In keeping with knowledge from Glassnode, Bitcoin‘s Over-The-Counter (OTC) holdings, an often-overlooked side of cryptocurrency buying and selling, have surged to their highest degree prior to now 12 months, with inflows persistently outpacing outflows since Could 2023.

Over-The-Counter (OTC) buying and selling denotes the direct alternate of belongings like Bitcoin between two events, bypassing the normal alternate. This off-exchange buying and selling occurs through a decentralized seller community and infrequently entails substantial quantities of Bitcoin.

That is performed via a decentralized seller community. Within the context of Bitcoin, OTC trades are sometimes utilized by whales who wish to purchase or promote Bitcoin with out impacting the market worth an excessive amount of. This may be essential as massive trades on public exchanges could cause vital worth fluctuations.

OTC holdings seek advice from the quantity of Bitcoin held by these OTC desks. These holdings can provide insights into the habits of huge buyers. For example, a rise in OTC holdings might recommend that extra whales purchase Bitcoin via OTC trades, probably indicating bullish market sentiment. Conversely, a lower in OTC holdings might imply the other.

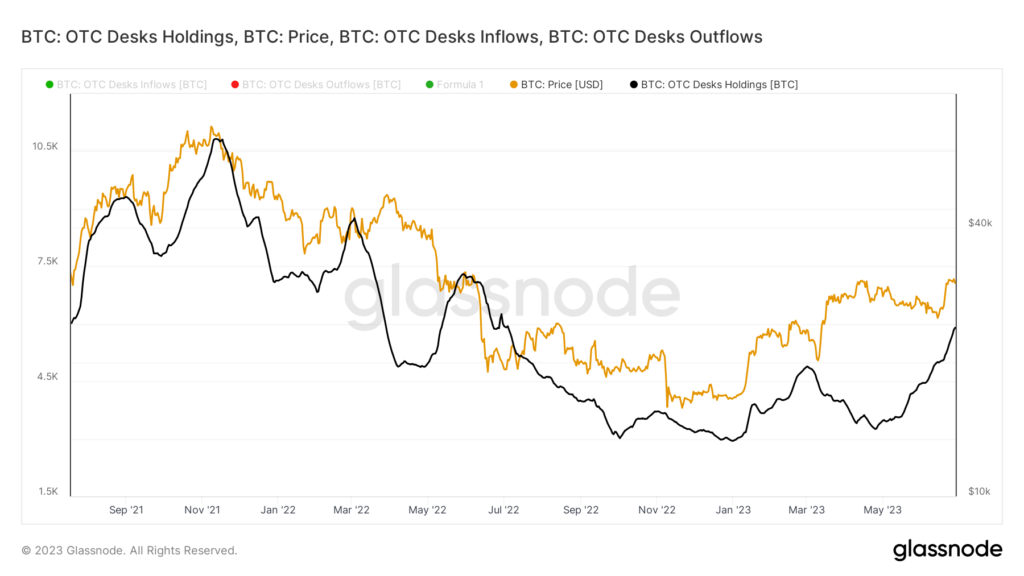

Bitcoin OTC holdings

Starting the 12 months with a neighborhood low of roughly 2,969 BTC, OTC holdings have bounced again, hitting 6,285 BTC on June 28, 2023, the very best degree witnessed since Could 2022.

Regardless of this latest surge, Bitcoin OTC holdings are but to surpass their all-time excessive of 11,928 BTC, established on Aug. 17, 2020. This document was set amidst Bitcoin’s peak worth of $68,692 on Nov. 10, 2021.

Apparently, the worth of Bitcoin and the OTC holdings seem loosely correlated, with OTC holdings lagging barely behind BTC costs. For instance, as Bitcoin has traded comparatively flat since June 21, OTC holdings have skilled a rise of 12.45%, climbing to five,899 BTC from 5,244 BTC utilizing a 30-day EMA. This increment occurred whereas Bitcoin’s worth remained across the $30k mark.

