The value of Cardano has been following a bearish trajectory for the previous couple of weeks. Nonetheless, in current buying and selling classes, there have been bullish makes an attempt as patrons tried to push the value larger. Sadly, promoting stress emerged once more, inflicting Cardano to commerce close to its essential help stage.

The technical outlook for ADA is bearish. The chart’s demand and accumulation indicators have been depreciating, suggesting a scarcity of shopping for curiosity available in the market.

Furthermore, the broader market energy stays unsure, with Bitcoin just lately dipping under the $27,000 worth zone within the current previous. This has resulted in lots of main altcoins, together with Cardano, dealing with rejection at their quick resistance ranges.

At present, Cardano finds itself at a important worth level. If it manages to maneuver above the overhead resistance, it may provoke a restoration for the coin. Nonetheless, if the value falls from its present stage, it could wrestle to maintain itself above the essential help, probably resulting in bearish dominance.

If Bitcoin trades above the $27,000 mark, it’d positively impression Cardano’s worth and probably result in a restoration.

Nonetheless, for a big worth turnaround, it’s important for purchasing confidence to resurface available in the market. The decline in Cardano’s market capitalization signifies that sellers have dominated the market.

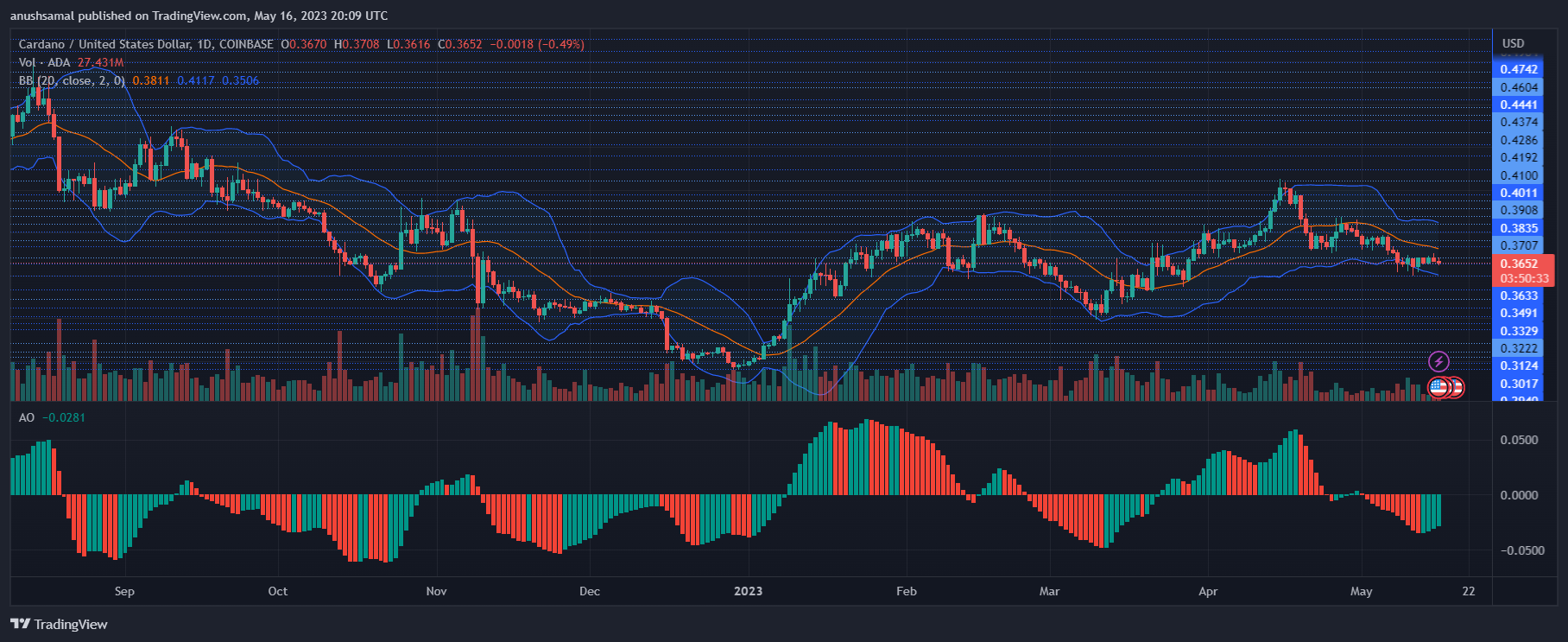

Cardano Worth Evaluation: One-Day Chart

On the time of writing, Cardano (ADA) was priced at $0.367. Over the previous 24 hours, ADA skilled a 1.3% decline in worth, whereas there hasn’t been any important motion on the weekly chart. The important thing resistance stage for ADA is at $0.37, which has confirmed to be a powerful barrier that the bulls have failed to interrupt by way of in current weeks.

If ADA surpasses the $0.37 resistance, it could possibly attain $0.39, leading to a big worth improve. Nonetheless, if the value falls from its present stage, it may drop under the essential help line of $0.35, which the bulls have been defending so far.

The buying and selling quantity of ADA within the final session was in purple, indicating a lower within the variety of patrons collaborating available in the market.

Technical Evaluation

All through the month, ADA has displayed weak shopping for energy. That is evident from the Relative Power Index (RSI) staying under the 40-mark, indicating a prevalence of promoting energy fairly than shopping for energy. Nonetheless, if ADA surpasses its quick worth ceiling, it may result in a restoration in shopping for energy.

Furthermore, ADA has additionally fallen under its 20-Easy Shifting Common (SMA) line, additional confirming that sellers have been driving the value momentum available in the market.

Opposite to earlier observations, ADA confirmed purchase indicators on the one-day chart. The Superior Oscillator, which signifies momentum and development reversal, displayed inexperienced histograms related to purchase indicators. This means a possible worth appreciation within the upcoming buying and selling classes.

The Bollinger Bands, which characterize worth fluctuation and volatility, had been additionally parallel and extensive. This means the next probability of worth fluctuations.

Featured Picture From UnSplash, Charts From TradingView.com