- Bitcoin hit $35,500 because the FOMC assembly led to a good choice for the market

- There have been lengthy positions focused at $ 42,697, as technical indicators recommend a steady worth rise

After Bitcoin [BTC] struggled to reclaim $35,000 earlier, dialogue a few doable plunge emerged amongst gamers out there. One motive for this worry was that many thought the market had seen sufficient good points for widespread profit-taking to begin in November.

Learn Bitcoin’s [BTC] Price Prediction 2024-2025

Balanced charges, rising values

Opposite to the speculations, that was not the case. In line with Santiment, the Federal Open Market Committee’s (FOMC) choice to maintain rates of interest steady between 5.25% and 5.50% was essential for BTC’s bounce to $35,500.

The FOMC is a department of the U.S. Federal Reserve system. The committee meets eight occasions yearly to debate financial coverage, employment situations, financial progress, and worth stability. Often, this consequence of the assembly tends to extend Bitcoin’s volatility whether or not the rates of interest improve or in any other case.

🇺🇸🎙️ #JeromePowell‘s #FOMC speech concluded 1 hour in the past, and the #Fed is maintaining rates of interest regular between 5.25%-5.50%, as they’ve been since July. #Crypto climbed all through the speech, and $BTC has hit $35.5K for the primary time since Could, 2022. 🎉 https://t.co/vFfusjYdLD pic.twitter.com/V2DKBgUUBV

— Santiment (@santimentfeed) November 1, 2023

Particulars from Yahoo Finance showed that Fed Chair Jerome Powell gave causes for the choice to hit the pause button on the charges. Certainly one of Powell’s key takeaways was that the committee is devoted to driving the inflation fee to 2%.

Concerning the most recent decision, he stated:

“Inflation has moderated because the center of final 12 months and readings over the summer season have been fairly favorable.”

Powell additional defined that,

“However a couple of months of fine knowledge are solely the start of what it would take to construct confidence that inflation is transferring down sustainably.”

Merchants look previous $40,000

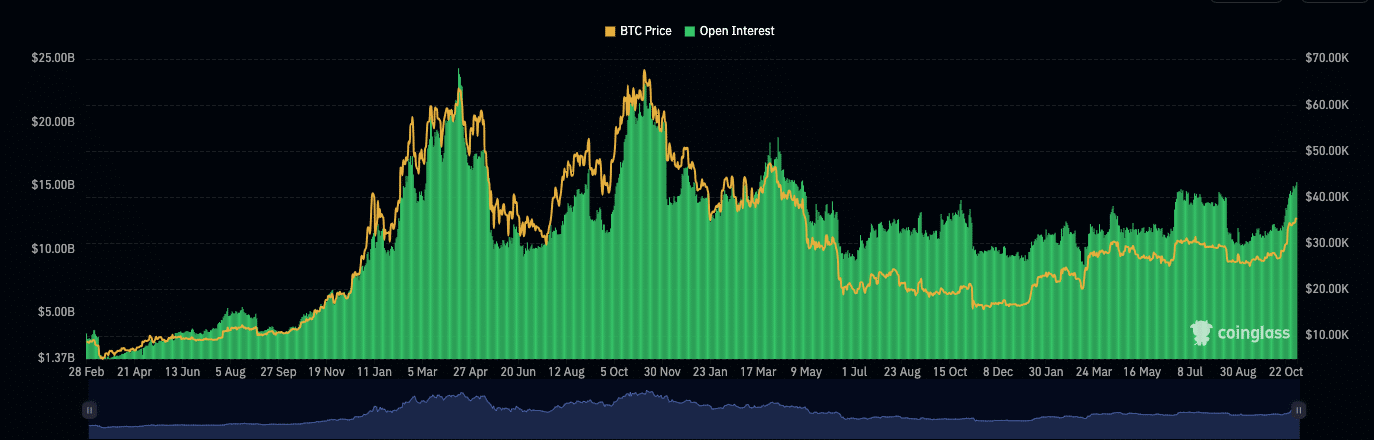

Other than the value improve, Bitcoin’s open curiosity additionally jumped on account of the FOMC choice. The Open Curiosity is the variety of open lengthy and quick positions within the derivatives market.

