- Blur’s NFT switch quantity has crossed OpenSea.

- The variety of new addresses on Ethereum remains to be low.

Since its launch in October 2022, Blur [BLUR] has gained important traction, overtaking business chief OpenSea in NFT switch quantity, Glassnode present in a brand new report.

How a lot are 1,10,100 BLURs value as we speak?

Blur marks important victories

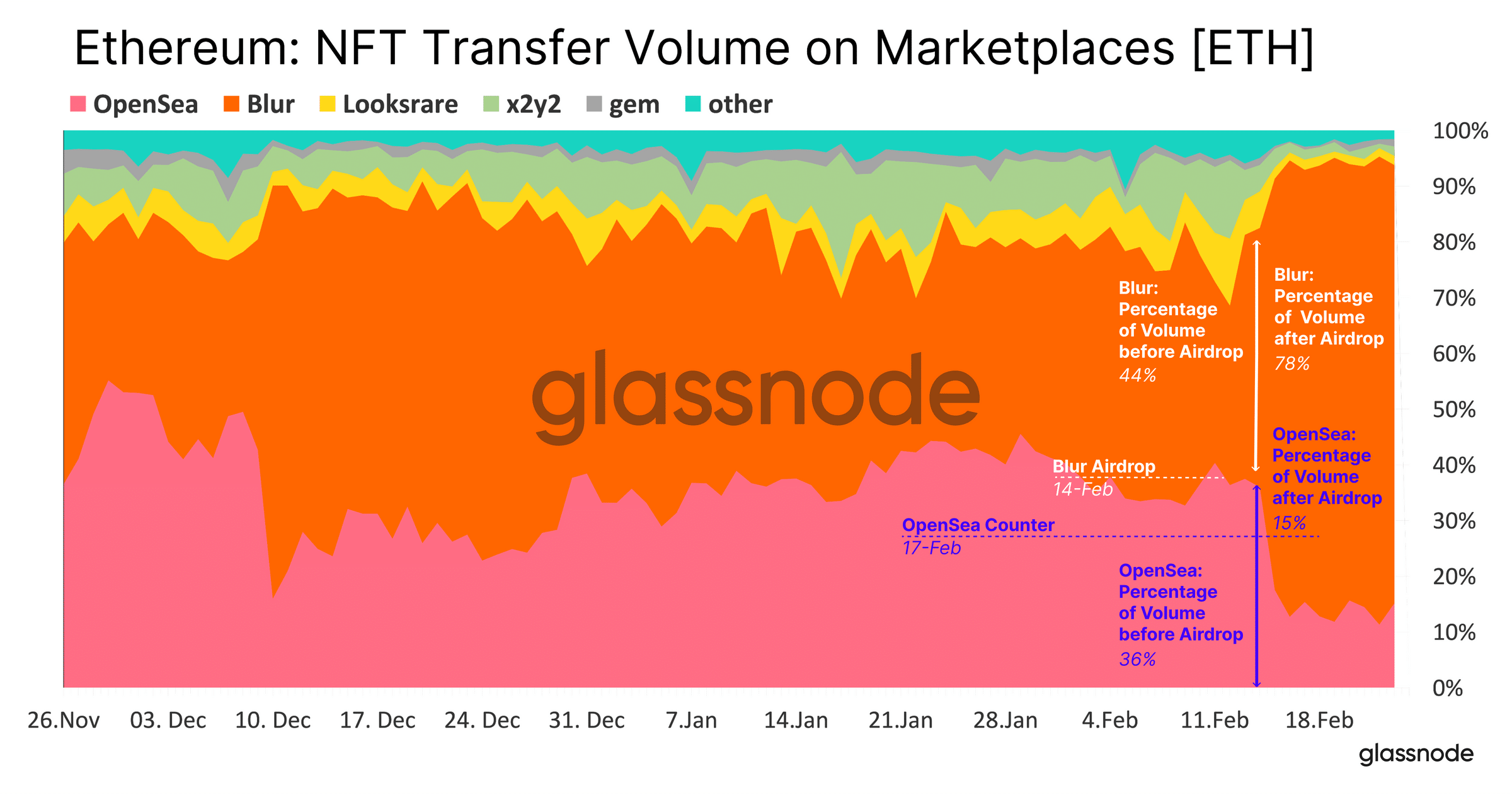

In line with the on-chain information supplier, the surge in Blur’s market share got here after its token AirDrop on 14 February. Previous to the BLUR token AirDrop, the NFT market and aggregator held 48% of the NFT switch quantity in the complete market. Nonetheless, following the AirDrop, its NFT switch quantity jumped to a excessive of 78%.

This considerably affected OpenSea as its NFT switch quantity dropped by 21% following BLUR’s AirDrop.

