- Binance altered storing the business restoration fund as stablecoins and moved it to BNB, ETH, and BTC.

- The crypto neighborhood believes that the choice might set off shopping for strain.

Binance CEO Changpeng Zhao introduced on 13 March that the alternate would cease maintaining the remainder of the $1 billion restoration fund in stablecoin.

CZ, as he’s popularly known as, confirmed that the fund had been saved in BUSD. However the ill-fated occasions that befell stablecoins just lately have made it essential to convert to crypto-native Binance Coin [BNB], Ethereum [ETH], and Bitcoin [BTC].

Given the adjustments in steady cash and banks, #Binance will convert the remaining of the $1 billion Trade Restoration Initiative funds from BUSD to native crypto, together with #BTC, #BNB and ETH. Some fund actions will happen on-chain. Transparency.

— CZ 🔶 Binance (@cz_binance) March 13, 2023

How a lot are 1,10,100 BNBs price at present?

In November 2022, Binance introduced a restoration fund after the FTX contagion revealed that crypto companies weren’t void of collapse. The alternate thought-about the fund useful in order to bail out distressed crypto property and tasks of their time of want.

Switching the shop of worth ends in…

Nevertheless, its Paxos-issued stablecoin received the regulatory hammer and has now been compelled to alter the storage location. And maintaining in one other stablecoin or a “trusted” financial institution might pose much more danger due to the turmoil round these entities.

Earlier than the disclosure, the BNB worth had elevated by 9.28% within the final 24 hours. This enhance, accompanied by an all-around market revival helped the coin regain the $300 area. However is BNB able to rejecting bearish want within the brief time period?

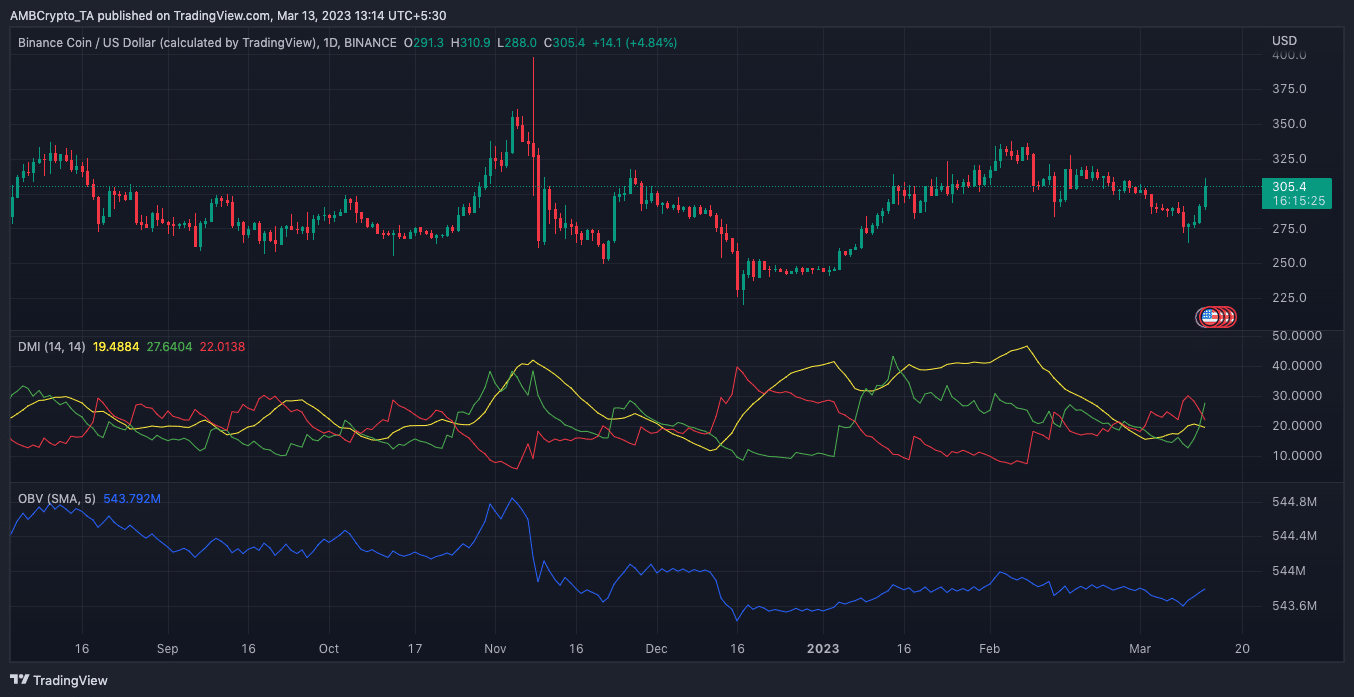

Indications from the every day chart confirmed that BNB was not fully in a security internet due to the Directional Motion Index (DMI) indicators. On the time of writing, the -DMI (pink) was 22.01 whereas the +DMI (inexperienced) was 27.64.

Supply: TradingView

Though the greens appeared larger, the Common Directional Index (ADX) didn’t verify a sustained motion but. At press time, the ADX (yellow) was 19.48. Since this indicator worth was under 25, it meant that the BNB pattern was not extraordinarily robust.

Nevertheless, the On-Stability-Quantity (OBV) appeared to be closing larger than the earlier days. If maintained, it might carve out a bullish end result for BNB relying on the traders’ sentiment.

Hovering on the BNB chain

Additional, the strife that hit the crypto topography final week couldn’t hinder the BNB chain from registering landmarks with actions therein.

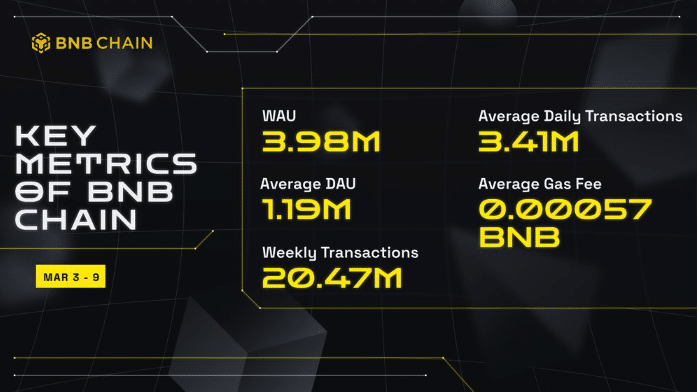

In response to its key highlight report, its Weekly Energetic Customers (WAU) summed as much as 3.98 million.

Learn Binance Coin’s [BNB] Value Prediction 2023-2024

The metric measures the variety of customers who take advantage of out of their crypto property by buying and selling. The chain was additionally in a position to meet up the WAU quantity with a mean every day transaction of three.41 million.

Supply: BNB Chain

Moreover, many feedback from the CZ revelation aligned with a doable bullish market because of the alternate motion. Notably, a couple of individuals within the crypto neighborhood believed that purchasing strain would quickly resume. And in response, might catapult the market within the upward path. Contemplate this tweet, as an illustration.

.@cz_binance has introduced to transform $BUSD within the Trade Restoration Fund to $BTC, $ETH, and $BNB.

With almost $1B untapped, this implies the market may have excessive shopping for strain quickly.

Bullish? pic.twitter.com/XvYHfrQSFu

— The Knowledge Nerd (@OnchainDataNerd) March 13, 2023