Because the Open Curiosity will increase, so does the volatility, liquidity, and a spotlight given to the asset.

When the metric decreases, it signifies in any other case. At press time, Coinglass’ knowledge confirmed that Bitcoin’s Open Interest climbed to important ranges as proven beneath.

Additionally, rising Open Curiosity alongside an uptrend suggests sufficient power for worth motion. If the indicator drops when the value will increase, it’s a signal of waning power for the coin. So, it’s doubtless that the Bitcoin worth will proceed to extend.

From the info above, merchants are focusing on as excessive as $42,697 within the quick to mid-term.

Nevertheless, BTC would possibly want rather more than a surging open curiosity to hit the value talked about above. Subsequently, it’s needed to take a look at the technical outlook.

Bears are far-flung

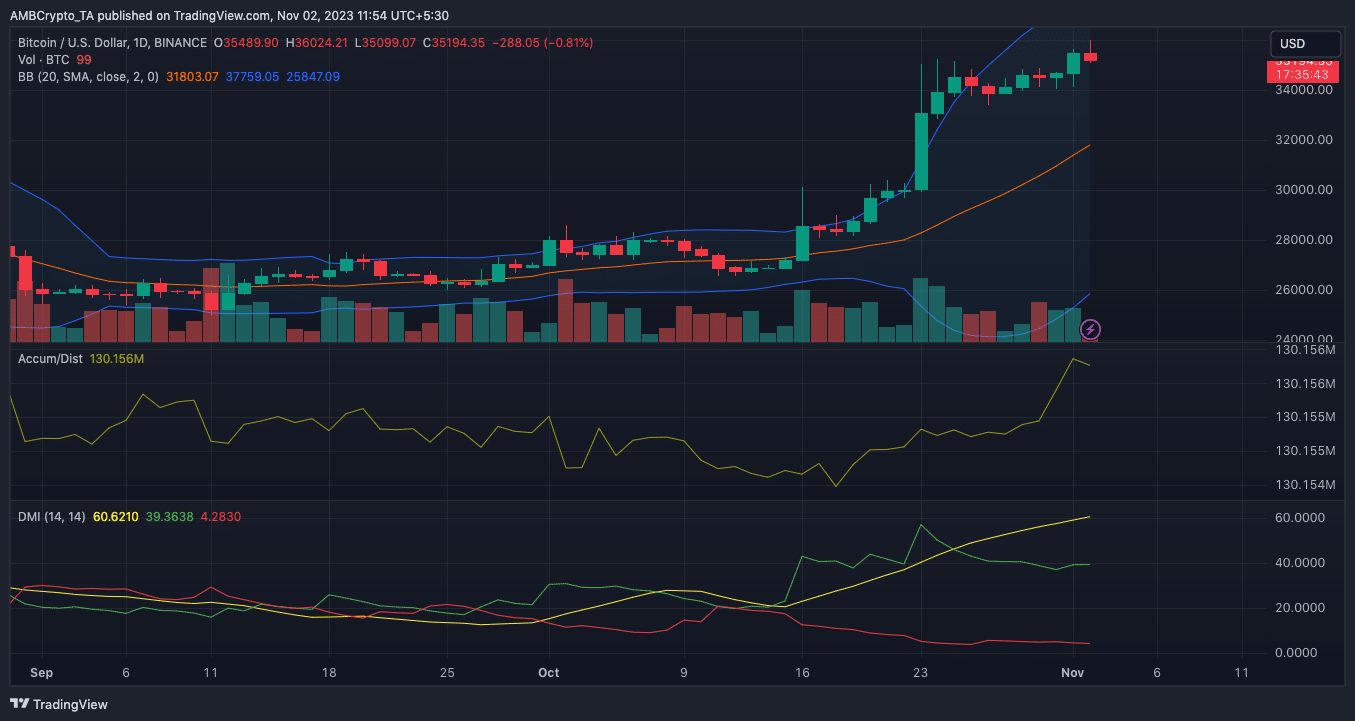

In line with the BTC/USD every day chart, the space between the Bollinger Bands (BB) widened. The BB is answerable for monitoring volatility. Typically, it additionally offers the concept a cryptocurrency is oversold or overbought.

