Disclaimer: The knowledge introduced doesn’t represent monetary, funding, buying and selling, or different sorts of recommendation and is solely the author’s opinion.

- The market construction was bearish.

- The descent into a robust bullish order block laid a transparent invalidation stage for would-be patrons.

Final Sunday (19 February), Cardano was buying and selling at $0.411. Previously week, the worth has fallen by 12.2% to commerce at $0.361 on the time of writing.

The market construction was bearish on the decrease timeframes. With Bitcoin headed decrease on the charts, it appeared ADA bulls may face additional losses.

How a lot are 1, 10, 100 ADA value right this moment?

But, the worth motion confirmed that Cardano patrons have been introduced with a shopping for alternative on the token. Ought to the bulls take it?

The 4-hour bullish order block may spark a Cardano rally

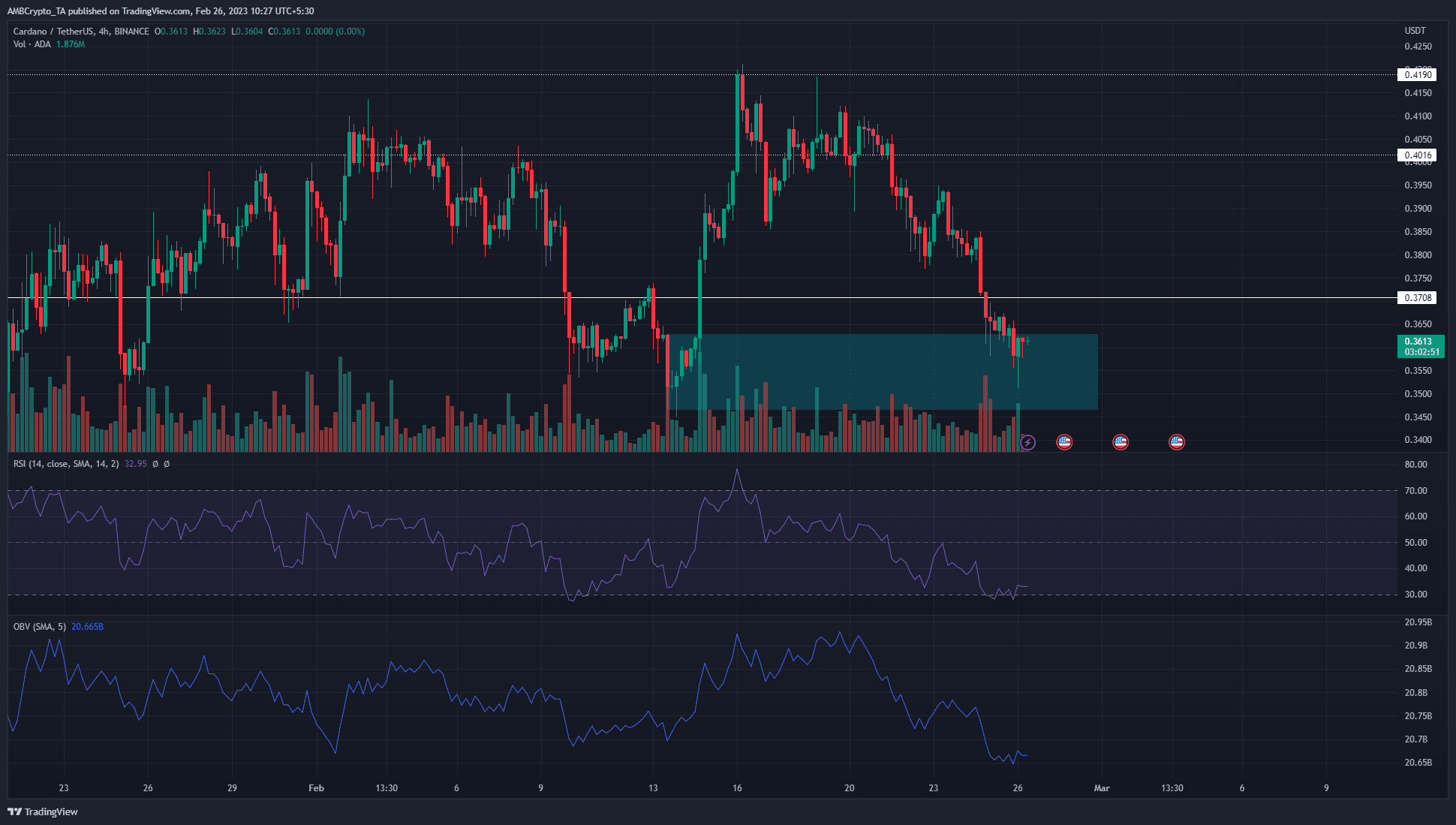

Supply: ADA/USDT on TradingView

On the face of it, the 4-hour and 1-hour market constructions have been bearish. They’ve shaped decrease highs and decrease lows over the previous week.

The RSI was at 32.9 displaying robust bearish momentum. The OBV has additionally been in a downtrend over the previous three days, signifying monumental promoting stress on the way in which down.

On the identical time, this was a retest of the H4 bullish order block that ADA made on the rally earlier this month. Highlighted in cyan, the $0.345-$0.36 is a area the place bulls can start to reverse the costs.

