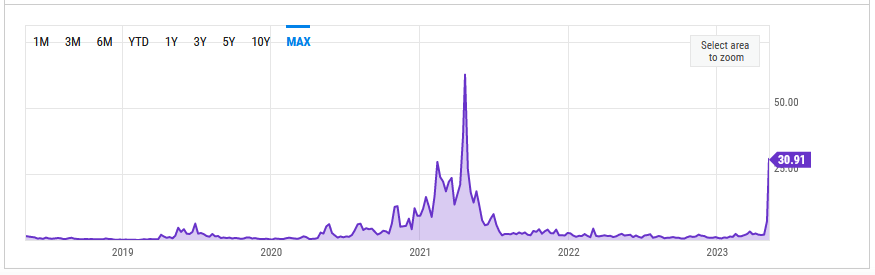

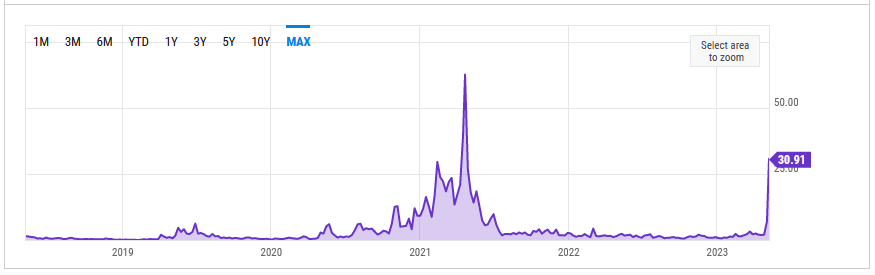

The common Bitcoin transaction charge has surged to $30.91 — a degree not seen since April 2021, per information from ycharts.com.

The interval within the run-up to April 2021 was characterised by a mania that noticed Bitcoin run to $64,900 — doubtless pushed by Coinbase’s NASDAQ itemizing and the narrative that crypto goes mainstream.

This run ended abruptly as China prolonged its anti-crypto coverage to ban Proof-of-Work mining, adopted by Elon Musk asserting Tesla would stop accepting BTC for automobile purchases as a consequence of considerations over miners utilizing fossil fuels.

In the present day, meme coin mania is driving exercise on the Bitcoin community through the lately launched BRC-20 normal.

What’s BRC-20?

In March, the BRC-20 normal was created by an nameless particular person often known as “Domo.”

Whereas Bitcoin was historically a single-asset blockchain, the Ordinals protocol, through the Taproot delicate fork, has enabled fungible BRC-20 property to function on the chain.

Taproot launched in November 2021 to make transactions faster and cost-effective whereas laying the groundwork for good contracts and dApps.

By February, Taproot’s capabilities have been getting used to retailer jpegs and movies straight on the blockchain, consequently making a non-fungible market on Bitcoin — a lot to the annoyance of purists.

On the time, commentators warned that this could finally result in increased transaction charges and chain bloat – with BRC-20 added to the combo, that scenario is taking part in out.

In line with the brc-20.io web site, BRC-20 tokens have a complete market cap of $693.2 million. The highest three tokens are Ordi, Nals, and Pepe —valued at $411.3 million, $42.3 million, and $34.7 million, respectively.

Scrolling the listing reveals tokens named d*ck, P*SY, attractive, and f*ck, indicating the overall triviality of the BRC-20 area at the moment.

Bitcoin on line casino

Regardless of this, echoing a remark from RamenPanda, foobar is adamant that BRC-20 tokens might be a big think about rising Bitcoin dominance, making Ethereum irrelevant.

“Subsequent bull market might be pushed by Bitcoin and BRC20 tokens

Bitcoin dominance will skyrocket to above 70%

Ethereum will grow to be irrelevant.”

Equally, Degen Spartan expressed a “can’t beat ’em, be a part of ’em” angle in the direction of BRC-20 — saying in the event you’re going to memecoin, you would possibly as nicely do it on Bitcoin.

“The eventual conclusion of the janky brc20 experiment might be that it’s higher to shitcoin on a sequence objective constructed to deal with and facilitate a full suite shitcoin on line casino.“

Willy Woo stated there are execs and cons to the present scenario. He defined that block rewards might be zero in the future, which means an alternate supply of mining income is required to maintain miners incentivized.

On the similar time, the trade-off is “unhealthy for nodes and decentralisation” — including that the influence of Ordinals is occurring at a time when mining rewards are nonetheless excessive.