NFT

Borrowing Bored Apes and Doodles is booming.

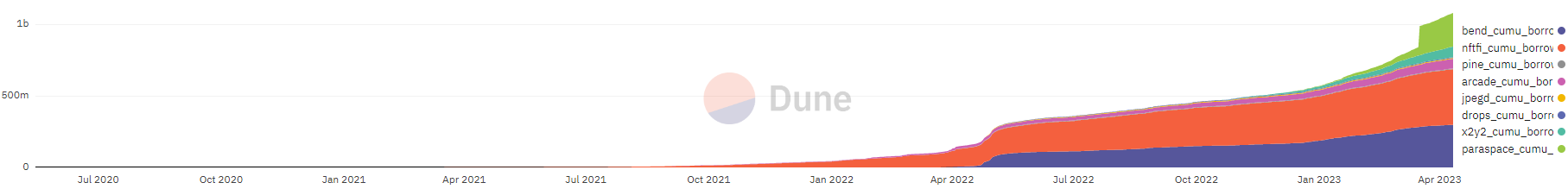

Per information pulled from Dune, the cumulative quantity for borrowing in opposition to NFTs has simply hit $1 billion.

This measures the greenback worth of borrowing exercise throughout a number of notable tasks together with market main NFT liquidity suppliers NFTfi and BendDAO, but in addition newcomers like Paraspace.

As of April 6, NFTfi facilitated greater than $390 million, BendDAO boasts almost $298 million, and Paraspace has already hit $236 million. The variety of cumulative customers has additionally soared nicely above 40,000.

Cumulative borrow quantity in {dollars}. Supply: Dune.

Borrowing in opposition to your Bitcoin is one factor, however how has a market meant for borrowing jpegs discovered such traction?

“NFT holders are more and more on the lookout for methods to unlock the worth of their belongings with out promoting them, and lending and borrowing platforms like JPEG’d supply an answer to this want,” JPEG’d’s advertising and neighborhood lead Derrick Nguyen informed Decrypt. “Moreover, decreased volatility has been one other results of the NFT market maturing, which has made utilizing NFTs as collateral increasingly viable and enticing.”

Nguyen additionally cited the platform’s liquidation insurance coverage, which lets customers purchase again their repo’d NFT from the JPEG’d DAO as a substitute of being immediately resold on the secondary market.

Rival NFT liquidity supplier NFTfi has its personal distinctive liquidation mechanism that leverages its peer-to-peer design.

“The one manner for debtors to lose their collateral is failing to repay the mortgage upon mortgage maturity,” NFTfi’s CMO Andrej Skraba informed Decrypt. “P2P lending permits for extra tailor-made mortgage agreements between the borrower and the lender. This contains phrases like rates of interest, collateral, and mortgage length, which may be negotiated (and renegotiated) on a case-by-case foundation.”

BendDAO’s co-founder Crylipto known as the enterprise proposition “easy.”

“We simply use lending and borrowing companies to enhance NFT asset liquidity,” they stated. “Whenever you maintain an NFT, you don’t must promote it, as a substitute, you need to use your NFT as collateral to borrow Ethereum for the liquidity demand.”

Borrowing Towards a Bored Ape NFT—What Might Go Unsuitable?

How does NFT borrowing work?

The assorted NFT liquidity suppliers have minor variations of their respective choices, however the primary premise is identical throughout the board: Squeezing liquidity out of illiquid jpegs.

JPEG’d, for instance, lets customers do exactly this, with just a few further bells and whistles.

For instance, customers who lock up an NFT within the platform’s vault can borrow as much as 60% of the NFTs worth in artificial variations of Ethereum (pETH) or {dollars} (PUSd). These artificial tokens can then be swapped out for bigger-brand stablecoins over on Curve, or proceed to earn yield there too.

BendDAO lets customers make down funds on particular blue-chip NFTs with a 40% minimal upfront and the remainder is roofed by a flash mortgage from Aave. In some ways, it resembles the financialization of the true property market, with hopeful NFT homeowners taking out a digital mortgage to get their very personal Bored Ape.

NFT Service JPEG’d Launching CryptoPunks Lending and Chainlink Integration

Likewise, Paraspace is constructing on the mannequin however including much more extra options, together with letting customers stake their APE tokens on the platform.

“With that collateral credit score and capital enlargement customers are capable of entry much more liquidity, and we’re seeing plenty of of them really leverage our Purchase Now Pay Later function on the platform to purchase extra NFTs,” a Paraspace consultant informed Decrypt.

Going past unicorn standing

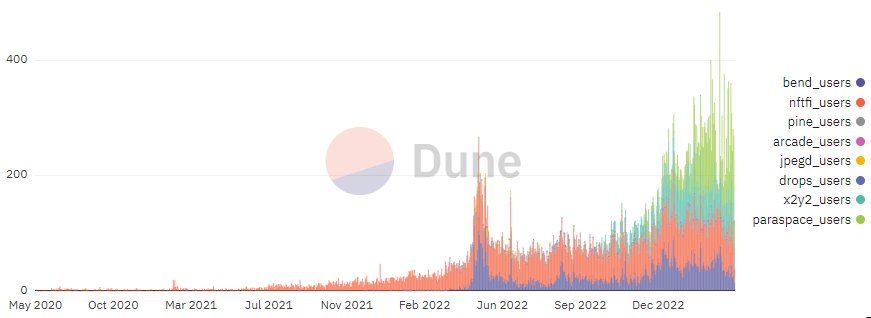

Cumulative volumes and customers are all wonderful and dandy, however a better take a look at the information reveals it is nonetheless pretty early days for borrowing in opposition to NFTs.

Per Dune information, the variety of day by day customers throughout all platforms has solely ever crossed 400 individuals twice. Day by day borrow volumes are additionally fairly low, with numbers hardly ever ever crossing greater than $1 million per platform.

Day by day customers throughout NFT lending platforms. Picture: Dune.

By way of how the house will proceed to develop, JPEG’d’s Nguyen stated the “market should capitalize on the potential of NFTs as digitalized property rights and acknowledge that just about something can turn out to be an NFT.”

Others, like NFTfi’s Skraba, recommend that past constructing out the infrastructure wanted to maintain unlocking illiquid NFTs, the business must also deal with “elevating consciousness” round most of these instruments.

“At current, many digital asset holders are both unaware of the existence of credit score markets or are unfamiliar with the assorted sorts of lending protocols obtainable,” stated the CMO. “As an business, we nonetheless have a lot to perform by way of educating the market and elevating consciousness. This elevated understanding will pave the best way for brand spanking new NFT verticals and integration alternatives.”