- Bitcoin miners had been discovered dealing with some challenges with the rise within the BTC’s hashrate.

- The variety of rigs required to mine Bitcoin elevated, nonetheless, it induced a decline in miners’ earnings.

Over the previous few months, Bitcoin miners have reaped the advantages of BTC’s short-term rally. Apparently, moreover BTC’s worth, the hashrate of the community has additionally elevated.

Learn Bitcoin’s Worth Prediction 2023-2024

“Hash”ing it out

Because of the rising hashrate, the demand for ASIC rigs required to mine Bitcoin has additionally elevated.

As #Bitcoin hashrate pushes to new ATHs, we are able to estimate the variety of operational ASIC rigs required to generate that hashpower.

Utilizing three newest era Antminer rigs, we estimate a fleet of

– 🟢5.5M S17s

– 🟡2.8M S19 Professionals

– 🔴1.2M S19 XP Hydhttps://t.co/O2EU4gZTCe pic.twitter.com/EQabTeA7mS— glassnode (@glassnode) March 5, 2023

This has induced the general funding behind Bitcoin mining to rise by a pointy quantity which, in flip, has affected the profitability of miners.

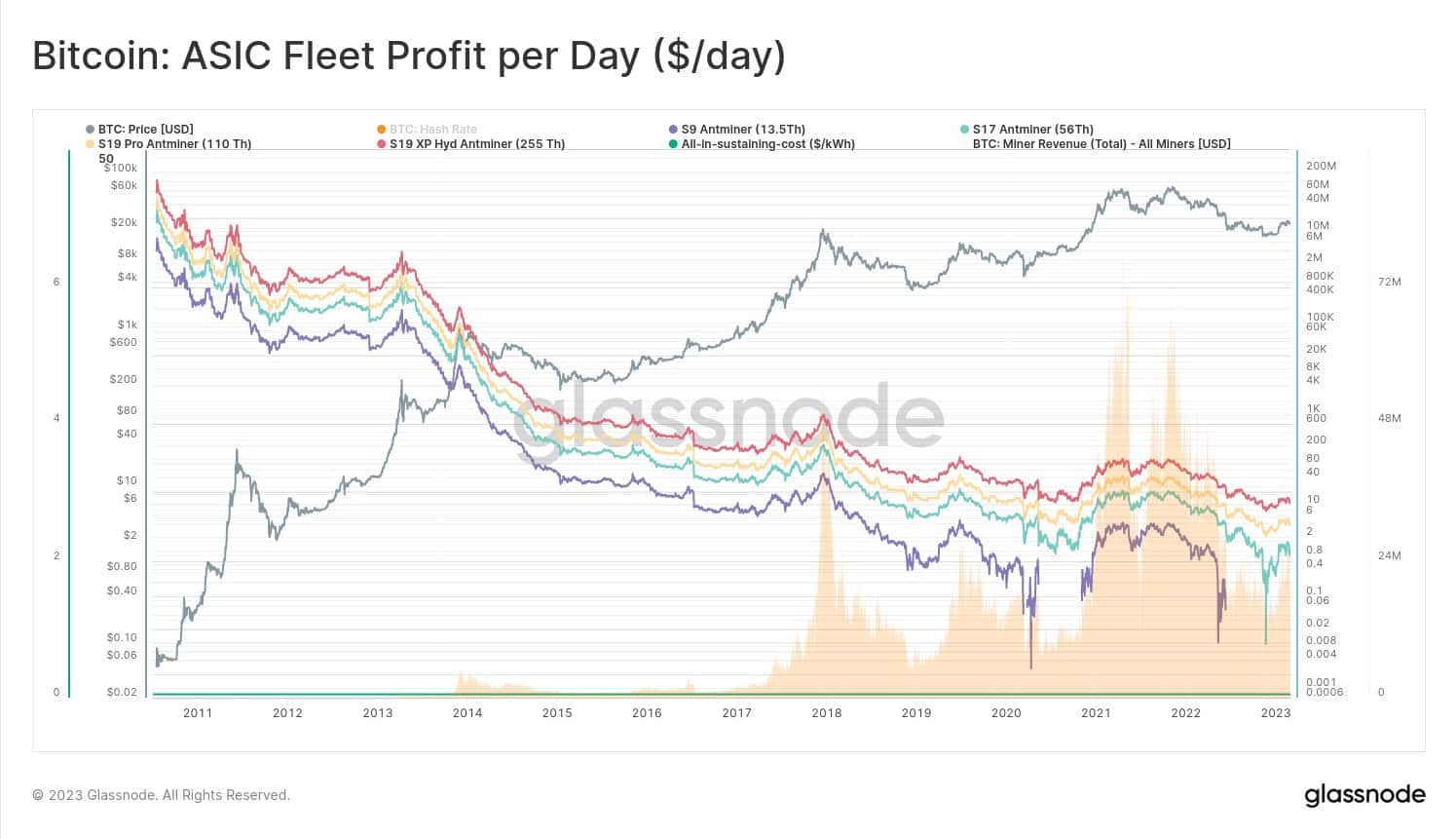

In accordance with glassnode’s information, the ASIC revenue per day has fallen considerably. Because of the decline in ROI (Return On Funding) for miners, the income generated by them has gone down by a major margin.

Supply: glassnode

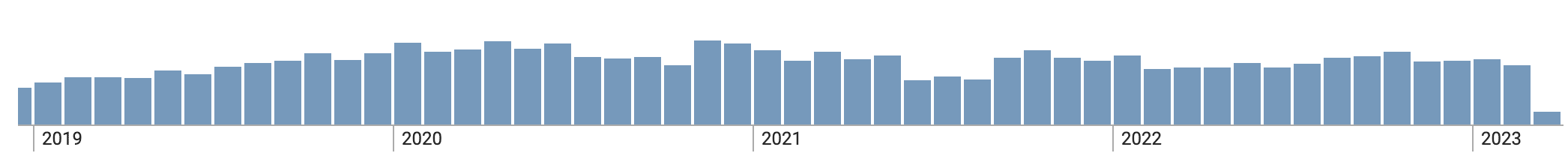

During the last week, the quantity of income generated by miners has fallen from 1065.06 BTC to 986.026 BTC. Nevertheless, regardless of the falling revenues, many of the massive mining swimming pools remained unaffected.