Life like or not, right here’s ADA’s market cap in BTC’s phrases

Throughout the earlier rally from this order block, the transfer upward was speedy and the pullback was sluggish. The $0.354 stage is a help stage from mid-January as properly.

Subsequently, regardless of the proof from the indications it was probably that ADA would get better and push towards $0.41 over the subsequent week. A drop under $0.345 would invalidate this concept.

The Open Curiosity remained depressed however demand might be choosing up

Supply: Coinalyze

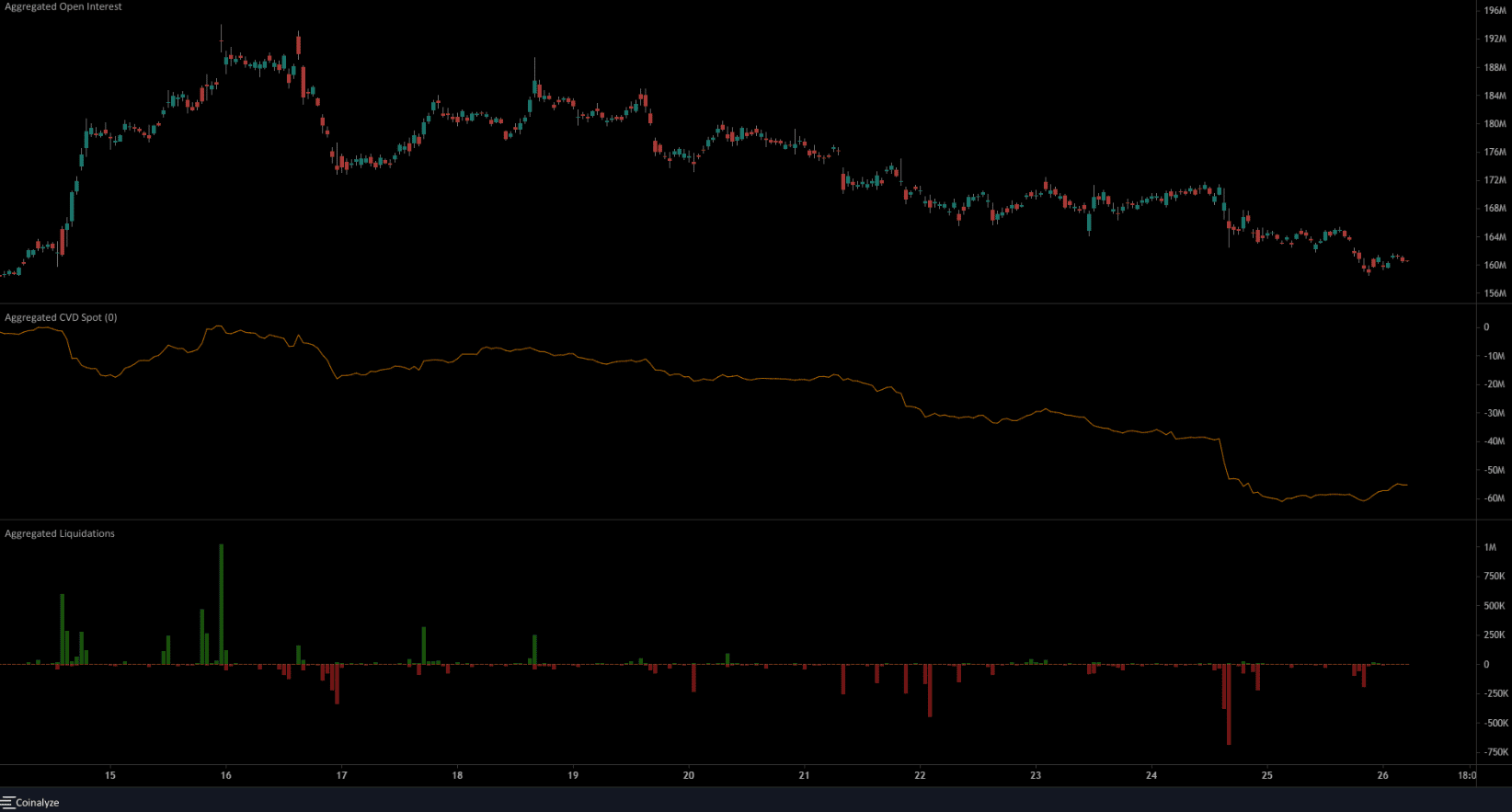

The 1-hour chart from Coinalyze confirmed Open Curiosity has fallen alongside the worth over the previous three days. ADA additionally dropped under $0.37 on this interval.

Subsequently, the inference was that lengthy positions have been discouraged and the market had a bearish sentiment within the close to time period. However, the spot CVD made a better low and started to climb up to now few days, indicating demand available in the market.

The liquidation charts additionally confirmed some lengthy positions have been liquidated on 24 February. In two hours, $1 million value of longs have been liquidated when Cardano dropped from $0.38 to $0.365 on 24 February.

![Cardano [ADA] traders can expect a bullish week- Here’s why](https://nomadabhitravel.com/wp-content/uploads/2023/02/PP-1-ADA-price-3-1536x870.png)