- Merchants are preferring to take a protracted place in distinction to the sustained decline in BTC’s value

- Whales’ motion may set off a bull development however quick liquidations stay at a minimal

Bitcoin [BTC] merchants appear unperturbed concerning the king coin’s drop under $22,000. The truth is, in keeping with CryptoQuant’s evaluation of the market, merchants within the derivatives market are eager on opening lengthy positions regardless of the obtrusive bearish publicity.

How a lot are 1,10,100 BTCs value at this time?

Shorts positive aspects could solely final short-term

The community-driven analytics platform opined that the stunning constructive sentiment could possibly be linked to the bull/bear market cycle indicator. The metric is characterised by the mixture view of day by day market members and sometimes corresponds with the financial cycle.

Though BTC’s value may not replicate the standing, CryptoQuant confirmed that the metric is now within the bullish area. Its report learn,

“The Bull/Bear Market Cycle Indicator stays within the bull territory, and the On-chain P&L Index momentum has entered extra sustainable ranges”

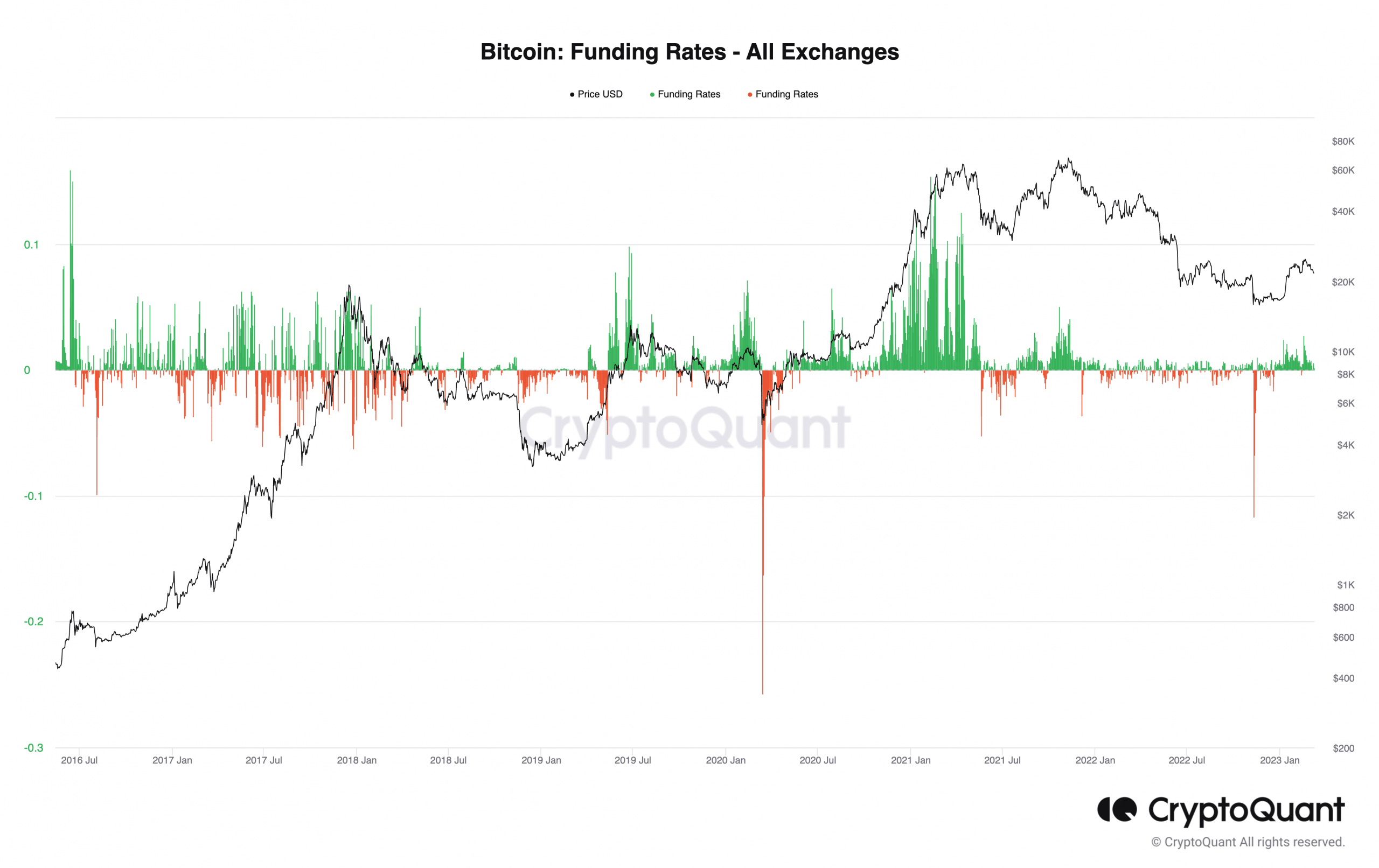

Merchants’ bias has additionally translated into motion, as evidenced by the funding charges.

Funding charges are periodic funds made to longs or shorts primarily based on the distinction between the perpetual swaps and present spot costs.

Supply: CryptoQuant

At press time, the Bitcoin funding rate was 0.0018. The metric, being constructive, implied that long-positioned merchants have been dominant within the derivatives market. As such, they’ve been keen to pay funding to quick positions.

Moreover, Bitcoin whales appear to be serving to the trigger as a result of their typical spending in correction intervals has been low, in comparison with earlier cycles. Low promote stress from these deep-pocket buyers may assist resist the draw back. CryptoQuant’s evaluation additional confirmed,

“Beforehand, whales spent over 500k BTC a day throughout or earlier than value corrections, however now they mainly spend under 150K BTC in day by day phrases.”

Settling the storm is perhaps…

Nevertheless, the optimism projected by merchants wouldn’t robotically wash away the prevailing existence of the reds. The truth is, the report went on to say that it could possibly be worthwhile for merchants to train restraint.