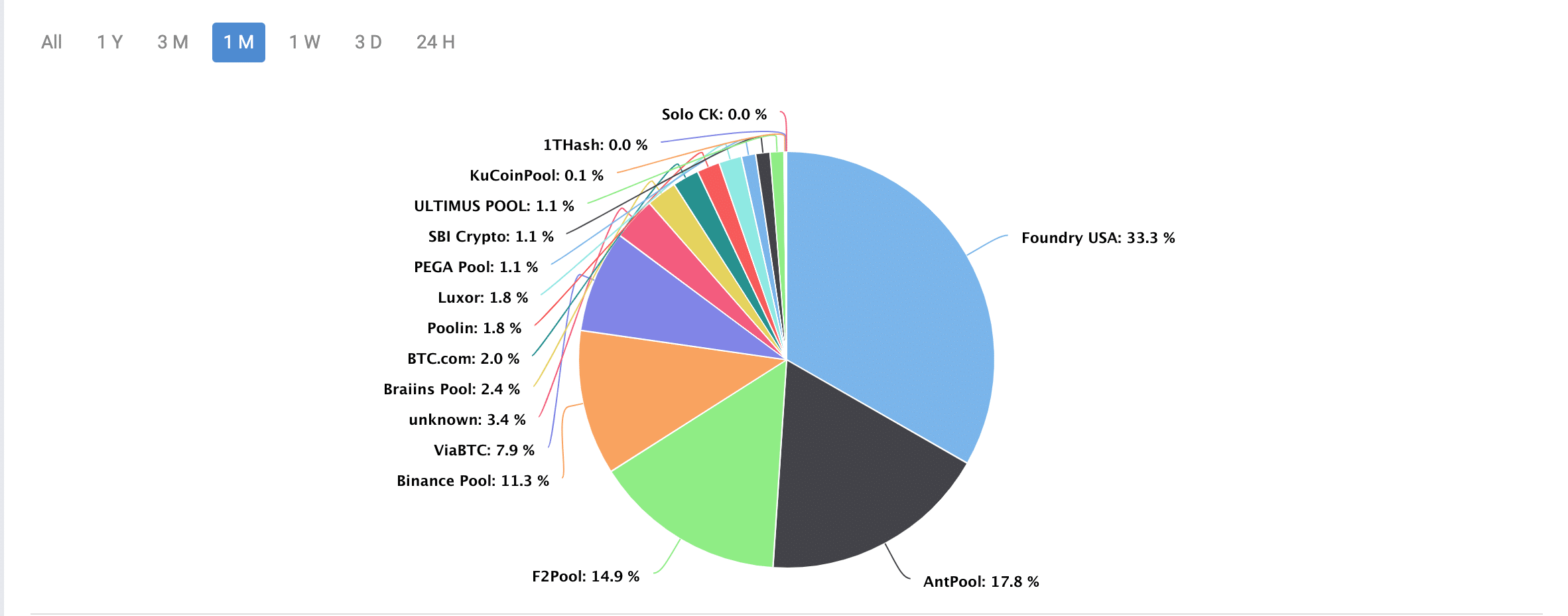

On the time of writing, three main mining swimming pools dominated the sector, specifically, Foundry USA which took 33.3% of your entire mining share. It was adopted by Antpool and F2Pool, which captured 17.8% and 14.9% of the mining shares, respectively.

Supply: BTC.com

Foundry USA managed to mine 7577 blocks prior to now six months. At press time, it managed to provide 2.29% of the transaction charges as a block reward.

However, Antpool mined 5,123 blocks throughout the identical interval. Nevertheless, F2Pool couldn’t handle to do very properly and was solely capable of mine 4,084 blocks within the final six months.

Is your portfolio inexperienced? Take a look at the Bitcoin Revenue Calculator