Supply: Glassnode

Glassnode said that Blur’s success inside just a few months of its launch was because of its nature as an expert buying and selling platform for NFTs, which incorporates a zero-trading charge mannequin and elective royalty funds.

As well as, following the BLUR token AirDrop, the platform applied a token reward system that incentivizes customers to put up bids. This has enhanced market depth and elevated NFT gross sales frequency, resulting in improved liquidity and buying and selling experiences.

OpenSea tried to counter Blur’s success by restructuring its charge mannequin and insurance policies, however this had a restricted impression because the platforms have completely different person bases.

We’re making some huge adjustments as we speak:

1) OpenSea charge → 0% for a restricted time

2) Shifting to elective creator earnings (0.5% min) for all collections with out on-chain enforcement (outdated & new)

3) Marketplaces with the identical insurance policies is not going to be blocked by the operator filter— OpenSea (@opensea) February 17, 2023

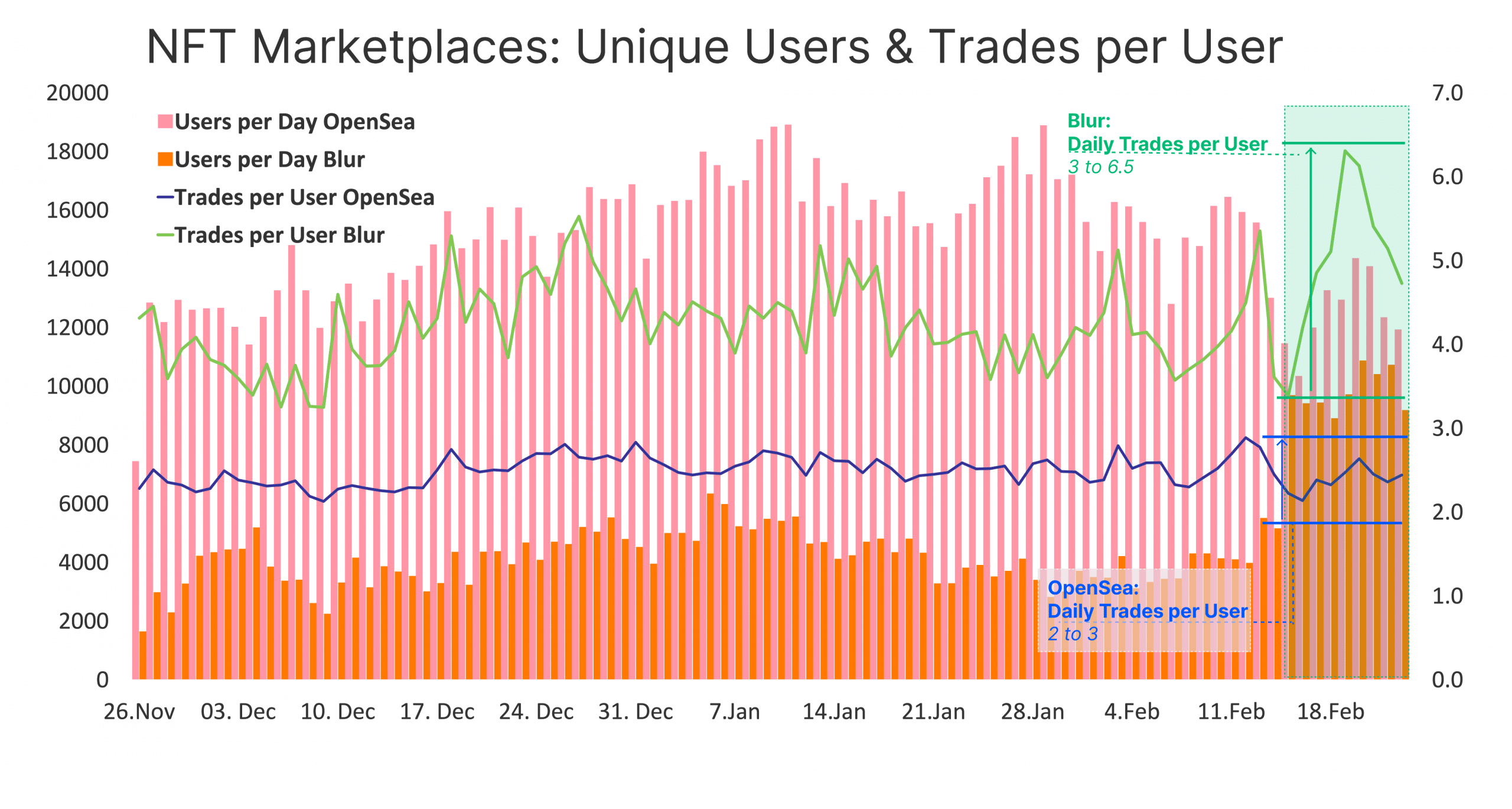

Furthermore, Blur’s day by day gross sales frequency per distinctive person is considerably larger than OpenSea. This, in accordance with Glassnode, creates “a flywheel impact,” with extra sellers feeling assured itemizing on Blur’s platform, creating a bigger providing that pulls extra consumers.

