After a powerful rally that pushed Bitcoin (BTC) over the $31,000 stage, the most important cryptocurrency by market capitalization has misplaced its bullish momentum and retraced to its earlier consolidation stage of $28,400. The retracement has been accompanied by a decline in buying and selling quantity and a lower in market sentiment, which has led some buyers to query the sustainability of the latest uptrend.

Is The Bull Pattern In Jeopardy For Bitcoin?

According to the dealer and analyst beneath the pseudonym “CJ,” Bitcoin has confronted weak spot throughout its each day highs, indicating a possible reversal in its bullish pattern. This has put strain on bulls, who are actually carefully monitoring the value motion to establish key assist ranges that should maintain to keep away from an extra worth decline.

One such assist stage is the $27,700, which has acted as a powerful assist flooring for BTC. If the value have been to interrupt beneath this stage, it might sign a shift in market sentiment and probably result in an extra decline in worth. Based on CJ, if BTC fails to push greater from this stage, it may very well be on the cusp of a major correction because the lows of 16k.

Moreover, CJ advises that buyers, whether or not in an extended place or not, ought to maintain an in depth eye on the bearish worth motion inside the 4-hour and 12-hour Fibonacci Quantity Zone (FVG). This zone represents a possible resistance space the place Bitcoin might face promoting strain and probably reverse its bullish pattern.

If a bearish worth motion is about up inside this zone, CJ suggests it may very well be a chance for buyers to enter a brief place. However, if Bitcoin manages to shut again above the $29,980 stage, CJ believes that the cryptocurrency may very well be off to the races, indicating a possible continuation of its bullish pattern.

Is Not All Unhealthy Information For BTC

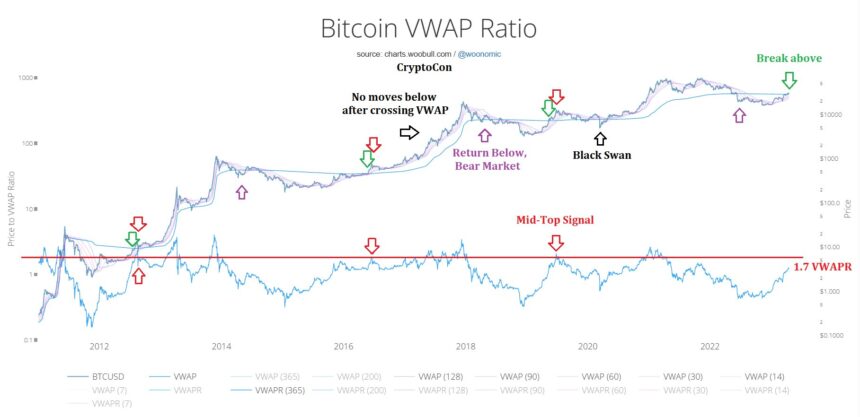

CryptoCon, a outstanding cryptocurrency analyst, has suggested that it might by no means see a lot decrease Bitcoin costs than $28,000 ever once more. This assertion relies on the VWAP (Quantity Weighted Common Value), a technical indicator that measures the typical worth of Bitcoin over a sure interval, weighted by its buying and selling quantity.

Based on CryptoCon, Bitcoin has simply damaged above the VWAP, a bullish sign suggesting a possible reversal within the present pattern. So long as this breakout is sustained within the quick time period, CryptoCon believes that earlier market cycles point out that the one factor that might take Bitcoin again beneath $28,000 is a black swan.

However, CryptoCon has identified that whereas Bitcoin has risen 1000’s of {dollars} with out experiencing a wholesome pullback, the three Week Bollinger Bands nonetheless point out {that a} return to the higher band is probably going at the moment at $35,790, as seen within the chart beneath.

Based on CryptoCon, earlier market cycles have proven that there have been no giant corrections till the higher band was reached, so if CryptoCon’s evaluation is right, it might recommend that Bitcoin is getting into a brand new part of its market cycle, which might probably result in additional worth and investor curiosity enhance.

Featured picture from Unsplash, chart from TradingView.com