Blockchain

Contemplating the requirements of 2022 and all that has occurred within the crypto house, layer 1 (“L1s”) can nonetheless be stated to have had a really attention-grabbing and eventful yr. Many notable occasions have taken place within the L1 house over 2022.

From Ethereum’s transition from proof-of-work to proof-of-stake in September, to the implosion of the Terra ecosystem in Could. New layer 1 have been introduced, with Aptos launching its mainnet and Sui anticipated early to take action subsequent yr.

Notable incumbent, BNB Chain and main layer-2 (“L2”) answer, Polygon, gained market share within the vacuum left by Terra, whereas Solana had a tougher yr, being one of many layer 1 extra impacted by the current FTX saga. The yr was rife with materials occasions in arguably an important sub-sector inside crypto.

What has occurred?

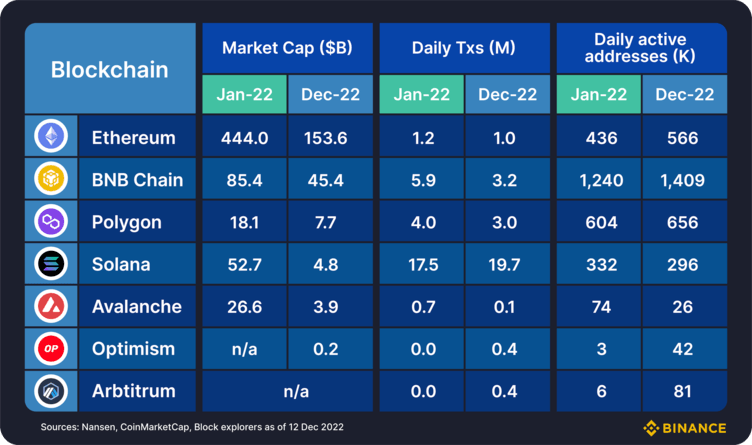

L1 / L2 market cap and each day on-chain metrics throughout 2022

Key Observations

- Market cap is, in fact, decrease for a large number of causes that we aren’t going to dedicate this piece to. Nevertheless, we must always very clearly notice that market cap doesn’t essentially correlate to crucial on-chain metrics when it comes to each day transactions and lively addresses. As we are able to see, BNB Chain and Solana excel right here, whereas Ethereum, regardless of the higher market cap, is evidently decrease when it comes to each day exercise.

- Ethereum: The Merge! Since this matter has been coated advert nauseum by everybody and their cat, somewhat than repeating, we wished to speak about its influence. Information exhibits that since finishing the transition to proof-of-stake in mid-September, $ETH provide development is massively down (from 3.58%/y to 0.005%/y). In truth, together with its burn mechanism, $ETH spent nearly all of November as a deflationary asset and at the moment sits very near that degree.

- BNB Chain: a commendable yr for BNB Chain, with market cap down solely ~45% YTD, fairly a bit higher off than main opponents Ethereum (-64% YTD) and Solana (-90% YTD). BNB Chain was one of many main L1s serving to onboard builders displaced by the Terra and FTX scandals. Every day exercise metrics stay extraordinarily excessive, with the launch of BNB Liquid Staking and zkBNB being notable highlights. Innovation and partnerships within the NFT house are additionally persevering with in full swing, with OpenSea lately asserting help for BNB Chain NFTs on its platform.

- Solana / Avalanche: 2022 was difficult for the basic “alt-L1” commerce of 2021. Solana noticed some sturdy traction of their NFT ecosystem, with development in collections, volumes and marketplaces. Avalanche noticed constructive headlines on the again of their Subnets, which provided scalability for decentralized purposes (“dApps”), notably within the gaming house. Nevertheless, each alt-L1s have suffered from poor publicity (for Solana this got here through the FTX scandal, whereas for Avalanche this was a product of some not-so-flattering information that obtained leaked just a few months in the past). Solana has additionally continued to undergo from common outages, calling into query the reliability of the community.

- Layer 2s: Whereas L2s are technically one step faraway from the L1, any dialogue on L1s is incomplete with out not less than commenting on the rising scaling market. Polygon is the undoubtable chief right here, with its quite a few options throughout the board. It has been a powerful yr for Polygon, with their enterprise improvement persevering with to shine (Starbucks NFTs, Reddit NFTs, Instagram/Meta NFTs to call only a few current headlines that Polygon has been behind). Extra pure-play L2s, Arbitrum and Optimism have additionally carried out strongly over the previous yr and continued to extend exercise / take market share from a number of the smaller alt-L1s. The OP token’s launch was a notable second for Optimism earlier this yr, whereas Arbitrum continued to concentrate on their core product choices with their launches of Arbitrum Nitro and Arbitrum Nova.

Expectations for 2023

Now that we have now obtained some concept of how the main L1s have moved by the yr and a few of their notable occasions, what concerning the coming yr? What are our tentative expectations?

Layer 1 (notably a number of the smaller alt-L1s) will really feel the stress of L2s

- One of many main narratives of the yr was so-called “L222” referring to 2022 being the breakout yr for L2s. Did we see this? L2 whole worth locked (“TVL”) figures present that there was a rise of 118% (in ETH phrases) for the reason that begin of the yr. So, in a approach, sure. It definitely has been the largest yr that L2s have had to this point. Nevertheless, in absolute phrases, whole TVL locked in L2s is just round US$4.5B. After we evaluate to whole DeFi TVL in Ethereum (round US$25B), and whole crypto market cap sitting close to US$900B, we are able to contextualize how far L2s nonetheless need to climb.

- Think about additionally the truth that, as proven in Determine 1, each Arbitrum and Optimism exceed Avalanche when it comes to each day on-chain exercise. Add to this the growing deployment of alt-L1s dApps on L2s e.g. Dealer Joe of Avalanche lately introduced their deployment on Arbitrum, and will probably be attention-grabbing to watch what occurs with a number of the smaller alt-L1s. There was an concept that has been mentioned amongst many within the crypto house that the main L1s will merely turn into settlement layers, whereas execution and exercise occurs on the L2s. Whereas we’re seeing a bit little bit of this already, 2023 may very nicely be the yr that we see this occur on a a lot bigger scale.

New L1s may survive if they really convey one thing new to the desk

- Think about essentially the most well-known new entrants within the L1 house, Aptos (who went to mainnet in This autumn of this yr) and Sui (who’re anticipated to launch in early 2023). Each of those L1s convey numerous new improvements with them, together with the Transfer programming language. Given the background of this language and all that it guarantees, alongside the potential will increase in transaction pace with each L1s, there’s a potential for some true innovation. It needs to be price conserving an in depth eye on whether or not both or each of those L1s are capable of make the most of their new applied sciences to convey a couple of step change within the crypto market.