The month-to-month blocks mined by F2Pool declined from 761 in October to 615 in March. If this pattern continues, F2Pool might lose its place because the third most profitable mining pool.

Supply: BTC.com

That being mentioned, it stays to be seen how these mining swimming pools handle to carry out, given the excessive variety of ASIC fleets required.

Evidently, if Bitcoin worth rises and rallies additional, it might present some reduction to miners.

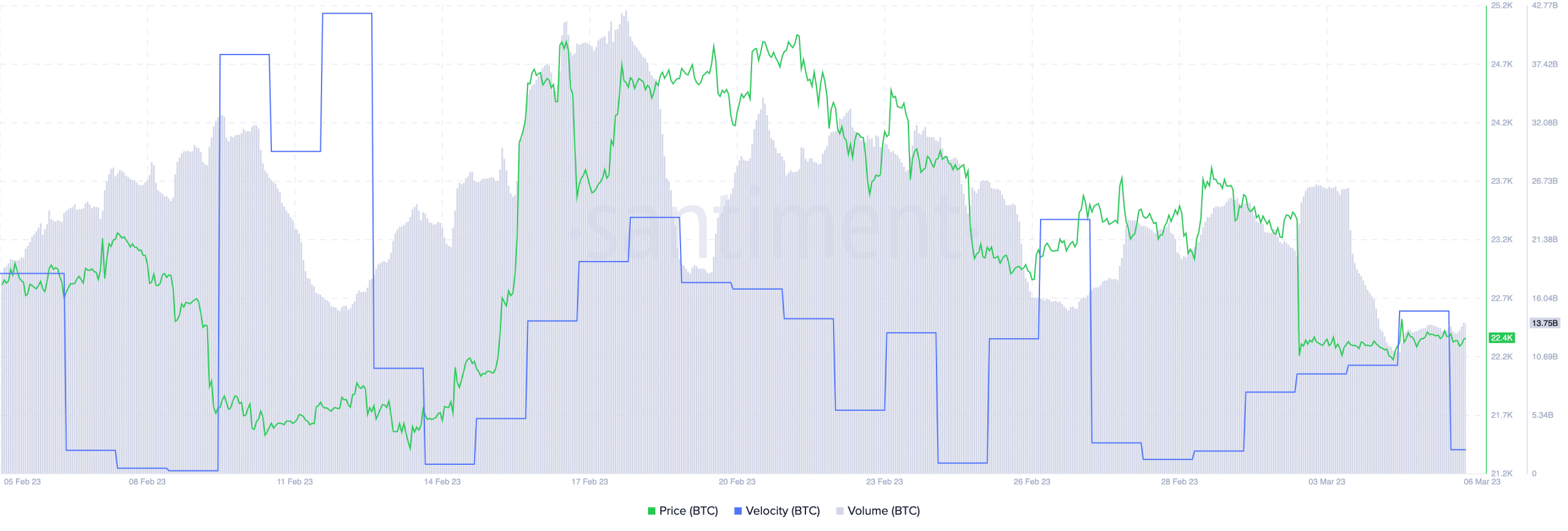

Nevertheless, at press time, BTC was buying and selling at $22,400 and its worth had fallen by 3.85% over the previous week.

Its quantity adopted go well with and fell from 22.78 billion to 13.75 billion in the identical interval.

Supply: Santiment