- Bitcoin’s whole variety of whales reached a three-year low at press time.

- Nonetheless, a number of on-chain metrics favored the bulls and instructed an uptrend.

Santiment’s analyst, in a 3 March YouTube stream, identified the dwindling curiosity of the whales in Bitcoin [BTC] and Ethereum [ETH]. As BTC’s value elevated just a few days in the past, whales continued to dump their holdings. It is a trigger for concern, because it might result in an additional drop within the king coin’s worth.

After the sudden market drop about 10 hours in the past, #crypto is again in restoration mode. However will it’s short-lived? Are whales already making their strikes with #Bitcoin again to $22.5k? Be a part of our stream and discover out!

Twitter: https://t.co/tdV9sHBGhA

Youtube: https://t.co/QkbjmwURfY pic.twitter.com/V5SyUVT3gG— Santiment (@santimentfeed) March 3, 2023

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

Along with that, Glassnode’s information revealed that Bitcoin’s whole variety of whales reached a three-year low on 4 March, reaching 1,663.

📉 #Bitcoin $BTC Variety of Whales simply reached a 3-year low of 1,663

Earlier 3-year low of 1,665 was noticed on 28 February 2023

View metric:https://t.co/k1K8OK2tl3 pic.twitter.com/Y6BKGhVIhG

— glassnode alerts (@glassnodealerts) March 4, 2023

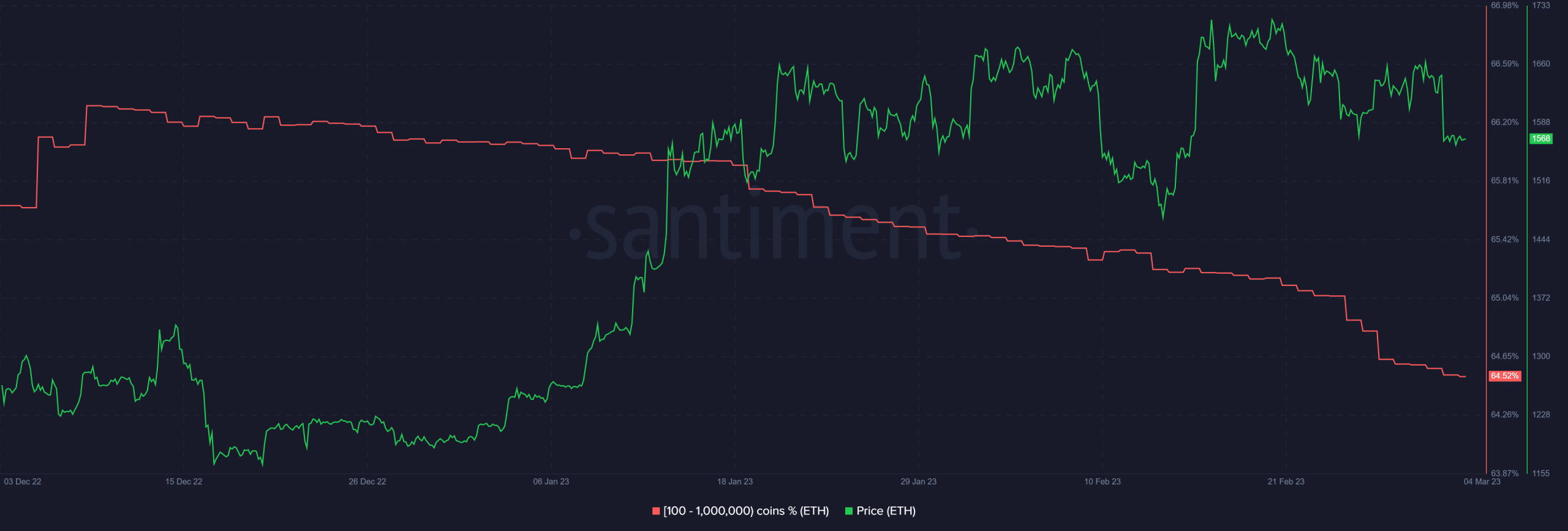

Ethereum whales following Bitcoin’s development?

