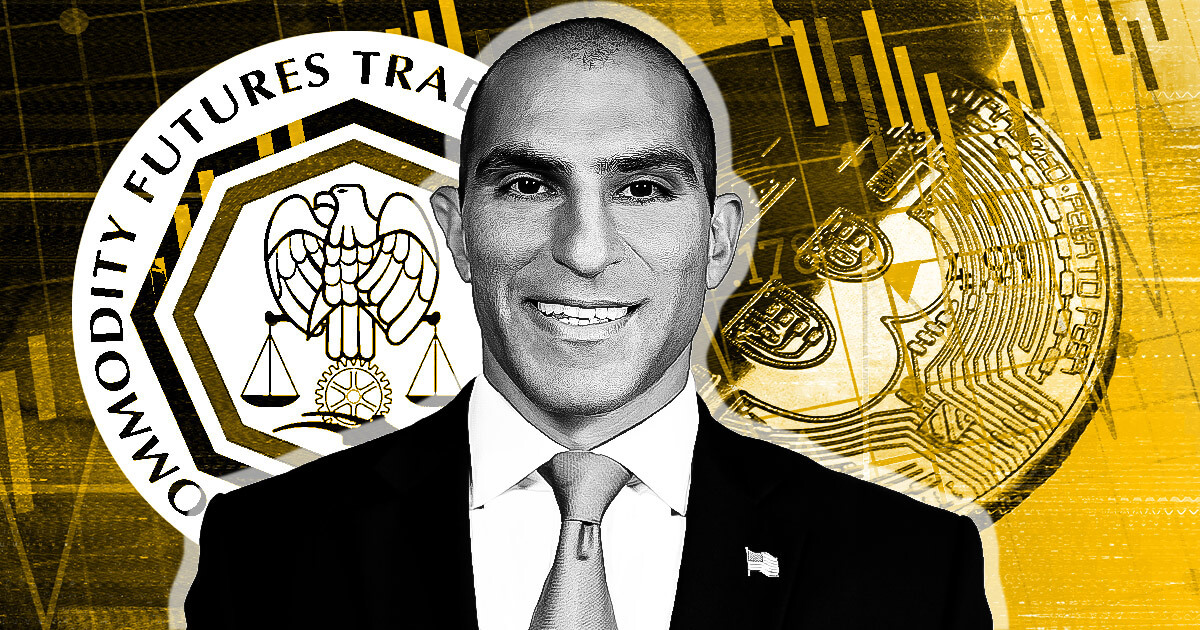

CFTC chair Rostin Behnam stated the company is open to serving as a main regulator for crypto throughout a Senate Agriculture Committee listening to on digital commodities oversight.

The listening to, held on July 10, broadly involved the CFTC’s request for extra regulatory authority.

Senator Roger Marshall requested Behnam whether or not it might be “easier” to make the CFTC a main regulator for digital property whereas leaving a small variety of “offshoots” for the SEC to deal with.

Behnam responded:

“I communicate for myself, [we] can be joyful to try this. I believe we’ve the capability to try this the experience and the expertise.”

Nevertheless, Behnam stated modifications to definitions of securities and commodities can be crucial if the CFTC assumes main authority.

Cooperation with SEC useful

Earlier, Marshall requested Behnam whether or not he helps the SEC being able to determine which property fall below the CFTC’s jurisdiction.

Behnam stated he doesn’t assist the SEC making such selections alone however added that the 2 businesses have labored collectively to outline property in gray areas for about 50 years.

Marshall additionally requested whether or not the CFTC is anxious it might face lawsuits over conflicting asset designations. Behnam stated he “can’t say that it’s not going to occur,” however cooperation between the SEC and CFTC will assist tackle novel authorized questions.

Behnam acknowledged Marshall’s issues that lawmakers might allow such lawsuits however confused the necessity for a contract itemizing system that matches the CFTC’s present powers and permits cooperation with the SEC. Behnam stated:

“I believe there’s a solution to construct a system of itemizing contracts that doesn’t extend or delay the itemizing of contracts in a regulated market.”

Behnam stated the CFTC needs to introduce tokens and contracts to regulated markets “as quickly as attainable” to cut back or remove investor dangers.

Most

Behnam believes that a good portion of the crypto market ought to fall below the CFTC’s purview because it can’t be categorised as securities. In the course of the listening to, Behnam stated that greater than 70% to 80% of the crypto market doesn’t fall below the class of securities, leaving the world with no direct federal oversight.

He stated the CFTC wants not less than $30 million within the first 12 months and not less than $50 within the second 12 months to ascertain a regulatory regime. The funding would go towards staffing, administration, and IT spending. Consumer charges submitted by registrants would offset requested funds.

Behnam additionally affirmed Senator Cory Booker’s issues round urgency, stating that if the CFTC doesn’t achieve authority, fraud and manipulation will proceed to influence people throughout the US.