NFT

In Venezuela, humor performs an essential position, both as a type of protest or a strategy to make sense of actuality.

In November 2021, humor and nonfungible tokens (NFTs) have been mixed with the launch of the Comedy Monsters Membership (CMC) venture. The venture was led by Roberto Cardoso, higher identified by his former stage identify “Bobby Comedia,” and co-founded with brothers José David Roa and David Roa.

The venture was marketed as the one comedy membership to make use of NFT collectibles as membership. Nevertheless, the hype would rapidly flip to confusion for the venture’s buyers.

An attractive narrative

Comedy Monsters reached the NFT-curious Latin American viewers by way of the well-known Venezuelan comedians.

Cardoso and his co-founders appeared in publications like Forbes Mexico and on fashionable reveals and comedy podcasts similar to Nos Reiremos de Esto and Escuela de Nada.

Listenting to an episode of Escuela de Nada titled “How To Make Cash With NFTs,” pseudonymous NFT collector Nairobi first got here to be taught in regards to the presumptive comedy membership. Later, they’d determine to affix the CMC group and buy an NFT themselves.

“It’s in that dialog the place you’ll be able to actually establish the venture’s promoting narrative,” Nairobi defined.

Through the episode, the hosts interview Comedy Monsters co-founder José David, a self-appointed “NFT professional.” Within the dialog, José David makes use of his personal instance of being an early investor in Bored Ape Yacht Membership, reportedly incomes over $300,000 from promoting considered one of his NFTs.

His get-rich-quick story is adopted by the mantra “do your personal analysis,” typically used to suggest that any earlier statements made by so-called consultants shouldn’t be taken as monetary recommendation.

“For somebody who’s new to the NFT ecosystem, this will result in false expectations,” Nairobi mentioned.

CMC formally launched in November 2021 with an providing of 10,100 NFTs. The beginning value for every was 0.1 Ether (ETH), price between $400 and $500 on the time of the sale. The monsters wouldn’t be revealed to their house owners till all of the NFTs have been bought.

Cardoso instructed Cointelegraph that the comedy membership’s function was “to ship as many experiential, materials and financial advantages” to its members as doable.

Nevertheless, past the novelty of the venture’s proposal, it was by no means clear how CMC would preserve or improve the worth of its NFTs. In a small part on its web site consisting of solely three sentences, the creators clarify the tokenomics behind the venture.

“The rarer it [the NFT] is, the higher advantages it should presumably have and the larger worth it should certainly have,” it reads.

Group “failure”

The interval after the preliminary launch of an NFT assortment may be essential to figuring out the venture’s success. The worth of the tokens will depend upon the general public’s continued curiosity in investing, placing tasks below strain to implement profitable advertising methods.

The CMC founders have been so involved in regards to the sale of their Monster NFTs that former members reported that the venture’s creators pressured the group to assist give you gross sales methods to promote them.

“We have been virtually demanded to give you advertising methods. There was additionally the alleged raffle of a Mutant Ape NFT inside the group, below the situation that Comedy Monsters Membership bought out in simply 15 days,” Nairobi recalled.

The strain on the group was stacked on high of one other key level: An insufficient execution of the membership’s roadmap.

The CMC roadmap had 5 levels: the manufacturing of a podcast, a comedy pageant unique to holders, video games and raffle prizes in ETH, a basis and a United States department.

Regardless of posts on social media showcasing 2022 as a profitable yr for CMC, its group shared a really completely different expertise. The venture launched a podcast, however stopped after lower than 20 episodes. CMC founders organized occasions, however they weren’t unique, and there have been restricted tickets for NFT holders. Even the raffles ended up switching from ETH prizes to giving out CMC NFTs as a substitute.

The venture by no means reached its aim of a complete sell-out. In response to its sensible contract, there are 2,320 holders, proudly owning 7,660 monsters in complete.

Cardoso mentioned {that a} important however unspecified variety of NFTs have been utilized in publicity stunts and giveaways, and he blamed the 2022 crypto market crash for the venture’s failure to promote out.

A tough approximation of the comedy membership’s earnings reveals that it might have made as a lot as $2 million to $3 million, primarily based on estimates of the worth of the bought tokens on the time of CMC’s launch.