It was slightly fascinating to notice {that a} comparable development was seen on Ethereum’s chart as whales continued to dump, regardless of the worth pump. Nonetheless, the rationale behind ETH whales’ motion could possibly be completely different, as they may be transferring their property to staking contracts forward of the Shanghai improve.

Supply: Santiment

Different aspect of the story

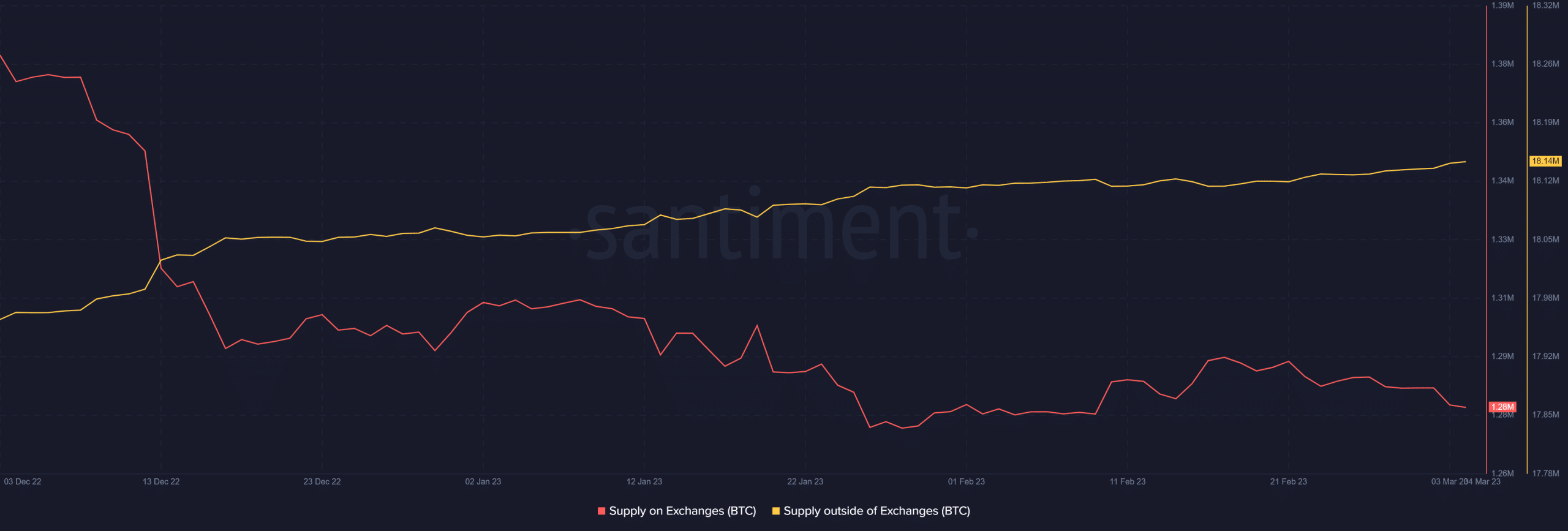

Nonetheless, although the whales decreased their holdings, different on-chain metrics had been bullish on BTC. As an illustration, BTC’s provide on exchanges decreased significantly, together with an uptick in provide exterior exchanges. This was a constructive replace, because it instructed that the border market was assured in BTC.

Supply: Santiment

As per CryptoQuant’s data, BTC’s netflow on exchanges was low in comparison with the final seven days, which additionally seemed promising because it indicated much less promoting stress. Moreover, BTC’s Binary CDD was inexperienced, which meant that long-term holders’ motion within the final seven days was decrease than the common, suggesting their will to carry the asset.

One other main bull sign for BTC was that its Relative Power Index (RSI) was in an oversold place at press time, which elevated the probabilities of a value hike within the coming days. Not solely that, however the variety of new addresses reached a 21-month excessive, additional establishing traders’ religion in BTC.