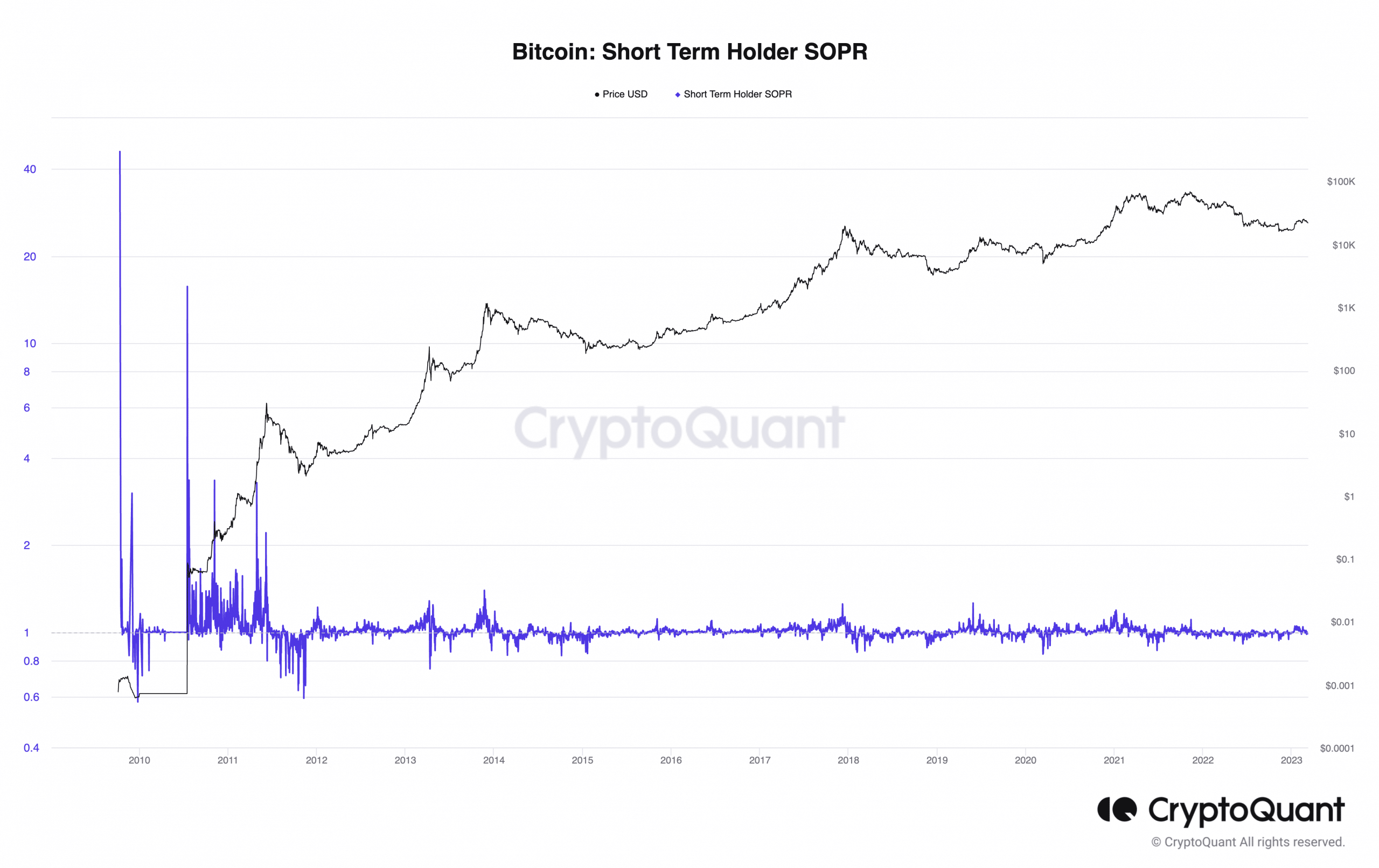

This, as a result of the most recent BTC correction correlated with miners and Brief Time period Holders’ (STH) actions. For example – In response to CryptoQuant, Miners’ BTC transfers to exchanges earlier within the month pointed to promoting stress linked to large quantities of the coin.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

Moreover, BTC STHs took revenue because the Spent Output Profit Ratio (SOPR) hit 5%. The SOPR accounts for income or losses taken inside a 155-day window.

