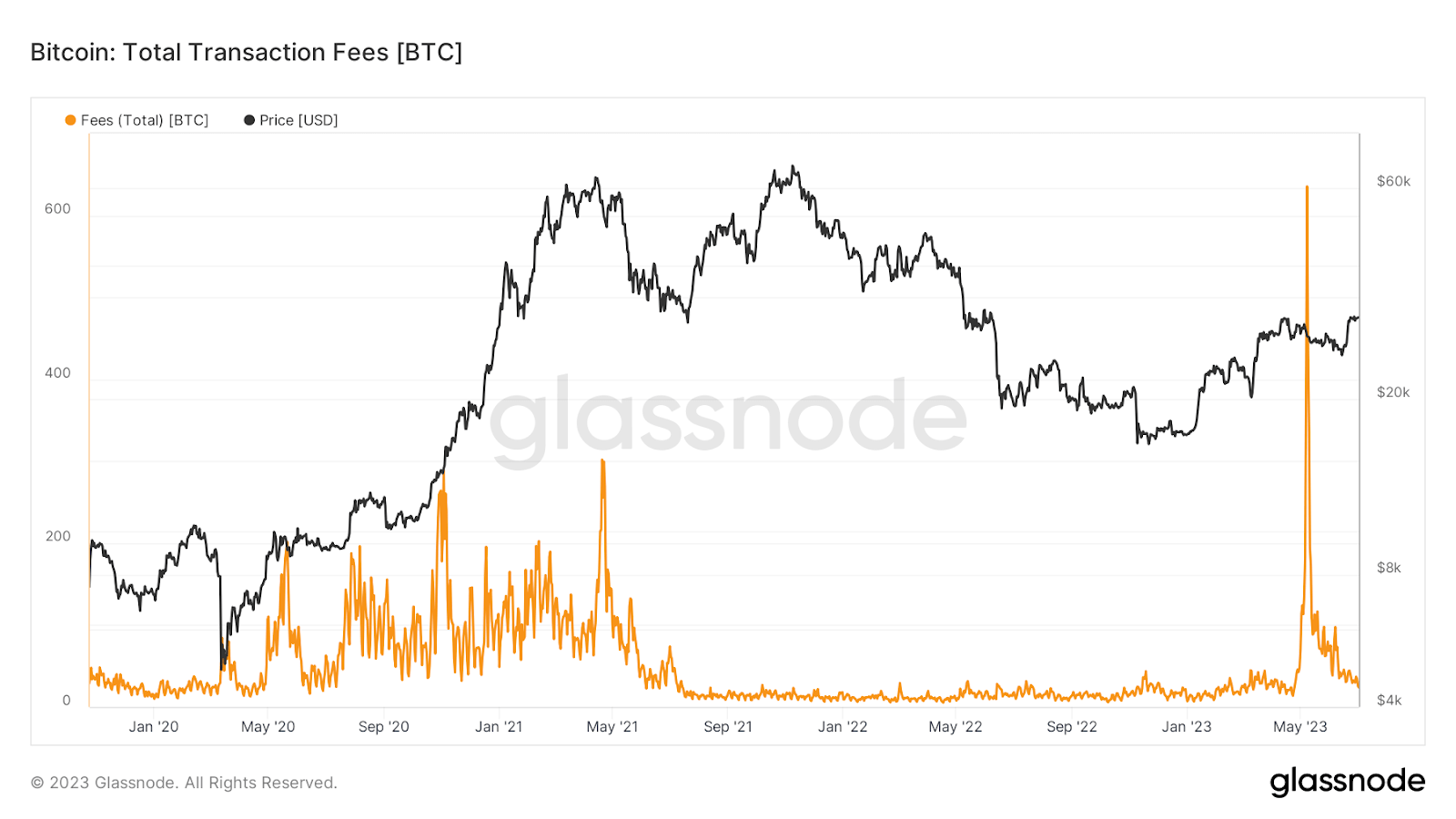

*Supply: Glassnode, charges on the Bitcoin community surge*

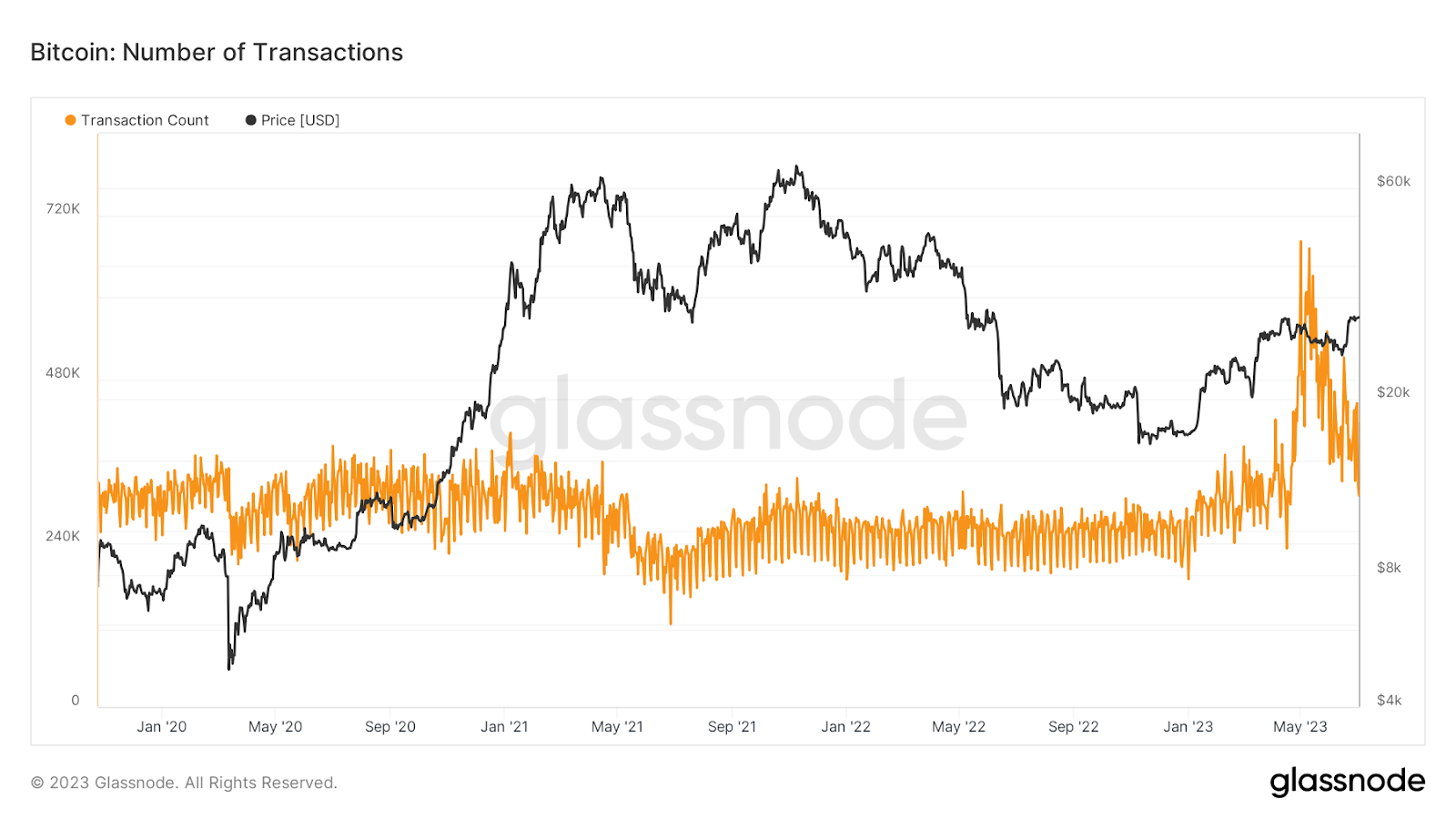

*Supply: Glassnode, Transaction rely on the Bitcoin community explodes*

The same sample may be noticed with general community exercise on the Bitcoin chain. Bitcoin ordinals triggered a sudden sharp uptick in exercise on the community in mid-Could. This exercise ultimately fell away and the sharp peaks couldn’t be maintained. Exercise on the Bitcoin community, nevertheless, stays greater than pre-Ordinals ranges.

Bitcoin Ordinals Clogging The Community

The emergence of Ordinals has had a transparent affect on the broader Bitcoin protocol. Whereas it has boosted transaction exercise and elevated demand to work together with Bitcoin, it has additionally bloated the community to the purpose of incapacity. The scalability of Bitcoin is but once more being questioned, with Ordinals now affecting the flexibility of Bitcoin to satisfy its major operate of peer-to-peer fee transactions.