Immediately, the CMC sensible contract reveals a stability of 0 ETH, and there’s solely somewhat over $300 in ETH left within the venture’s major pockets.

A “tender rug-pull”

The group by no means knew for certain how the funds have been spent on the venture’s roadmap or how a lot was taken by Cardozo and the Roa brothers, making the case for a doable tender rug-pull.

Suspicion in regards to the venture’s trustworthiness arose in early March 2022 when holders started to complain in regards to the founders’ neglect of the group.

In response to the testimony of a number of former CMC holders, considerations started when David, the venture’s appointed CEO, left the Discord group, adopted shortly by his brother, José David. The group additionally reported that CMC holders who raised questions on Telegram chats have been being blocked.

Cardoso instructed Cointelegraph that he really signed a separation settlement together with his former co-founders on Nov. 9, 2022, leaving him on the head of the venture as founder and CEO. Particular particulars of this settlement remained personal.

In November, CMC holders and group members additionally famous an absence of transparency surrounding the utilization of funds.

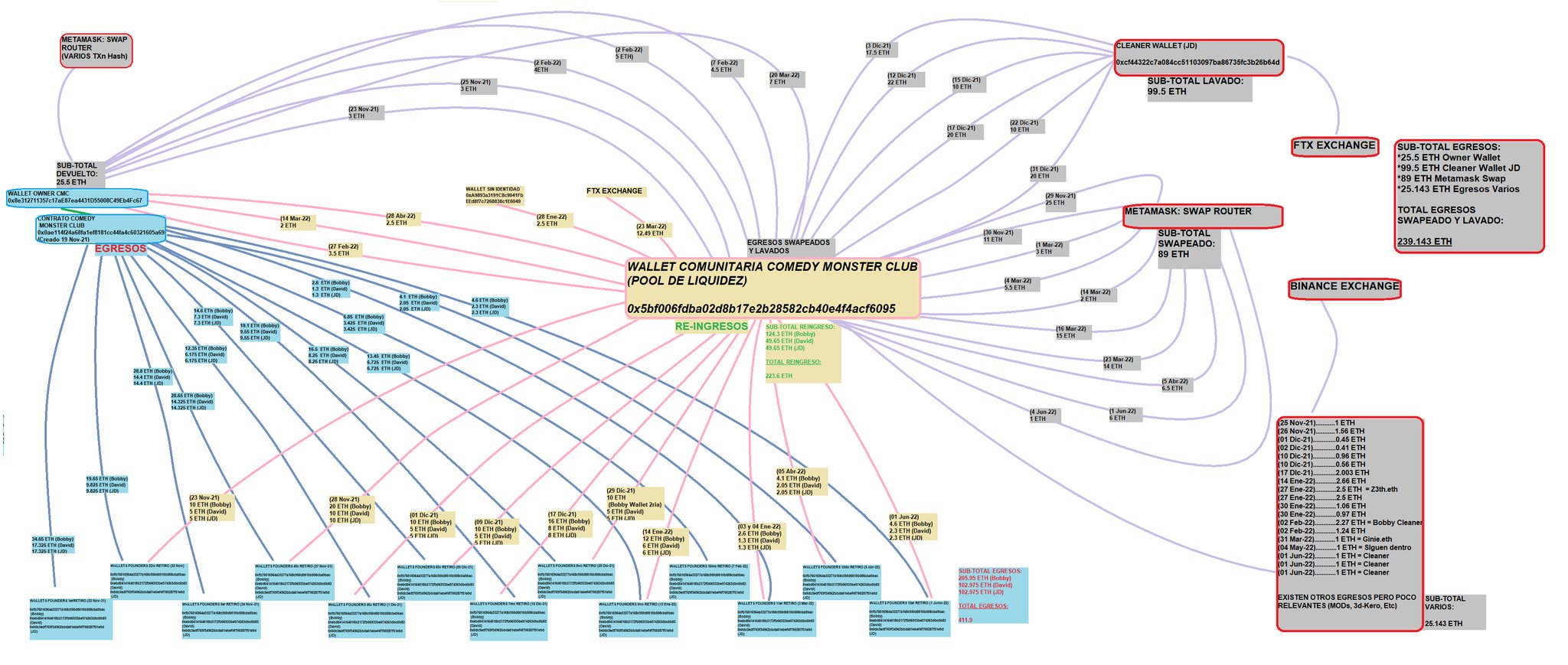

One pseudonymous CMC holder, RAMXx, proceeded to trace the venture’s funds on the blockchain. The general public report revealed that 411.9 ETH — valued at over $1.18 million utilizing ETH’s common value between November 2021 and June 2022 — had been extracted from the venture and swapped utilizing completely different cryptocurrency exchanges.

Map of venture funds from RAMXx. Supply: Twitter

Venezuelan Twitter consumer Victor Noguera additionally shared extra info by exhibiting his course of monitoring every part on the blockchain.

His analysis additionally discovered that the cash had been divided between three wallets. The contract reveals that two wallets obtained a share of 25% every whereas a 3rd obtained 50%, which the group presumed have been managed by the Roa brothers and Cardoso, respectively.

Cardoso confirmed the pockets quantities to Cointelegraph: “All of the earnings from the minting was divided into three wallets. Logically, my earlier co-founders and I had entry to those wallets to function the membership.”

With these findings, the group confirmed that the venture lacked a group pockets, an instrument typically utilized in Web3 communities to permit holders to maintain observe of invested funds and serving as a treasury for a venture’s roadmap.

The shortage of a group pockets got here as a shock for some CMC NFT holders, whose investments’ ground value is now simply 0.015 ETH, or lower than $30.

Cardoso confirmed the group findings to Cointelegraph, stating that the Monster NFTs have been solely “a membership for a membership which features a roadmap with advantages.”

