All candidates for a spot Bitcoin exchange-traded fund (ETF) have submitted their ultimate Kind S-1 amendments to the US Securities and Trade Fee (SEC). This marks a pivotal second, particularly because the deadline for submission was set for 8:00 am EST as we speak, January 8.

Main the pack, Valkyrie submitted its ultimate S-1 modification nicely forward of the speculated January 10 date, which many business insiders imagine may see the primary approvals of spot Bitcoin ETFs within the US. Following swimsuit, main gamers equivalent to WisdomTree, BlackRock, VanEck, Invesco, Galaxy, Grayscale, ARK Make investments, 21Shares, Bitwise, Franklin Templeton and Grayscale additionally accomplished their submissions.

Nonetheless, Hashdex has not up to date its S-1. The brand new filings are the penultimate step earlier than the spot Bitcoin ETF approvals. The final one is the SEC voting on the 19b-4s filings within the coming days, particularly on Wednesday.

Scott Johnsson, finance lawyer at Davis Polk elaborated: “Finest guess on timing (not definitive): – Monday: “Last” S-1/3 filed – Wednesday: 19b-4 approval orders issued post-close – Thursday: Requests for acceleration from issuers – Friday: Discover of effectiveness filed from SEC – Tuesday: Buying and selling begins”

Finest guess on timing (not definitive):

– Monday: “Last” S-1/3 filed

– Wednesday: 19b-4 approval orders issued post-close

– Thursday: Requests for acceleration from issuers

– Friday: Discover of effectiveness filed from SEC

– Tuesday: Buying and selling begins— Scott Johnsson (@SGJohnsson) January 8, 2024

Others count on that the spot Bitcoin ETFs may even begin buying and selling as early as Thursday or Friday.

Payment Battle For Spot Bitcoin ETFs Begins

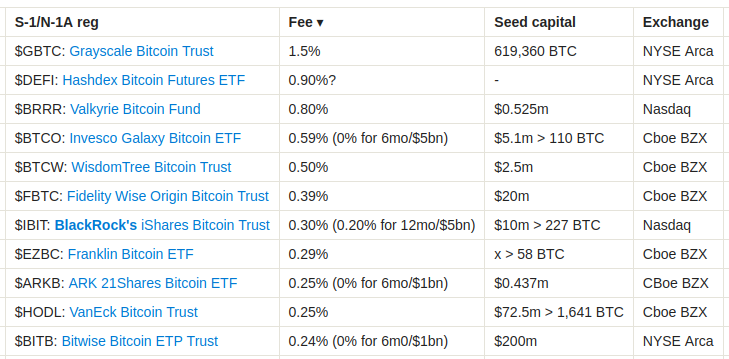

The S-1 amendments are essential as they disclose details about charges for the potential ETFs. In an fascinating flip of occasions, a number of filers have considerably lowered charges for buying and selling their potential spot Bitcoin ETF merchandise. Initially, BlackRock was main with the bottom charges. Katie Greifeld, anchor of The Shut and ETF IQ on Bloomberg, highlighted:

BLACKROCK’S FEE is lastly listed. Last charge is 30bp, BUT 20 bps within the first 12 months or till the primary $5 billion in belongings. That’s the brand new low-water mark.

Nonetheless, Cathie Wooden’s Ark Make investments introduced decrease charges shortly after. The newest S-1 of Ark exhibits a drop from 0.80% to 0.25%, and a particular provide of 0% charges throughout a six-month interval from the day of itemizing, for the primary $1 billion in transactions. Eric Balchunas, a Bloomberg analyst, commented on this aggressive panorama:

However wait, ARK simply dropped their charge to 0.25% in an S-1 filed 20 minutes after BlackRock’s. Informed y’all of the charge battle would escape bf they even launched. And that is w out Vanguard on the combo. Rattling. […] ARK going from 80 bps to 25 bps in a single shot is breathtaking. The charge wars are intense however that’s one other degree. Altho they kinda needed to. BlackRock at 30 bps is potential on the spot destroyer of anybody a lot larger.#

Nonetheless, Ark was undercut on the final minute as nicely. Bitwise submitted a 0.24% charge. No charges are charged for the primary six months or $1 billion AUM.

Notably, VanEck additionally disclosed a charge of solely 0.25%, although with none particular promotions for the launch, in contrast to BlackRock and Ark Make investments. The main quartet is adopted by Franklin Templeton (0.29%), Constancy Smart Origin Bitcoin Belief (0.39%), WisdomTree Bitcoin Belief (0.50%), Invesco Galaxy Bitcoin ETF (0.59%), Valkyrie Bitcoin Fund (0.8%), Hashdex (0.90%) and Grayscale (1.5%).

Eric Balchunas elaborated that, traditionally, momentary charge waivers haven’t considerably impacted investor choices, as advisors are inclined to deal with long-term charges. Nonetheless, given the uniformity of companies supplied by these ETFs, he urged that charge variations may play a extra vital function this time. “Traditionally this hasn’t moved the needle a lot […] Advisors targeted on common charges since they’re long run buyers. That mentioned, given all these ETFs all do the identical factor, perhaps it can matter all else equal, we’ll see,” he remarked.

Katie Greifeld commented, “I spoke too quickly re: low-water mark! Ark and 21 Shares are going 0.25% and NO FEE for the primary six months or till $1 billion in belongings. These are very, very low numbers. […] VanEck additionally coming in scorching with a 25 bp charge. For context, GLD — the biggest bodily backed commodity ETF — expenses 40bp.”

Following the information, the Bitcoin worth reacted with a 2% bounce, rising as excessive as $45,300.

Featured picture from Shutterstock, chart from TradingView.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t signify the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your personal analysis earlier than making any funding choices. Use info supplied on this web site totally at your personal danger.