The Ethereum community, the second-largest cryptocurrency by market cap, has not too long ago witnessed an uncommon however noteworthy pattern. For the primary time in 6 years, the variety of Ethereum’s change depositing transactions has dropped to an all-time low. The query on each dealer, investor, and fanatic’s thoughts is: “What does this imply for Ethereum’s (ETH) worth? Might or not it’s a springboard for a leap in direction of the $2,000 mark?”

Ethereum’s Trade Depositing Transactions Attain 2017 Ranges

As uncertainties surrounding the US debt ceiling and potential rate of interest hikes weigh closely on the cryptocurrency market, main belongings comparable to Bitcoin and Ethereum discover themselves struggling to supply a definitive outlook. However, our examination suggests a burgeoning bullish sentiment poised to propel the value of ETH on an upward trajectory.

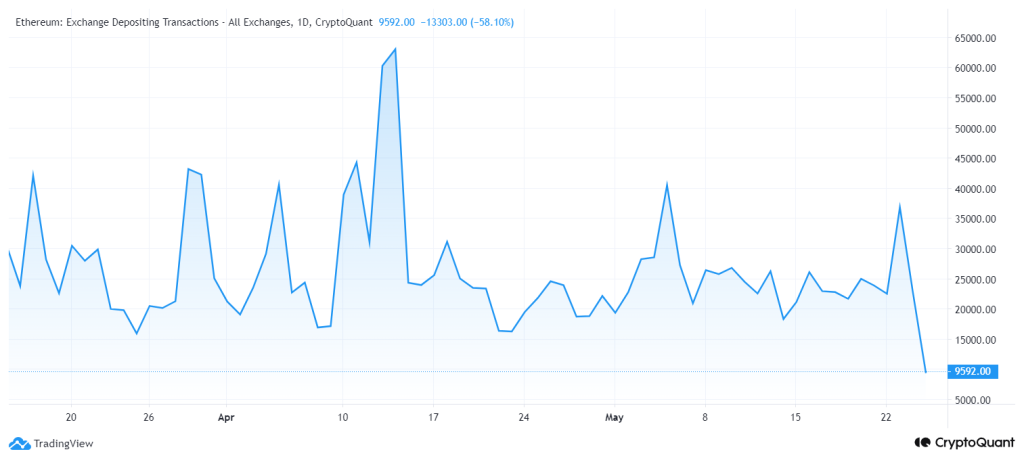

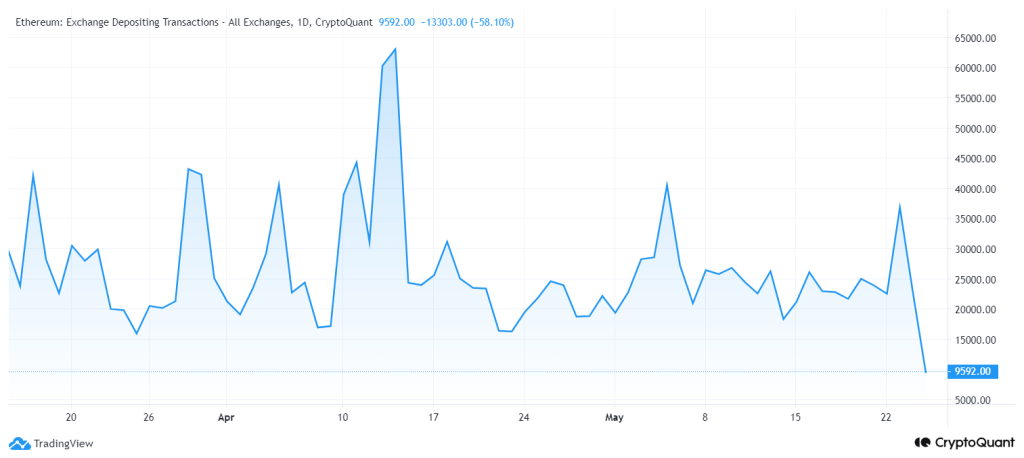

Upon shut inspection of Ethereum’s change depositing transactions, we’ve famous a major multi-year trough as we speak, bottoming out at 9,592 transactions. This can be a noteworthy commentary as this similar stage was final skilled on April 23, 2017, proper earlier than Ethereum launched into its inaugural bull run, touching the $1000 mark.

The variety of change depositing transactions is a essential information level for crypto evaluation. This metric offers a dependable indication of potential sell-offs or worth pressures. A excessive variety of deposit transactions normally alerts an impending sell-off as extra holders are transferring their belongings onto exchanges.

Conversely, a low quantity means that holders are withdrawing their belongings, indicating a bullish sentiment as buyers present much less curiosity in promoting their ETH holdings.

“The noticed resurgence within the worth of Ethereum is certainly important, probably indicating a bullish part within the coming months. The marked lower in deposit transactions finally alerts a optimistic outlook for the asset.”

What To Anticipate From ETH Value Subsequent?

Regardless of opening this week with a optimistic rally, Ethereum encountered a agency rejection near the $1,870 mark. Following this, ETH’s worth has been on a downward spiral, discovering a security internet on the $1,760 stage. However, Ethereum’s newest bounce again from its assist threshold, paired with its ascension previous rapid Fibonacci ranges, has rekindled bullish optimism.

As of writing, ETH worth trades at $1,802, surging over 0.15% within the final 24 hours. Analyzing the 4-hour worth chart, Ethereum skilled important shopping for strain as we speak at $1,780, sending the value to an intraday excessive of $1,812.

If the ETH worth continues to carry its present momentum and breaks above its rapid hurdle of EMA50 at $1,815, the asset may surge to its subsequent resistance of $1,877. A breakout above its ultimate resistance will clear the street to $2K.

Conversely, any unfavorable financial indicators might function the set off, driving the ETH worth beneath the important assist stage of $1,750.