Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion.

- LINK has been making decrease lows up to now few days.

- There was optimistic sentiment and demand, which might increase short-term bulls.

Chainlink [LINK] appears hopeful regardless of prevailing challenges. It has cleared many of the features made at the beginning of the yr. Thus far, it has plunged by 14%, dropping from $8.4 to a key $7.2 assist. If the $7.2 assist proves regular, bulls might be hopeful of a profitable restoration.

Is your portfolio inexperienced? Take a look at the LINK Revenue Calculator

LINK’s momentum declined

Supply: LINK/USDT on TradingView

LINK’s market construction weakened as momentum declined additional. LINK made decrease lows up to now few days, sliding down the descending line (white, dashed). The Relative Power Index (RSI) additionally remained within the decrease ranges in the identical interval.

Close to-term bulls might goal the 38.20% Fib degree ($7.516) if the RSI breaks above the equilibrium mark of fifty. The restoration seen at press time might be accelerated if Bitcoin [BTC] breaks above $23.86k. However bulls should clear the impediment at $7.4 (above the 26-period EMA).

Failure to shut above the 26-period EMA might tip bears to regain entry into the market. Brief-term sellers might look to e book income on the 23.60% Fib degree ($7.309) or $7.2 assist. The descending line or the 0% Fib degree might test a drop under the assist.

The RSI worth was 50, exhibiting a impartial market construction. Then again, the Chaikin Cash Circulate (CMF) has been hovering barely above the zero line since 24 February, indicating that bulls made a collection of unsustainable restoration makes an attempt.

Learn Chainlink’s [LINK] Worth Prediction 2023-24

LINK noticed improved buyers’ confidence and an accumulation pattern

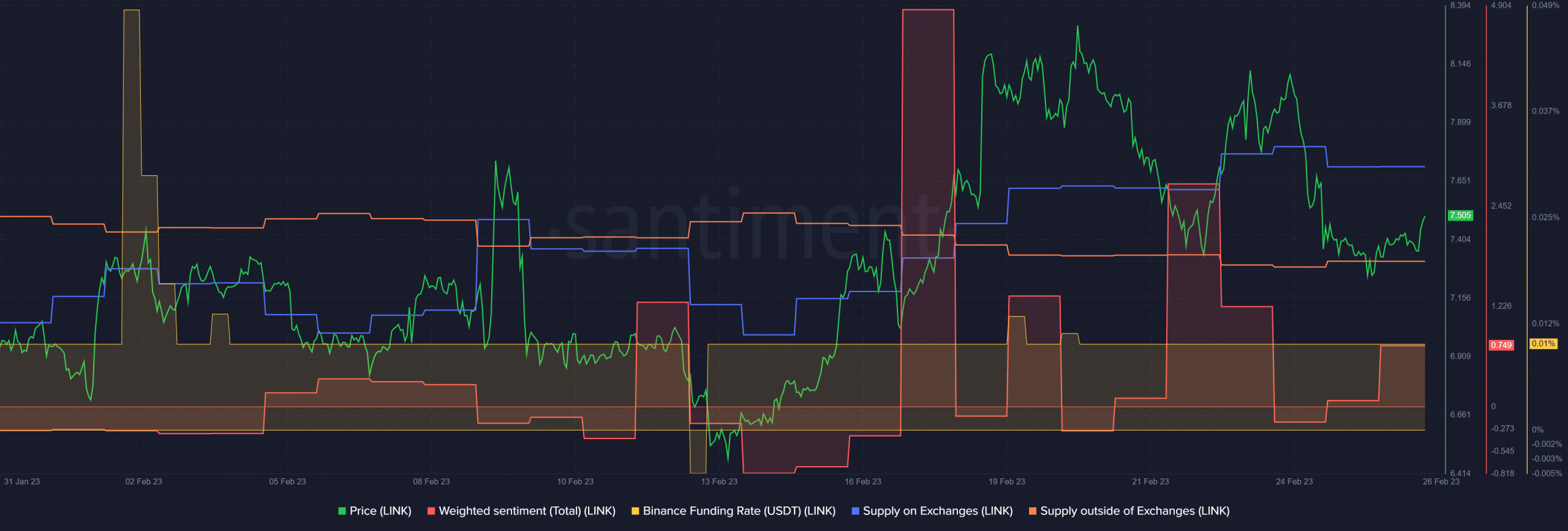

Supply: Santiment

In response to Santiment, LINK’s provide on exchanges dropped and stagnated, indicating lowered short-term strain all through final week (from February 25). Furthermore, the availability exterior of exchanges spiked, indicating elevated short-term accumulation in the identical interval.

LINK’s optimistic weighted sentiment reveals buyers’ confidence within the asset improved and additional reinforces the above accumulation pattern. So, if the pattern continues, the restoration might push LINK to retest the 38.2% Fib degree ($7.516). However bulls could solely be assured of such a transfer if BTC breaks above $23.86k.

![Chainlink [LINK]: Will $7.2 support hold steady? Analyzing…](https://nomadabhitravel.com/wp-content/uploads/2023/03/pasted-image-0-32-1536x874.png)