On-chain knowledge reveals the Bitcoin realized loss metric has stayed at a low worth lately, regardless of the volatility that the coin has skilled.

Bitcoin Realized Loss Continues To Be At A Comparatively Low Worth

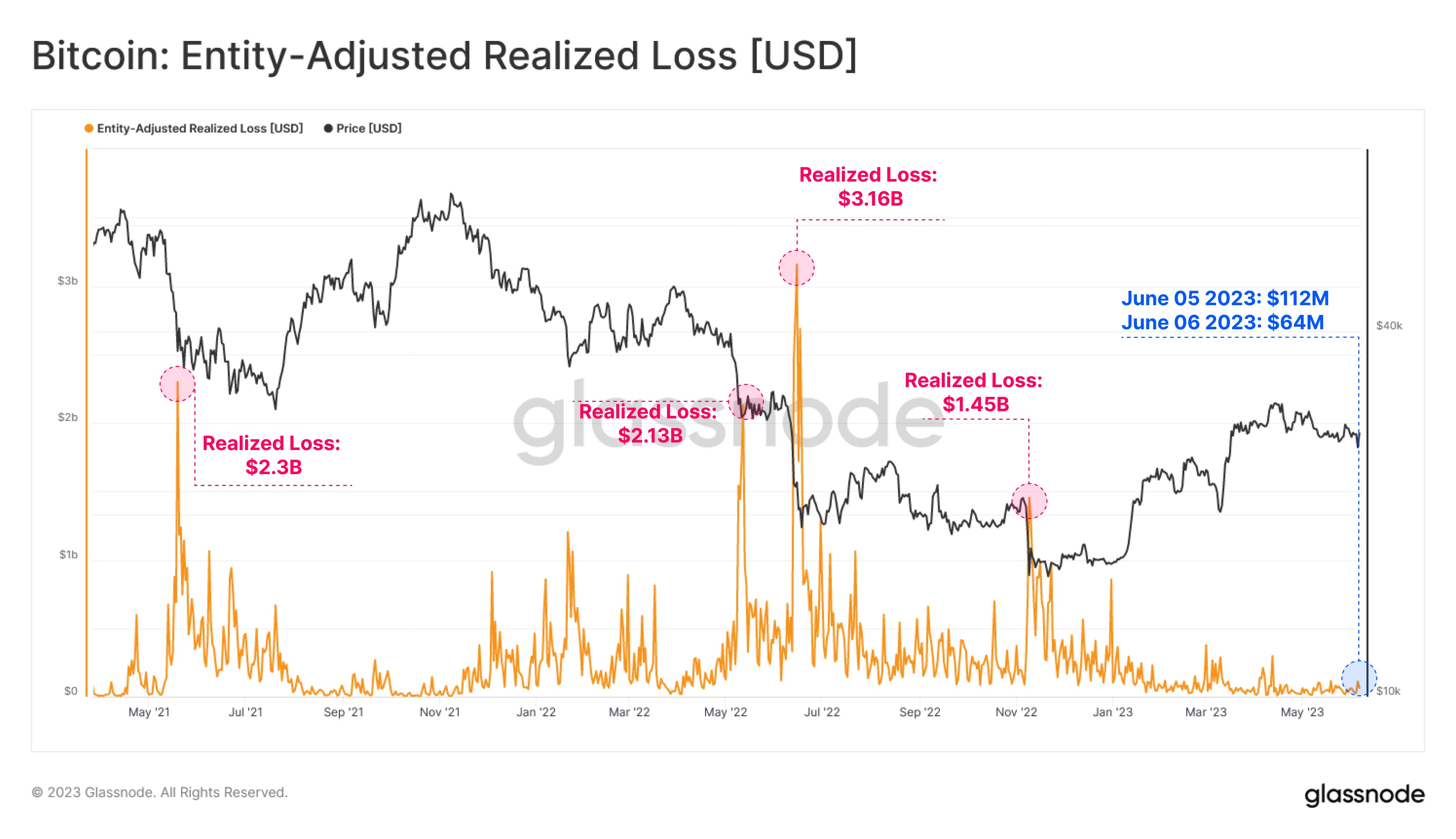

Based on knowledge from the on-chain analytics agency Glassnode, buyers realized simply $112 million in losses in the course of the latest plummet within the cryptocurrency’s worth.

The “entity-adjusted realized loss” is a metric that measures the entire quantity of loss (in USD) that Bitcoin buyers have lately been realizing on the blockchain.

Every time a coin sits nonetheless on the community for some time (which means that it hasn’t been transferred to a different tackle) and the value goes above or under the worth at which it was acquired, the coin is claimed to realize an “unrealized revenue/loss.”

When such a coin that’s carrying an unrealized revenue or loss is lastly moved or offered on the blockchain, the revenue/loss it was carrying beforehand then turns into “realized.”

The realized loss metric particularly tracks such losses being harvested all through the community (and naturally, the counterpart indicator, the realized revenue, measures the earnings).

Now, here’s a chart that reveals the pattern within the Bitcoin entity-adjusted realized loss during the last couple of years:

Seems to be like the worth of the metric has been comparatively unchanged in latest weeks | Supply: Glassnode on Twitter

As proven within the above graph, when Bitcoin crashed a few days again after the information of contemporary regulatory strain on the cryptocurrency alternate Binance, the realized loss had measured round $112 million. Then, the next day, losses had been nearly halved because the metric measured to round solely $64 million.

Normally, throughout unstable occasions like crashes, there are numerous buyers who panic and dump their cash, even when they’re holding them at a loss. Such buyers are typically inexperienced short-term holders, who’re fast to lose their conviction within the asset.

Due to this purpose, sharp plunges within the value of the cryptocurrency have traditionally been marked by enormous capitulation occasions the place the realized loss indicator registers a big spike.

From the chart, it’s seen that the Might 2021 crash, the LUNA collapse in Might 2022, the 3AC chapter in June 2022, and the FTX collapse in November 2022 all noticed widespread capitulation from the holders.

Out of those, the crash after the 3AC chapter noticed the biggest quantity of realized losses, because the indicator’s worth hit round $3.1 billion throughout it, whereas the FTX collapse noticed the least quantity of losses at $1.45 billion.

Each of those values are, nevertheless, extraordinarily massive when in comparison with the losses that Bitcoin buyers have harvested on this newest interval of value volatility. Based on Glassnode, this pattern would counsel “an elevated diploma of resilience amongst market members.”

BTC Value

On the time of writing, Bitcoin is buying and selling round $26,800, down 1% within the final week.

The asset appears to have made restoration in the course of the previous day | Supply: BTCUSD on TradingView

Featured picture from iStock.com, charts from TradingView.com, Glassnode.com