“The sources or funds belong to those that promote the token, to not the group. There isn’t a social contract that claims that the funds belong to the group or a ‘group’ pockets,” he defined.

The dialog in regards to the irregularities of CMC reached social media by December 2022. A group moderator, Alfonzo González, recalled on a Twitter House that the founders improvised loads, which mixed with a notable lack of transparency and unsustainable methods to maintain up with the roadmap.

The grey zone of NFTs

In right now’s NFT trade, authorized protections for customers nonetheless stay unclear. Because the Web3 house depends closely on communities to create their very own guidelines, customers typically get entangled in tasks with a variety of promise however little obligation to their contributors.

This may be seen within the phrasing of targets and the clarification of deadlines — or lack thereof — in venture roadmaps. If founders don’t present accountability measures in case they fail to satisfy the venture’s targets and the contributors or holders don’t demand them, it might lead to losses for the group if the venture fails.

The one seen promise the Comedy Monsters creators made to their group was a tough roadmap. The venture lacked deadlines and particular penalties if it failed to satisfy its targets. The entire venture was primarily based on the utility of the NFTs — offering real-world advantages, together with worldwide comedy occasions and different experiences, like workshops.

In response to Maria Londoño, a lawyer and co-founder of the NFT venture Disrupt3rs, this ambiguity is what led to severe miscommunication between the founders and the group.

“They made very imprecise guarantees, and there have been makes an attempt to solidify them. Nevertheless, there are neither specified, dedicated events nor deadlines for the guarantees. There isn’t any contractual obligation that could possibly be demanded,” she instructed Cointelegraph.

“Saying issues like ‘This may most likely go up in worth’ might sound like a promise or return on funding by way of hypothesis, however it may be plain ignorance,” Londoño added.

After the social media storm, Comedy Monsters Membership continues to be energetic, providing occasions and workshops to their holders.

Cardoso mentioned the venture would proceed regardless of the injury to the membership’s picture. “Part of it’s to be taught and enhance,” he mentioned.

Londoño additionally believes that, in the long run, the creators of Comedy Monsters Membership underestimated the significance of creating express guidelines and expectations for themselves and their holders:

“I consider that each events (creators and group) have been improper by not setting and demanding clear guidelines. The group misplaced cash and the creators their status. It’s a lose-lose state of affairs as a consequence of lack of information that the foundations of the normal world nonetheless apply in Web3.”