- Uniswap witnessed a excessive surge in exercise resulting from SVB’s collapse.

- Nonetheless, its UNI token didn’t see the identical progress.

The autumn of SVB has introduced a shockwave to many traders within the crypto group. Whereas main companies and enormous stablecoin issuers confronted the warmth, the DEX sector of the crypto house, managed to see progress.

Learn UNI’s Worth Prediction 2023-2024

For example, Uniswap witnessed an all-time excessive by way of quantity and outperformed Nasdaq by 5%.

Different DeFi protocols reminiscent of Aave and Curve additionally noticed a spike in exercise throughout this era. Because of the excessive exercise registered on these protocols, the charges generated by them elevated.

Yesterday, #DeFi transactions have been extremely energetic due to the panic surrounding #USDC. #Uniswap charges noticed a surge, reaching $8.7 million, the very best since Could 12 of final 12 months. Curve charges additionally elevated, reaching $950,000, the very best since November 10 of https://t.co/TuhZEhbDtA… https://t.co/LGTNu4bUGi pic.twitter.com/vysQRnlfke

— BecauseBitcoin.com (@BecauseBitcoin) March 12, 2023

Curiously, the spike in charges generated impacted the income collected by these protocols. Based on Messari’s information, income generated by Uniswap elevated by 0.74%, whereas the Curve protocol witnessed an uptick of 0.12%.

Nonetheless, Aave noticed probably the most progress on this regard because it noticed a spike of 48.76% by way of income collected over the past week.

The excessive spike in income for Aave was made doable as a result of there was a surge of 89.93% within the variety of distinctive customers on the Aave protocol.

Not all roses and sunshine

The excessive exercise on all these protocols, nonetheless, didn’t translate to a surge within the whole worth locked (TVL) on them.

Based on DeFi Llama’s information, Uniswap’s TVL fell by 17.29% up to now few days. The Curve protocol’s TVL witnessed an identical decline and fell by 20% in the identical interval.

In the meantime, it was discovered primarily based on Messari’s information, bots have been accountable for almost all of the exercise on the Uniswap protocol.

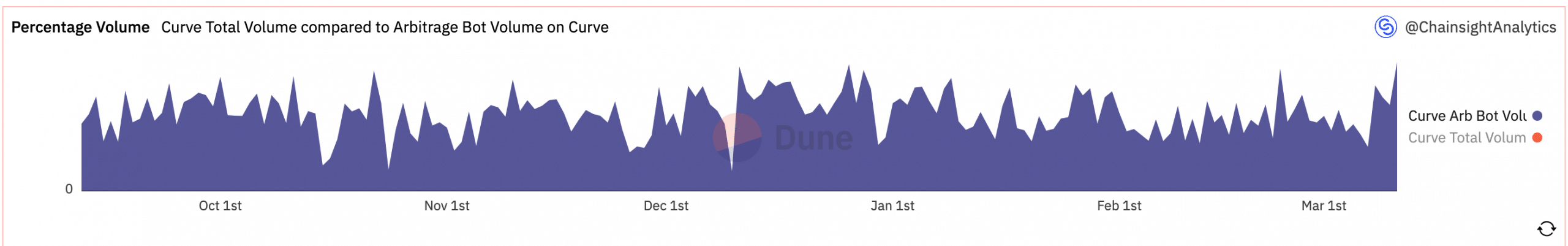

The identical was noticed for the Curve protocol. Based on Dune Analytics’ information, the bot quantity on the curve protocol elevated from 13.5% to 41.3% in the previous couple of days.

Supply: Dune Analytics

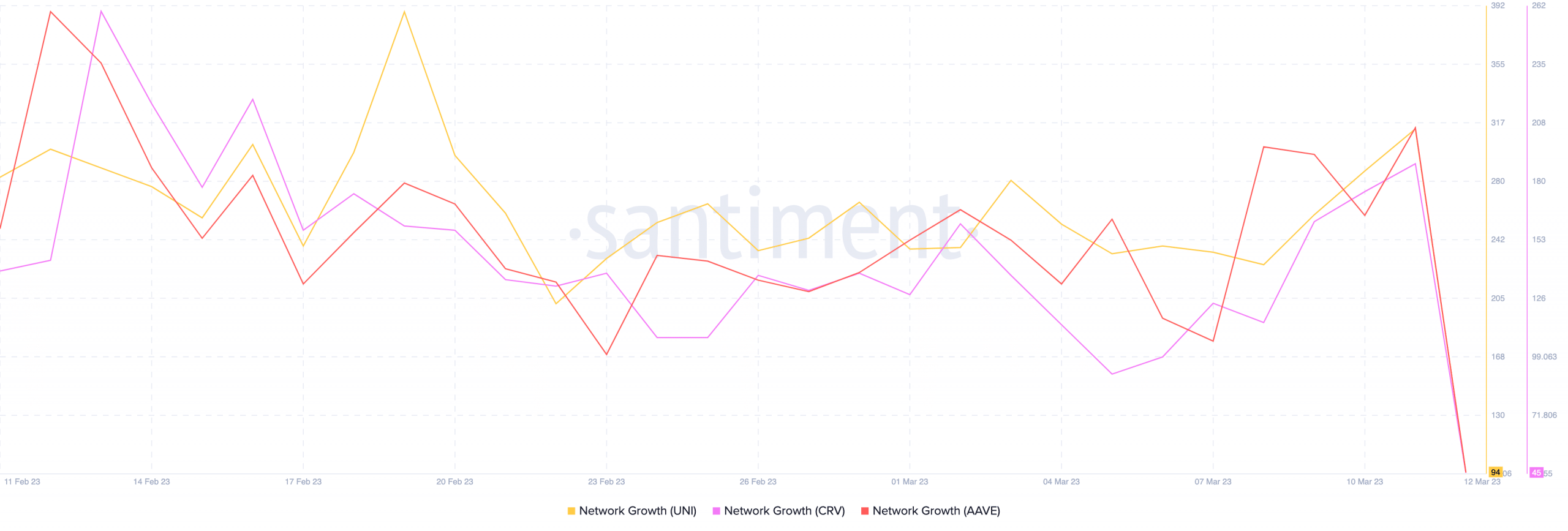

The tokens of those protocols didn’t observe any progress both. The costs of UNI, CRV, and AAVE, fell over the past month.

Parallelly, the community progress of the tokens declined at press time. Thus, suggesting that these tokens weren’t being utilized by any new addresses, on the time of writing.

Supply: Santiment