With the metric worth above 1, it means extra short-term buyers have been promoting at a revenue.

Supply: CryptoQuant

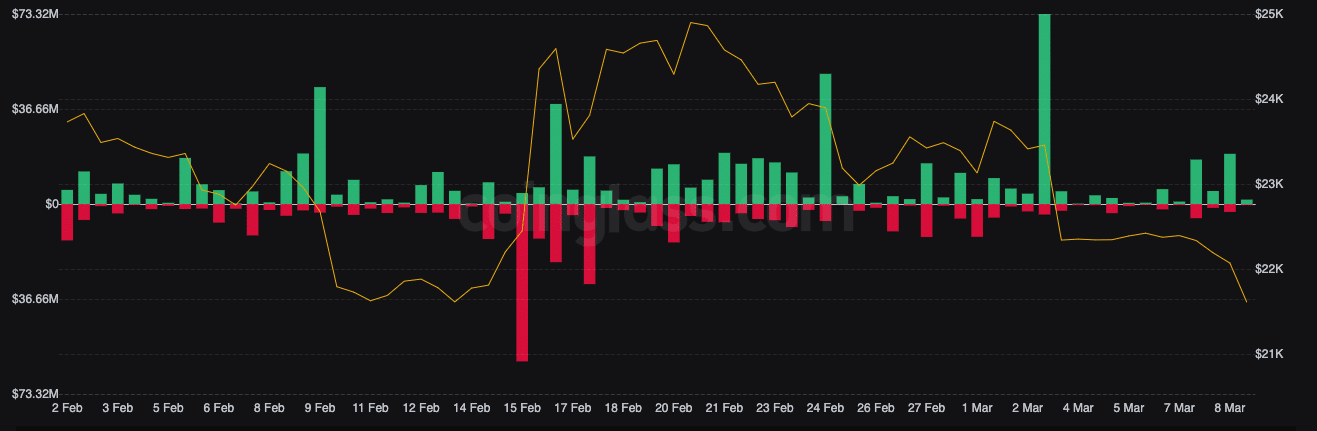

Regardless of the passion proven by BTC longs, nonetheless, they took an enormous share of the liquidations of 8 March.

Shorts have been, nonetheless, not exempted. Even so, Coinglass data revealed that long-positioned merchants suffered a $19.37 million wipeout out of a potential $25.23 million.

Supply: Coinglass