One of many components resulting in Ordinals bloating the community is the NFT measurement. Ordinal interactions are layered and may require near Bitcoin’s max capability of 4mb, normal Bitcoin transactions solely take up a couple of kilobytes. The rationale the Ordinals NFT measurement is so giant is that they retailer knowledge straight on-chain as a substitute of pointing to a separate bodily asset.

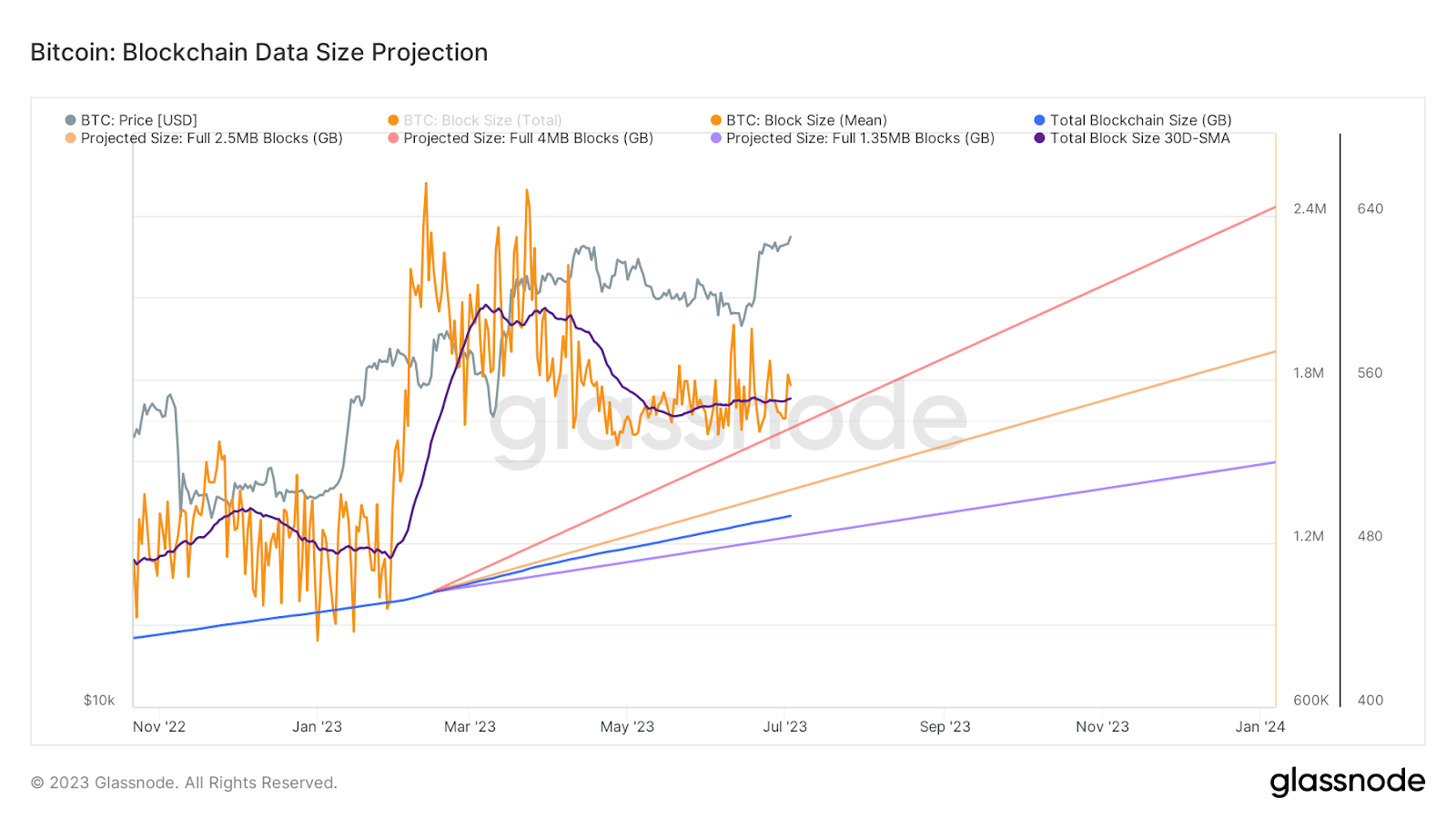

On June seventeenth, onchain knowledge supplier GLASSNODE’s Twitter account reported that considerations that the recognition of the Ordinals protocols would bloat the Bitcoin chain measurement to unfeasible ranges, had been exaggerated. The Onchain knowledge supplier has mentioned that the Bitcoin block measurement remains to be rising at a manageable fee of 1.89MB per block. Because of this future node runners will nonetheless have the ability to obtain the Bitcoin with out extreme {hardware} necessities.