📈 #Bitcoin $BTC Variety of New Addresses (7d MA) simply reached a 21-month excessive of 19,869.101

Earlier 21-month excessive of 19,839.119 was noticed on 14 November 2022

View metric:https://t.co/tDzY9Fl7QL pic.twitter.com/zVNOCTxkcG

— glassnode alerts (@glassnodealerts) March 4, 2023

Is your portfolio inexperienced? Verify the Bitcoin Revenue Calculator

Nonetheless, a bearish end result can’t be dominated out but

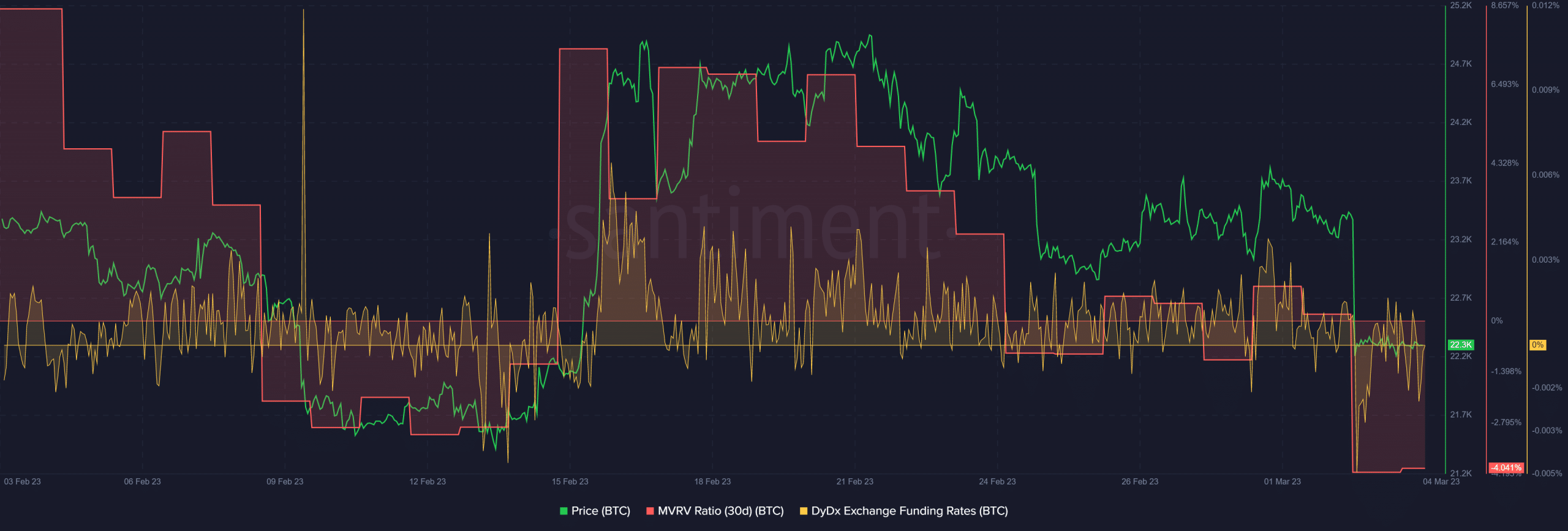

Whereas the aforementioned metrics supported the probabilities of an uptrend, just a few different metrics had been nonetheless within the bears’ favor. BTC’s MVRV Ratio declined due to the current downtrend, which might lead to an additional value plummet. Demand from the derivatives market additionally appeared to have declined as BTC’s DyDx funding fee went down.

The variety of energetic wallets used to ship and obtain cash has decreased. Subsequently, contemplating all of the datasets, it was solely time to reply which approach BTC’s value strikes within the close to time period. At press time, BTC was trading at $22,362.03 with a market capitalization of over $431 billion.

Supply: Santiment