- BTC traded briefly under the $20,000 worth degree on 10 March, resulting in vital lengthy liquidations.

- On the each day chart, elevated coin sell-offs have been noticed.

Within the early buying and selling hours of 10 March, Bitcoin [BTC] traded momentarily under the $20,000 worth degree for the primary time in seven weeks, inflicting market-wide liquidations.

In line with information from CryptoRank, $422 million in lengthy and brief positions was liquidated from main derivatives exchanges, with 86.2% of liquidated positions being lengthy ones.

Supply: CryptoRank

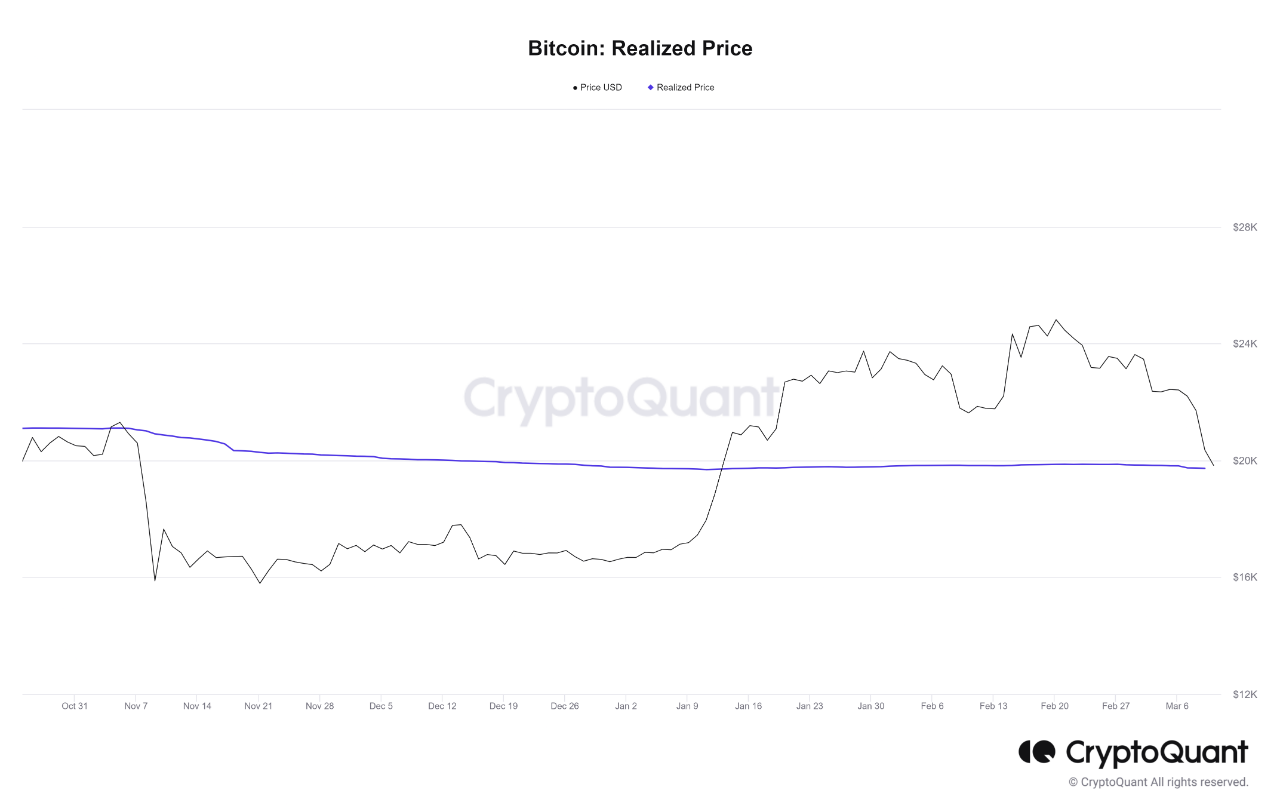

Whereas BTC reclaimed the $20,000 worth degree and traded at $20,662 at press time, pseudonymous CryptoQuant analyst Crazzy Blockk discovered that the momentary decline within the king coin’s worth brought about it to check the realized worth of $19,700.

Is your portfolio inexperienced? Try the Bitcoin Revenue Calculator

In line with the analyst, “sustaining this degree is critical for the continued bullish outlook of the market.” That is so as a result of a sustained drop under this degree may point out a big loss in worth for BTC holders.

Supply: CryptoQuant

The bulls and bears slug it out within the open

Presently buying and selling at a five-week low, the sharp fall in BTC’s worth on 10 March didn’t deter the whales from additional accumulating the king coin.

In line with Twitter analyst WuBlockchain, on the identical day, a number of BTC whales have been noticed shopping for name choices with a strike worth of $25,000 within the April expiration and promoting the identical strike name choices for the June expiration.