It’s noticeable that the transferring common of the full Bitcoin block measurement has leveled off significantly for the reason that launch of Ordinals in January 2023. This means Ordinals creators have developed methods to effectively create Ordinals and launch them to the community.

Ordinals pushes Bitcoin additional with the inception of BRC-20s

<span>Glassnode has not too long ago reported that,</span> for less than the fifth time in historical past, the typical price per block exceeded the block subsidy. The final occasion of this occurring was the 2017 market peak. In all 5 of the historic circumstances, excessive charges eased and the community normalized. Glassnode say that the price increase was pushed by the recognition of the BRC20 normal, enabled by the Ordinals protocol.

Transaction charges reached 6.66BTC, nicely above the 6.25BTC block reward. This made the full miner reward a staggering 12.9BTC per block or ~US$348,000.

BRC-20 was created by nameless developer Domo. They’re just like Ethereum’s ERC-20 customized token mannequin however should not powered by good contracts. Because of this they don’t seem to be capable of be plugged into decentralized purposes or have a number of features like Ethereum tokens. Customers can presently solely mint, deploy and switch tokens.

Not all Ordinals are BRC20s however all BRC20s are Ordinals. Whereas there are hundreds of thousands of Ordinals there are round 35,000 BRC20s. The market cap of BRC20s has rapidly risen to ~US$163 million however has dropped from peak ranges hit late Could and early June.

BRC20s operate utilizing JSON to provoke easy token contracts, create new tokens and transfer tokens round. The restricted performance has meant that they’ve turn out to be a well-liked strategy to difficulty meme cash that are designed to don’t have any utility and act extra as neighborhood badges. A few of the largest BRC20s embrace PEPE, MEME, and BRUH. Ordi–the biggest BRC20–has a market cap of ~US$149 million and is listed on exchanges reminiscent of Crypto.com and Gate.io.

BRC20s and Ordinals have created controversy due to how they’re stressing the community. There are additionally naysayers who imagine that Ordinals are tainting the community as a result of they don’t seem to be aligned with Satoshi’s model of a peer-to-peer decentralized cash switch community. They think about Ordinal transactions as spam.

Essentially the most well-documented of the restrictions of Bitcoin’s Proof-of-Work community consensus is a scarcity of scalability. Blockchains like Bitcoin face scaling challenges as a result of each node within the community has to confirm and execute each transaction. That is computationally intensive and costly.

Developments within the Ordinal House

* Multichain NFT market Magic Eden introduced on June twenty seventh that it might start supporting buying and selling of BRC20 tokens. It’s going to permit customers to commerce BRC-20 tokens on a secondary market and also will features a launchpad for customers to create their very own tokens that may then be tradeable on Magic Eden. The Magic Eden BRC-20 launchpad shall be a premium service with advertising and marketing and technique assist for creators.

* An NFT from the favored Ethereum assortment, cryptopunks, has been burnt after which symbolically tied to an Ordinal NFT. The transfer was one thing of a publicity stunt by a gaggle of Bitcoiners however however clearly identifies the grassroots recognition of Ordinals. On June seventeenth, Cryptopunk #8611 offered for 55 Ether or ~US$110,000 in right now’s costs.

This NFT was then put to relaxation in a well known inaccessible Ethereum handle which additionally incorporates US$24.7 million value of Ether (~12,598 ETH). Cryptopunk #8611 was then ‘recreated’ as Ordinal inscription 12,456,749 which seems similar to Cryptopunk #8611. The choice to burn and recreate was a community-led effort by a gaggle referred to as the Bitcoin Bandits, which has issued a set of Western-themed collections of Ordinals inscriptions. 150 individuals contributed to the Cryptopunk conversion trigger. The Bitcoin Bandits say that after CryptoPunk #8611 is ceremonially despatched to a digital pockets that belongs to Satoshi Nakamoto, in a a technique journey just like a burn, they may launch a particular Ordinal NFT assortment.

* Litecoin, alongside Bitcoin, has been having fun with an Ordinal pushed enhance in transaction exercise. In February a developer introduced Ordinals to Litecoin round a month after they arrived on Bitcoin. Litecoin Ordinals are accessible on marketplaces like liteverse.io. On Could twenty third, 2023 the Litecoin Basis mentioned that the three million inscription mark was formally reached on the community. Litecoin is a fork of Bitcoin created in 2011. The value of LTC is up ~40% within the final two weeks. The Litecoin block reward halving, a significant bullish basic halving which happens each 4 years, is anticipated to happen in 28 days.