As was talked about earlier, volatility was now excessive. Which means that there may very well be important worth fluctuations both to the upside or draw back. Nevertheless, the Accumulation/Distribution (A/D) line additionally elevated.

The standing of this indicator signifies that there was important shopping for stress. If the stress stays in the identical course, then BTC might drive within the $40,000 direction.

One other indicator thought-about within the chart above is the Directional Motion Index (DMI). The DMI signifies the doable course a crypto is prone to comply with. At press time, the +DMI (inexperienced) was 39.36 whereas the -DMI (pink) was 4.28.

This massive distinction explains how patrons are in full management of the market. So, it is extremely unlikely for BTC’s worth to nosedive anytime quickly.

This assertion was additionally validated by the Common Directional Index (ADX). On the time of writing, the ADX was 60.62, suggesting a powerful directional upward motion for Bitcoin.

The preliminary worry is tapering off

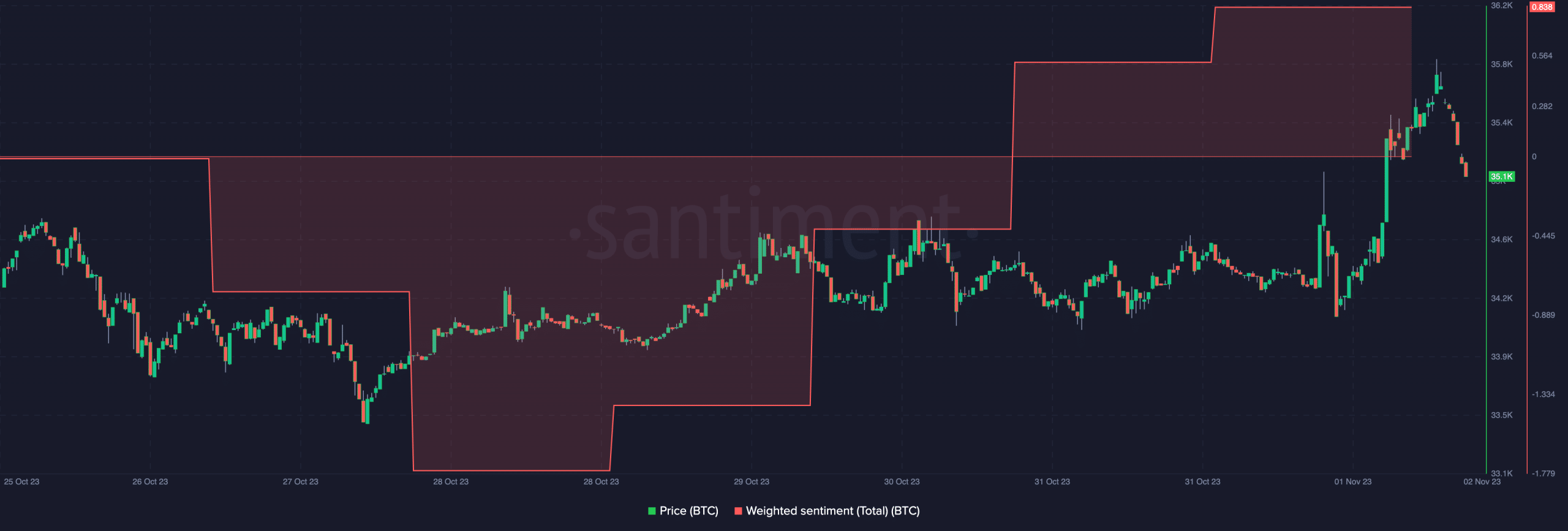

Moreover, on-chain knowledge reinforced the notion of renewed optimism out there, due to the Weighted Sentiment metric.

The Weighted Sentiment traces the notion proven by contributors out there.

Is your portfolio inexperienced? Examine the BTC Profit Calculator

When this metric spikes, it means most messages are constructive on the identical time. Conversely, a notable drop within the metric signifies disappearing optimism.

As of this writing, the Weighted Sentiment had skyrocketed to 0.83. Subsequently, a big a part of the market expects the Bitcoin worth to proceed its uptrend until halted by an all-inclusive promote block order.