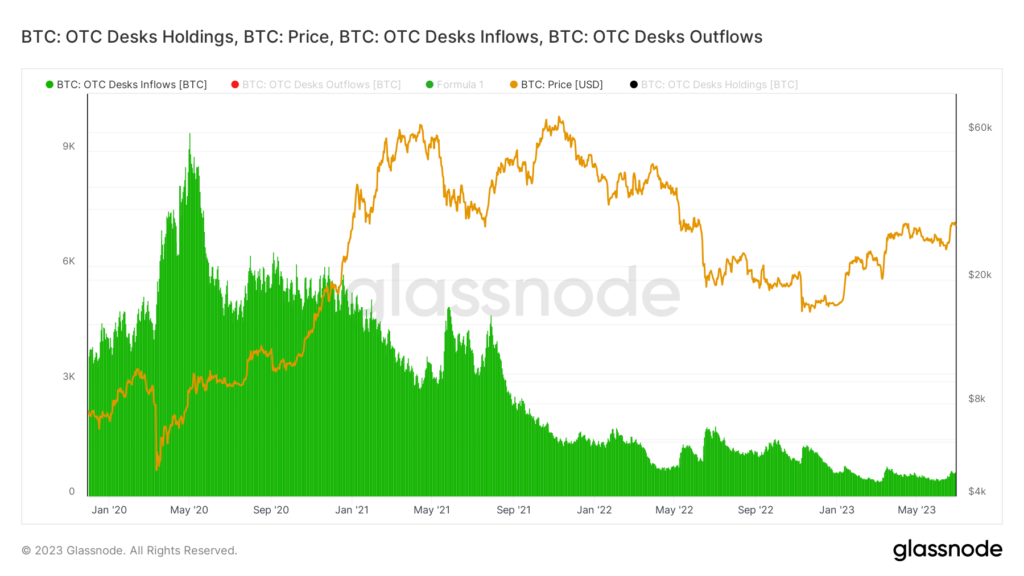

Bitcoin OTC inflows

Concurrently, Bitcoin OTC inflows have repeatedly declined since their peak across the final Bitcoin halving in Could 2020. At the moment, OTC desks usually noticed inflows effectively above 6,000 BTC. Nevertheless, as evident from the discount in holdings, 2023 has been much less favorable, with inflows plunging to a 30-day EMA low of 394 BTC.

Nevertheless, June seems to have reversed the development, with inflows rising to roughly 645 BTC, a big drop from pre-pandemic ranges.

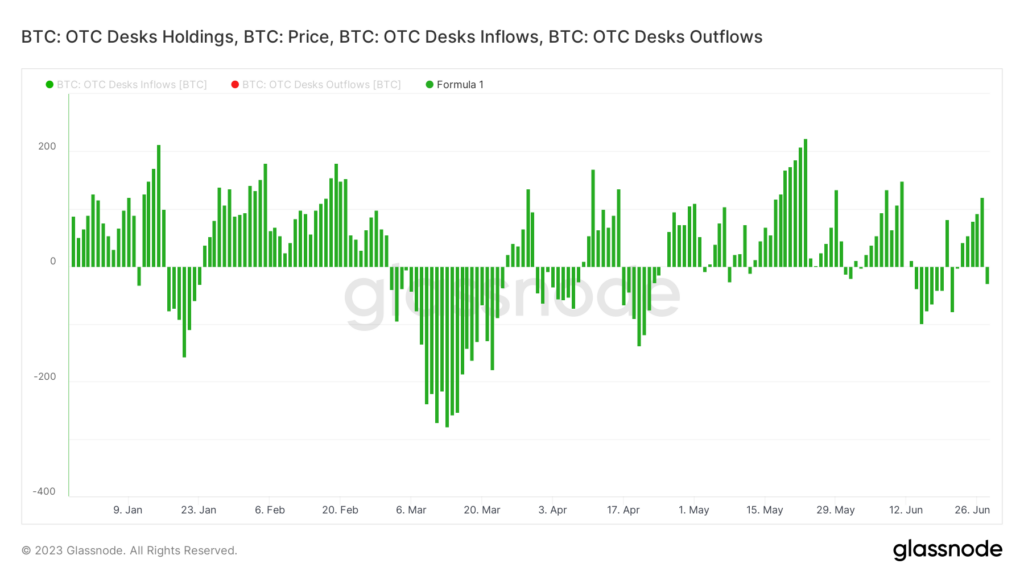

As per Glassnode knowledge, a comparability of OTC inflows and outflows reveals a constant surplus of inflows since Could 2023. That is notably notable as a result of the final interval of extra outflows was noticed in March 2023.

Whereas latest traits in OTC holdings and inflows trace at renewed market confidence in Bitcoin, the general decline in inflows since 2020, together with OTC holdings nonetheless being considerably beneath their all-time excessive, signifies that the market has substantial room for progress.

These traits and metrics are value anticipating buyers and fanatics, serving as crucial indicators of whale sentiment and potential funding alternatives. Additional, given the myriad of bankruptcies, lawsuits, and different regulatory points which have plagued the crypto business over the previous 12 months, OTC desk trades are anticipated to see continued exercise as reserves are reorganized, or collectors are repaid.