Totally different approaches to scaling – The main Bitcoin layer-2’s

Not less than within the brief time period, Ordinals are right here to remain. Exterior of blocking the protocol, there’s doubtlessly one other means across the congestion and scaling points – layer-2 expertise. Unique base layer applied sciences like Bitcoin and Ethereum have had historic challenges with scaling and breaking down when dealing with stress. This led to the constructing of Layer-1 and Layer-2 infrastructures.

Layer-1 protocols like Bitcoin and Ethereum could be a base layer that interacts with a third-party layer-2 protocol. The layer-2 takes computational load away from the bottom chain and leaves it to deal with duties like verification and finality.

# The Lightning Community

The Lightning Community is a Bitcoin layer-2 that may buffer the community in periods of congestion. The conception of the Lightning Community started in 2015 when Joseph Poon and Tadge Dryja started work to resolve the excessive charges of the Bitcoin community, a key ache level for customers of the blockchain. In January 2016, a whitepaper for the Lightning Community was printed and builders started engaged on options for layer 2 which had a Satoshi-driven deal with fee channels.

Inside a few years, a beta model of the Lightning Community was launched. The core of the protocol is enabling the creation of a peer-to-peer fee channel between two friends on the Bitcoin community. As soon as the channel is established, the 2 transacting events can switch an infinite variety of transactions cheaply and rapidly. This makes it helpful for smaller fee transactions that could be beleaguered by excessive charges and wait instances of base layer Bitcoin.

Solely interactions just like the opening and shutting of a channel are recorded on the primary Bitcoin chain. The Lightning Community has nodes that confirm transactions throughout friends inside a channel, this frees up the capability of major Bitcoin community nodes. The Lightning community has the additional advantage of decreasing the environmental output of Bitcoin.

The lightning community can also be able to routing transactions by combining particular person channels of involved funds. It might probably additionally consolidate transactions. That is when two channels selected to complete transacting. All of the transactions are recorded after which despatched to the Bitcoin mainnet.