Within the choices market, there have been numerous calendar unfold transactions consisting of enormous calls within the final hour, primarily concentrated in: BTC-25000-C purchase April and promote June; ETH-1600-C purchase April and promote June. @GreeksLive mentioned that this will likely present confidence in… https://t.co/c46OmX68vX pic.twitter.com/aGW8ZfqrUf

— Wu Blockchain (@WuBlockchain) March 10, 2023

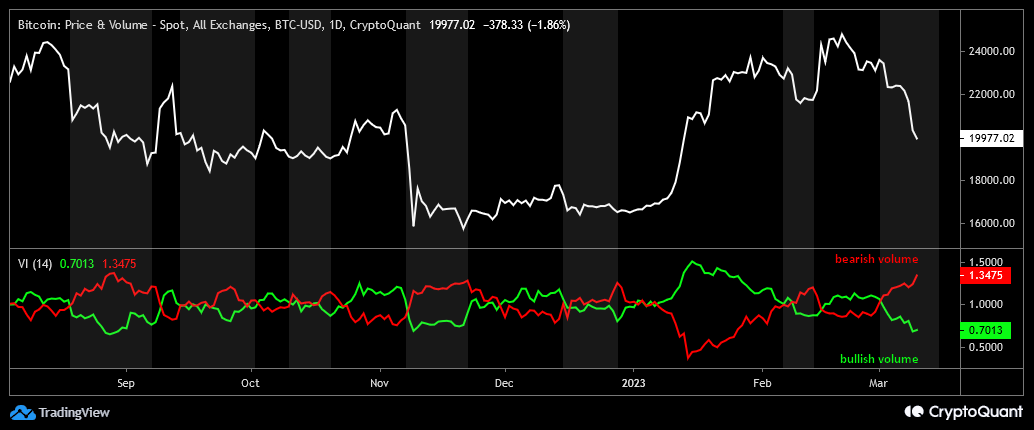

Conversely, CryptoQuant analyst Baro Virtual assessed BTC’s vortex indicator (VI) and located that “the positions of the bears started to strengthen on March 2, 2023, and proceed to strengthen till now.” In line with the pseudonymous analyst, BTC bears stay relentless with distribution regardless of some cool-off durations.

Advising traders to commerce with warning, Baro Digital warned:

“For now, vendor exhaustion mayn’t occur as a result of the domino impact because of the collapse of the FTX hasn’t but ended, and the White Home and different US authorities monetary establishments are attempting to kick Bitcoin in each potential approach. In a phrase, uncertainty is returning to the crypto market once more.”

Supply: CryptoQuant

Redder within the coming days?

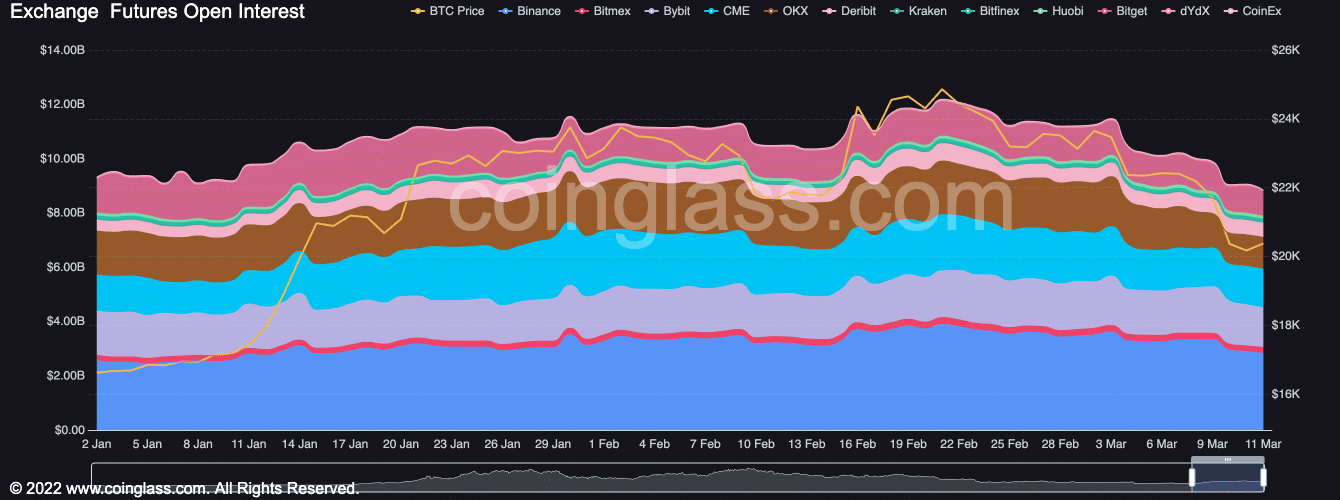

In line with information from Coinglass, BTC has seen a big decline in Open Curiosity prior to now 24 hours. As of this writing, the coin’s Open Curiosity stood at $8.834 billion. For context, the coin’s Open Curiosity has declined by 19% within the final 10 days.

Supply: Coinglass

On a each day chart, elevated coin distribution has pressured key momentum indicators to lie under their impartial strains. For instance, oversold at press time, BTC’s Relative Power Index (RSI) and Cash Move Index (MFI) have been 30.52 and 29.08, respectively.

Learn Bitcoin [BTC] Value Prediction 2023-24

Additionally, the Chaikin Cash Move (CMF) was positioned in a downtrend at -0.06, under the centerline. This was a bearish sign because it meant that promoting outweighed shopping for, thus projecting an extra decline in BTC’s worth.

Supply: BTC/USDT on TradingView