Supply: Glassnode

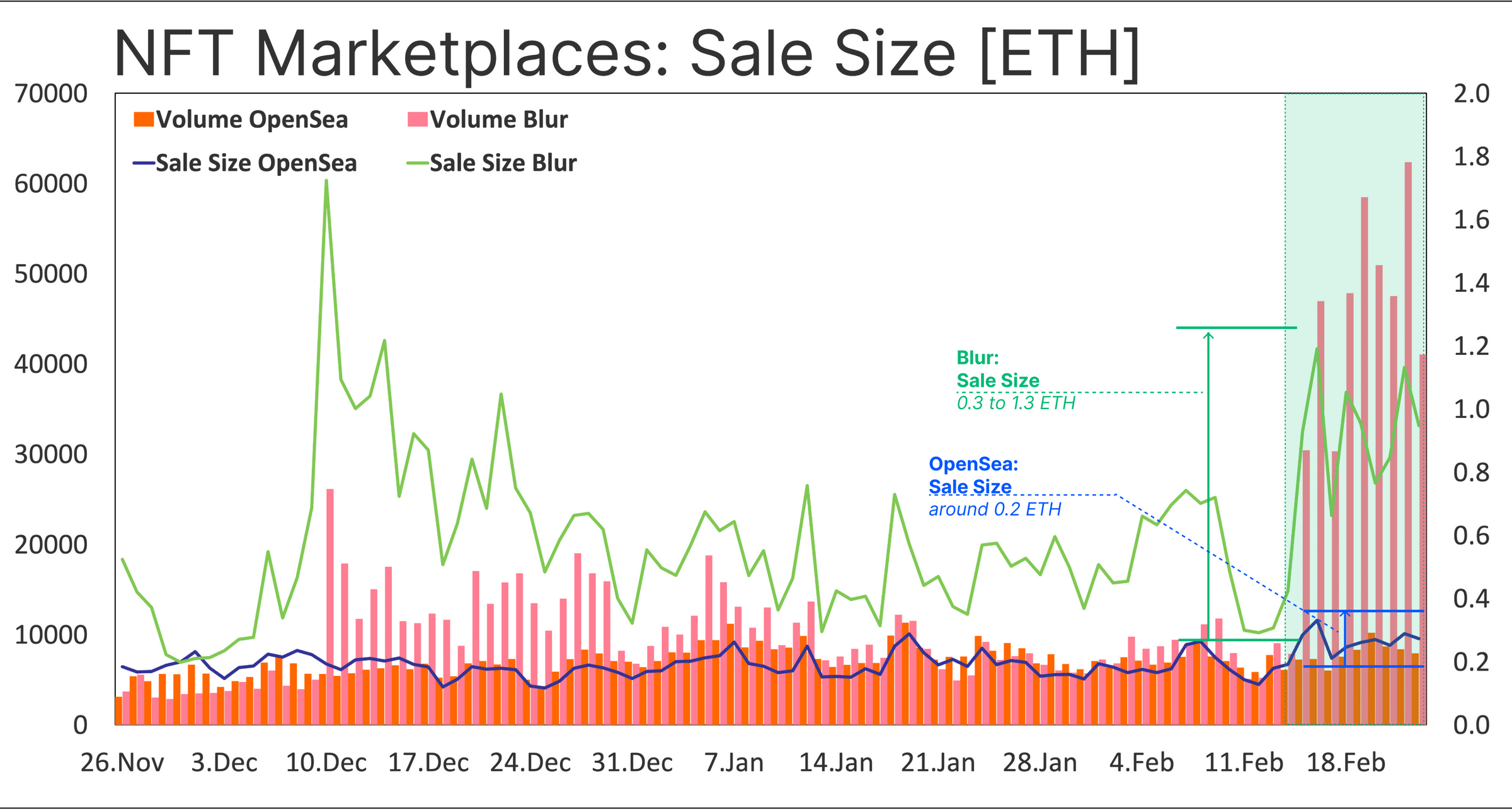

Glassnode discovered additional that evaluating the sale sizes of the 2 marketplaces revealed that Blur’s strategy has created a extra profitable gross sales ambiance, as evidenced by sale quantities starting from 0.3 to 1.3 ETH. In distinction, OpenSea has maintained a gentle common of roughly 0.2 ETH for a number of months.