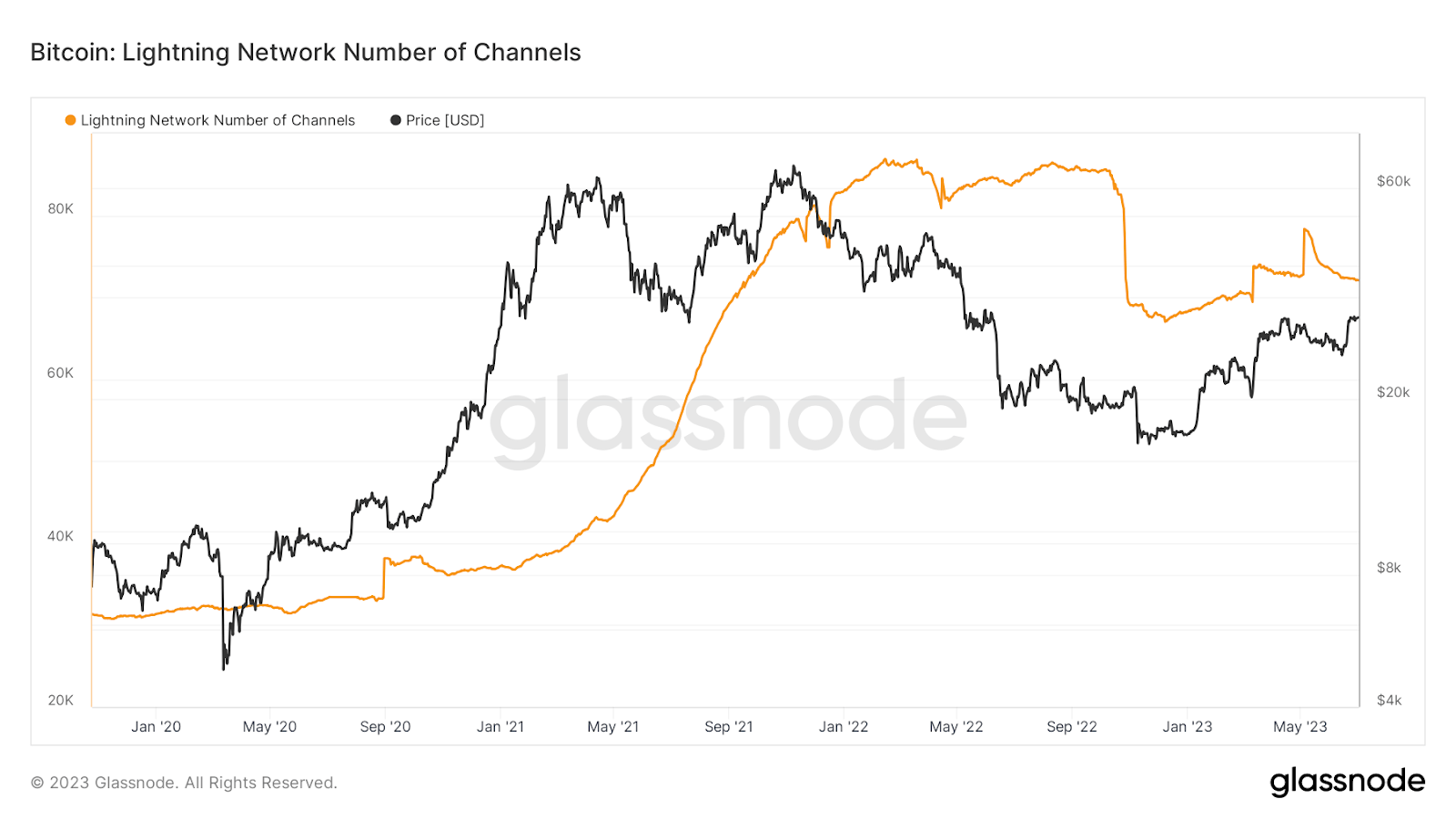

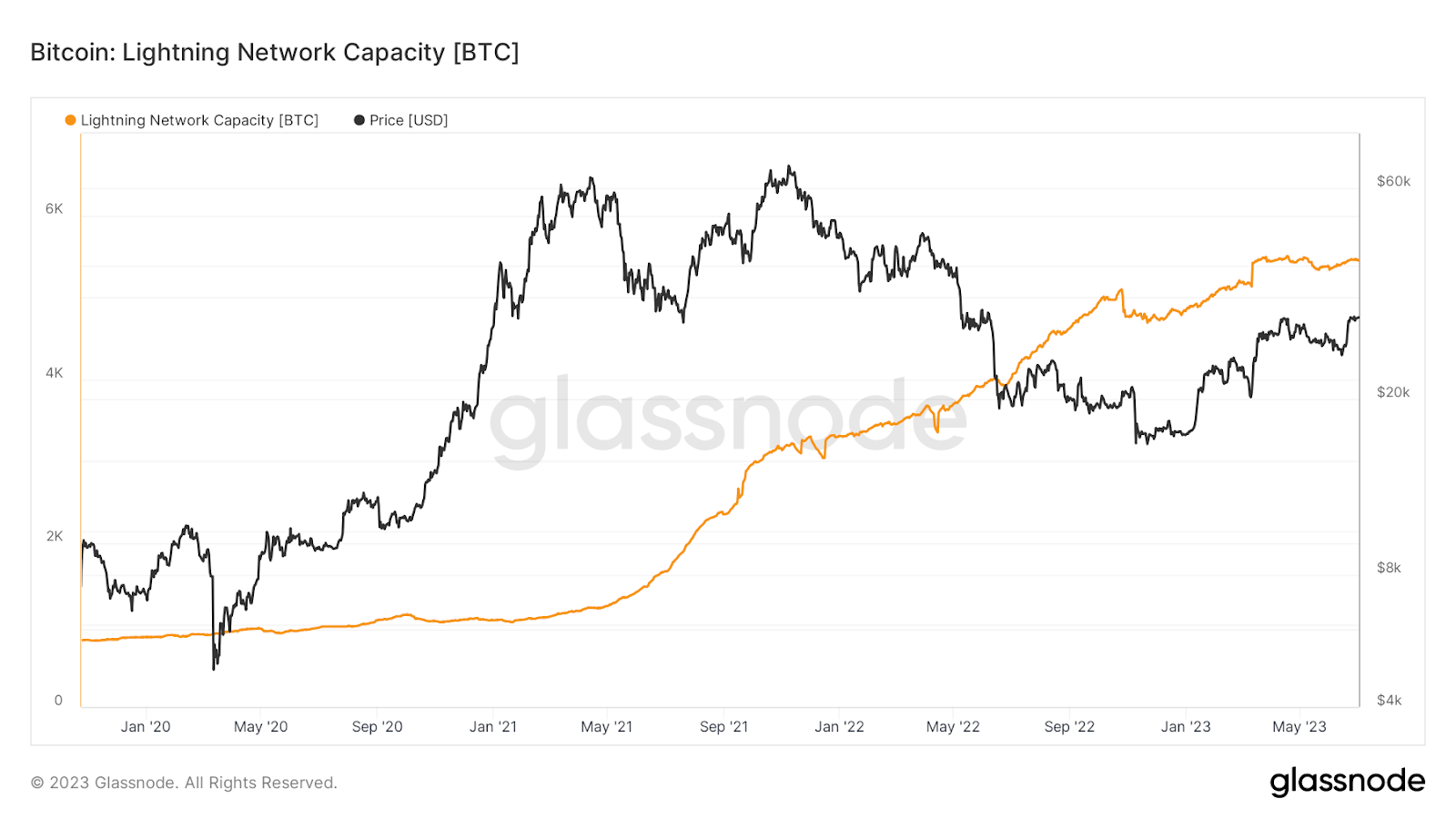

*Supply: Glassnode*

*Supply: Glassnode*

The variety of channels and the quantity of Bitcoin tied to the Lightning Community rose sharply in 2022 however has considerably stalled to this point in 2023.

The Lightning ecosystem has a wide range of instruments for node administration, wallets, funds, and gaming designed so as to add performance. They embrace —

* Pool: They assist to handle liquidity wants for Liquid customers

* Taro: A instrument to difficulty or mint property on the Lightning Community

* Faraday: a knowledge analytics instrument that helps node operators optimize channels and the circulation of funds

* Lightning Community Daemon: A Lightning Community node implementation instrument

* Neutrino – A lightweight consumer specification to permit non-custodial Lightning wallets to confirm transactions privately, trustlessly, and a full sync to the Bitcoin blockchain.

# The Stacks Answer

Stacks is one other layer-2 blockchain resolution that connects with Bitcoin via a singular ‘Proof-of-Switch’ (PoX) mannequin. Stacks goals to spice up the utility of Bitcoin by permitting extra computationally intensive actions like Good Contract and Decentralized Purposes (Dapps). Stacks has a local token, STX, designed to align incentives throughout the community.

Stacks was based as Blockstacks in 2013 earlier than a rebrand in 2020. The venture was based by Muneeb Ali and Ryan Shea who met at Princeton College’s Pc Science Division. Blockstacks first model focuses on changing the reliance on centralized cloud service suppliers seen throughout the smartphone and browser app markets. It was a decentralized id knowledge storage resolution that leveraged the Bitcoin blockchain.

