During the last yr, Bitcoin Ordinals have taken the digital collectible world by storm, and so they’ve now garnered the eye of economic titan Franklin Templeton. The digital property division of the worldwide funding agency right this moment featured the rise of Ordinal inscriptions in a brand new prospectus.

“Prior to now yr, Bitcoin innovation and growth has seen a renaissance in exercise,” Franklin Templeton Digital Property wrote. “Optimistic momentum in improvements is primarily pushed by Bitcoin NFTs, often known as Ordinals, new fungible token begins comparable to BRC-20 and Runes, Bitcoin Layer 2s, and different Bitcoin DeFi primitives.”

The agency recapped the acceleration in exercise round Bitcoin NFTs after Casey Rodarmor launched the Ordinal protocol final yr. In 2022, Rodarmor developed the “ordinal concept” idea that assigns a particular quantity to every Satoshi, the bottom denomination of a Bitcoin, on the community.

The Rise of Bitcoin Ordinals pic.twitter.com/nKLwwlMM4d

— Franklin Templeton Digital Property (@FTI_DA) April 3, 2024

“Our digital property analysis staff commonly surveys your complete digital asset ecosystem,” a Franklin Templeton spokesperson instructed Decrypt. “This piece particularly was impressed by the latest surge in buying and selling quantity and market cap of Ordinals relative to NFTs on different networks.”

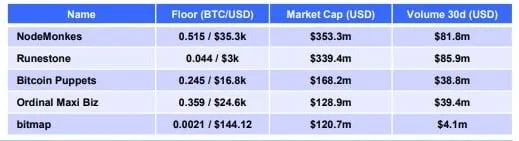

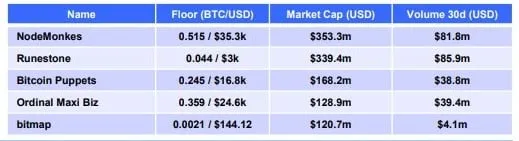

Franklin Templeton Digital Property laid out the surge of Ordinal collections within the NFT market in quantity and market capitalization, highlighting NodeMonkes, Runestone, Bitcoin Puppets, Ordinal Maxi Biz, and Bitmap—phrases that seemingly have by no means earlier than appeared in one among their prospectuses.

“Bitcoin Ordinals have seen a surge in buying and selling quantity over the previous a number of months,” Franklin Templeton Digital Property stated. “That is mirrored in a rise in dominance beginning in December of 2023 when it surpassed ETH in buying and selling quantity.”

The digital property staff at Franklin Templeton has been a vocal proponent of cryptocurrency and blockchain expertise on social media, and was described as going “full degen” in January after the U.S. Securities and Alternate Fee accredited the primary spherical of Bitcoin ETFs, together with the Franklin Bitcoin ETF (EZBC).

“Franklin Templeton has been very progressive in terms of digital property, and their enterprise arm has been investing in Ordinals infrastructure startups behind the scenes,” Runestone venture contributor and pseudonymous NFT historian Leonidas instructed Decrypt on Twitter. “It doesn’t shock me in any respect that Runestone is on the radar of their digital asset staff.

“Runestone dropped solely three weeks in the past and simply right this moment grew to become the third largest NFT assortment by market cap throughout all blockchains,” he added.

pic.twitter.com/nfDroxSzJS

— Franklin Templeton Digital Property (@FTI_DA) March 28, 2024

Not losing any time after its Bitcoin ETF was available on the market, Franklin Templeton turned its consideration to Ethereum and Solana. In February, Franklin Templeton filed a proposal with the SEC for a spot Ethereum ETF.

The response to the bullish tweet from Franklin Templeton Digital Property was met with enthusiasm by the Ordinals neighborhood.

🫡🫡🫡🫡

— Magic Eden on Bitcoin 🟧 (@MEonBTC) April 3, 2024

“Ordinals, Ordinals, & Ordinals,” one account tweeted in response.

NFT archaeologist Adam McBride responded with the “Girls and Gents, we received him” meme drawn from the US seize of Saddam Hussein.

Final week, Magic Eden co-founder and Chief Working Officer Z Yin stated the upcoming Rune protocol—a brand new fungible token commonplace launched by Casey Rodarmor through the Bitcoin halving later this month—will “supercharge the Bitcoin ecosystem.”

“We predict Runes goes to supercharge the Bitcoin ecosystem even additional, opening up a brand new wave of builders and asset varieties beforehand solely attainable on different layer-1 chains,” Yin instructed Decrypt. “It’s a no-brainer for us to double down on this ecosystem by including Runes to our present Ordinals market, which has already hit $1 billion in quantity in 2024 alone.”