Supply: Glassnode

The Ethereum community isn’t the winner, in spite of everything

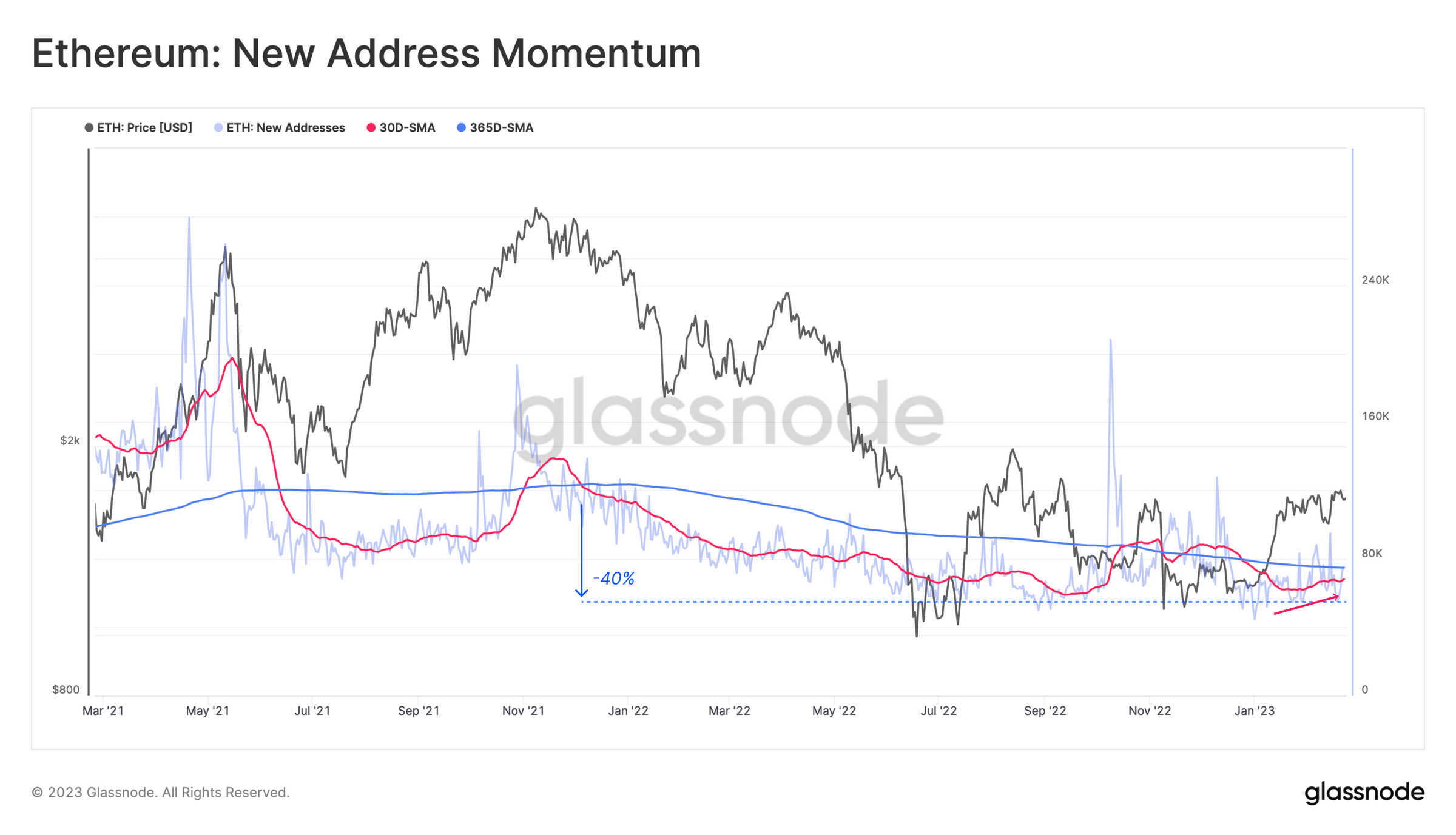

Whereas Blur’s exercise might need led to elevated demand in blockspace and validator charges on Ethereum, opposite to the assumption held by many, there was no considerable impression on community adoption, Glassnode discovered.

Whereas there was a development in on-chain exercise, the variety of new addresses remains to be 40% decrease than this time final yr, indicating detrimental momentum.

In line with Glassnode:

“The newest curiosity in NFTs seem to primarily attraction to present customers, and are as but, unable to draw new customers to the Ethereum community. This additionally means that each NFT marketplaces mentioned above, and certainly most protocols, are combating over the identical preexisting person base of crypto-natives.”

Supply: Glassnode