In January 2021, the Stacks 2.0 mainnet was launched. This allowed customers to deploy good contracts and decentralized purposes (Dapps) on the Bitcoin blockchain.

A key promoting level for Stacks is its distinctive “Proof-of-transfer” (PoX) consensus mechanism that straight ties to the Bitcoin blockchain. PoX requires miners to spend Bitcoin to take part in miner elections and create a brand new block on the Stacks blockchain. PoX is tied 1-for-1 with Bitcoin.

Miners ship BTC to set addresses for an opportunity to validate transactions and mine the subsequent Stacks block. Basically bidding with BTC to have an opportunity to mine the subsequent Stacks block. The PoX mannequin resembles the Proof-of-Burn (PoB) mechanism utilized by tasks like Slimcoin. Not like PoB the place Bitcoin is shipped to a burn handle, with PoX BTC is shipped to be distributed to STX stakers.

This mannequin signifies that Stacks validators compete based mostly on Bitcoin that’s bid, versus computational sources, as is the case with the Bitcoin base chain’s Proof-of-work mannequin. Increasing PoW with out creating greater vitality consumption, greater prices and ready is extraordinarily difficult. PoX is designed to be an expansionary system for the Bitcoin community. It’s depending on Bitcoin’s output for each block

Stacks is completely different from the Lightning Community as a result of it isn’t designed to be a peer-to-payment fee resolution. It’s centered on creating an enlargement of Bitcoin that enables Bitcoiners to work together with a wise contract and dapps. On this sense it’s much less aligned with the unique Bitcoin imaginative and prescient than different scaling options.

