On-chain knowledge exhibits that Bitcoin short-term holders have continued to make change inflows, however the asset’s worth has held on to date.

Bitcoin Brief-Time period Holders Make Excessive Deposits For 20 Straight Days

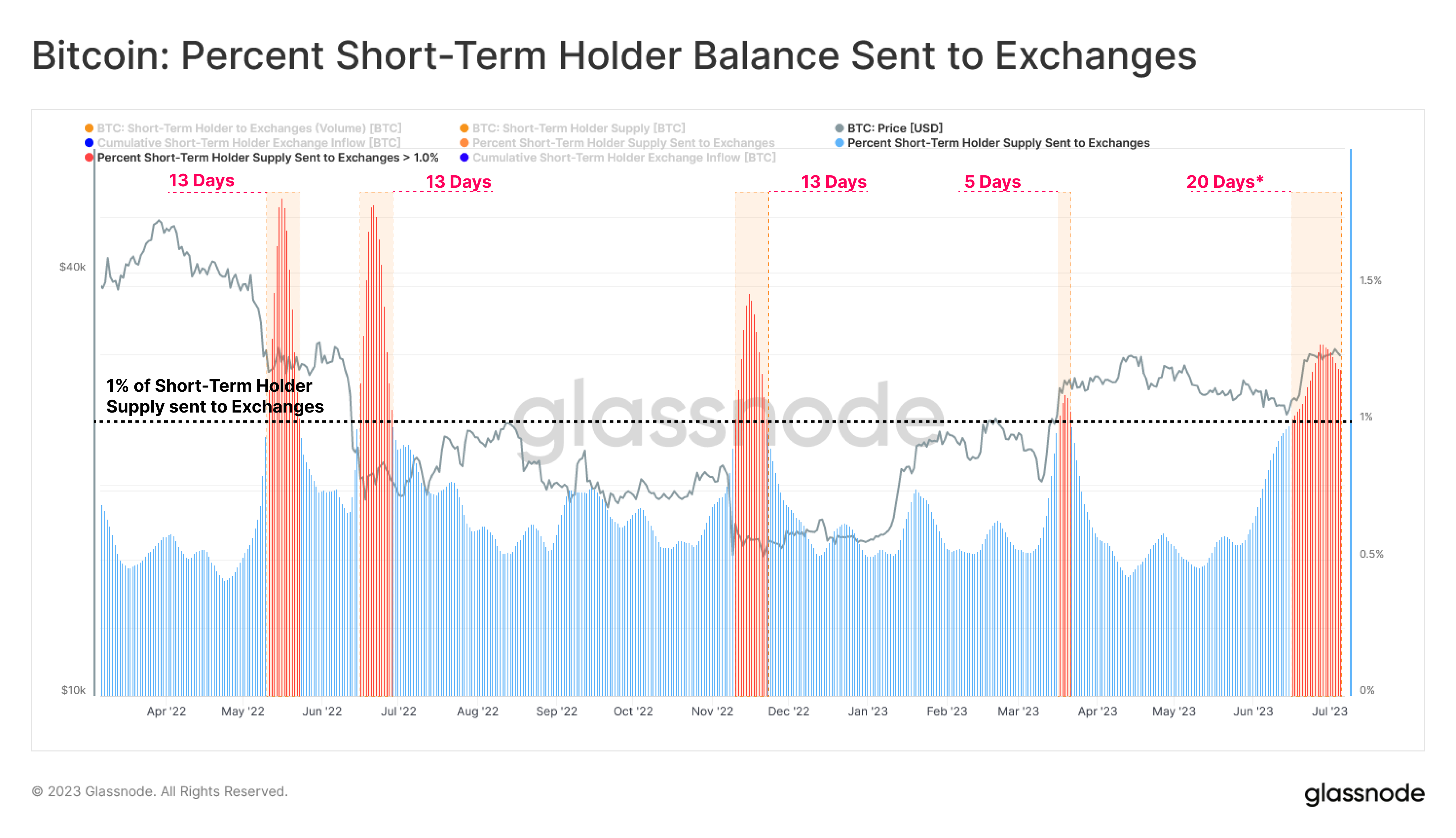

In accordance with knowledge from the on-chain analytics agency Glassnode, the short-term holders have despatched 617,000 BTC to exchanges through the previous 20 days. The “short-term holders” (STHs) right here check with Bitcoin traders who’ve been holding onto their cash since lower than 155 days in the past.

The STHs are usually the much less skilled palms of the market, who might simply promote during times of widespread FUD available in the market, or throughout sharp surges within the cryptocurrency’s worth.

Normally, these traders make use of exchanges for collaborating in such selloffs, so the info for his or her “change inflows” can present hints about their present conduct.

The change influx right here naturally refers back to the whole quantity of Bitcoin that the STHs are depositing to the wallets of centralized exchanges. When the worth of this metric is excessive, it may be an indication that these holders are promoting numerous cash at the moment. Naturally, such a development might have bearish penalties for the asset’s worth.

Now, here’s a chart that exhibits the development within the Bitcoin change influx for these STHs over the previous 12 months or so:

Appears to be like like the worth of the metric appears to have been comparatively excessive in current days | Supply: Glassnode on Twitter

Right here, the Bitcoin STH change inflows are represented by way of the share of their provide. As the provision of those traders can change, it makes extra sense to think about the share of it as it will make comparisons with historical past simpler (the pure figures, however, could also be incompatible).

From the graph, it’s seen that the Bitcoin STH change inflows have been elevated lately. Over the last 20 days, these traders’ inflows have measured above 1% of their provide.

On this interval, the cohort has deposited a complete of about 617,000 BTC ($18.6 billion on the present change charge) to those platforms, which is kind of a big quantity.

Within the chart, Glassnode has additionally highlighted the earlier situations over the last 12 months or so the place the indicator crossed the identical threshold of 1%. It appears like by way of the magnitude of the influx spikes, the three capitulation intervals that adopted the LUNA collapse, 3AC chapter, and FTX crash, respectively, noticed bigger peaks than the current ranges.

The period of the newest interval of elevated change influx exercise from the Bitcoin STHs, nevertheless, has been fairly extraordinary, because it has gone on for a minimum of 20 days to date. Whereas the aforementioned capitulation selloffs solely lasted for 13 days every.

However, regardless of the excessive promoting stress from this cohort, It could seem that the worth of the cryptocurrency has been holding sturdy to date, because it’s nonetheless floating above the $30,000 degree.

BTC Value

On the time of writing, Bitcoin is buying and selling round $30,100, down 2% within the final week.

BTC has been caught in sideways motion lately | Supply: BTCUSD on TradingView

Featured picture from Kanchanara on Unsplash.com, charts from TradingView.com, Glassnode.com