However, there seems to be an inevitably about options like Stacks. As Bitcoiners have noticed cash flowing into Good Contract pushed sectors like NFTS and Gamefi, they probably need a piece of that motion.

STX is up a powerful ~204% year-to-date, displaying vital and outpacing many different digital property. Over the identical interval, BTC is up ~63%.

# Ck-BTC

Courageous New Coin not too long ago interviewed Dominic Williams from the DFINITY Basis (a significant contributor to the Web Pc) about Ck-BTC, a singular new implementation of layer-2 Bitcoin.

ckBTC, a model of Bitcoin constructed on the Web Pc, is a multi-chain Bitcoin ‘twin’ that’s cryptographically secured 1:1 with actual Bitcoin. It’s created by a pair of open-source, verifiable good contracts, which permits for cross-chain transactions to remain utterly decentralized.

The Web laptop is a blockchain community that may be a set of protocols that permit impartial knowledge facilities around the globe to band collectively and supply a decentralized different to the present centralized Web cloud suppliers.

Williams says that because of chain-key ECDSA and threshold cryptography, “Web Pc good contracts can create their very own Bitcoin addresses and signal bitcoin transactions on the Bitcoin community. This can be a key distinction: there aren’t any bridges or centralized custodians concerned. ICP is among the many first blockchains to carry out direct integrations with different blockchains.”

In 2022, the DFINITY R&D staff developed a framework for ICP to straight talk with different blockchains like Bitcoin and Ethereum by designing a brand new protocol for threshold ECDSA (Elliptic Curve Digital Signature Algorithm). The protocol is detailed on this analysis paper. The protocol’s design works with a trustless means of computing ECDSA signatures utilizing a cryptographic multi-party protocol, with canister good contracts controlling ECDSA signing keys on a public blockchain.

ckBTC permits Bitcoin transactions to be built-in into a wide range of good contract-based decentralized purposes. This contains messaging app OpenChat. “Each OpenChat account doubles as a crypto pockets. Because of this OpenChat customers can ship ckBTC as prompt chat messages. When you overlook your buddy’s birthday or must pay again somebody for dinner you’ll be able to simply ship them a message with ckBTC connected and they’ll obtain it immediately. ckBTC can all the time be redeemed for BTC, there’ll by no means be a liquidity difficulty or a bridge exploit.” Williams defined.

Williams additionally acknowledged that the increase of the Ordinals protocol has emerged as a chance for merchandise like ckBTC. “Multi-chain options like ckBTC can permit the Bitcoin community to operate whereas Ordinal NFTs develop in recognition, I believe it’s a optimistic. We wish extra individuals to make use of blockchain expertise and we now have the options to cater for greater than only one use case.” Williams additionally defined that his staff is working in direction of constructing a Bitcoin Ordinals market that may make the most of ckBTC as a fee technique.

Conclusion

The emergence of the Bitcoin Ordinals protocol in current weeks has ushered in a brand new paradigm for the Bitcoin community. This one, like those earlier than it which led to occasions like the larger block debate and Segwit, is full of promising alternatives but additionally formidable challenges. Whereas the recognition of the Ordinals has died down, it has nonetheless modified the community without end, producing essential questions surrounding the scalability and utility of Bitcoin.

One of many vital alternatives offered is to the Bitcoin layer-2 ecosystem – options which are designed to assist it with its scaling challenges. Now greater than ever, Bitcoin wants assist scaling, given the inflow of latest transactions affecting the person expertise of the community.

As with all innovation,nevertheless, it is essential to stay conscious of the potential trade-offs and challenges forward. Layer 2 options are sometimes seen as distractions that fragment the community. Probably, funding and growth that might in any other case go into Bitcoin could also be going into layer 2 options, and a few argue that this can be a detriment of the primary chain. Quite a few layer-2 creates competitors for worth, whereas ideally, all worth ought to be flowing into Bitcoin.

Bitcoin at the moment stands because the gold normal of cryptocurrency and can probably need to proceed coping with patches of excessive transaction calls for. This can be due to hype durations just like the one created by the Ordinals protocol, or just because Bitcoin organically turns into extra widespread as a fee medium.

Bitcoin will probably need to adapt and innovate additional. Leveraging layer-2 options just like the Lightning Community, Stacks, ck-BTC, and Liquid could also be key in addressing the community’s present scaling points, optimizing transaction prices, and guaranteeing development and enlargement. As Bitcoin forges forward on its journey, the teachings realized from the Ordinals episode will undoubtedly be invaluable in shaping its future.