A broadly adopted crypto strategist believes that Litecoin’s (LTC) pre-halving rally might have already hit its peak.

Pseudonymous analyst Kaleo tells his 593,200 Twitter followers that the peer-to-peer funds community could also be mirroring its worth motion through the second half of 2021 when it rallied by over 187% solely to start out a multi-month bear market.

In line with the analyst, Litecoin not too long ago revered its bear market trendline when LTC bulls did not maintain momentum above $110.

“Right here’s why I flipped brief on LTC:

1) Clear rejection at resistance. Retrace after the latest vary breakout appears extremely much like what we noticed on the finish of 2021, which resulted in new lows.”

Kaleo can also be wanting on the efficiency of LTC previous to its 2019 halving occasion. In line with the dealer, the earlier halving marked the start of a downtrend for LTC.

“2) The halving is across the nook (date is ~August 2nd). As a lot as this has been overrated as a bullish occasion, that isn’t essentially what occurred previously. Let’s check out what occurred after the final halving (8/5/19). It was a sell-the-news occasion. Worth nuked.”

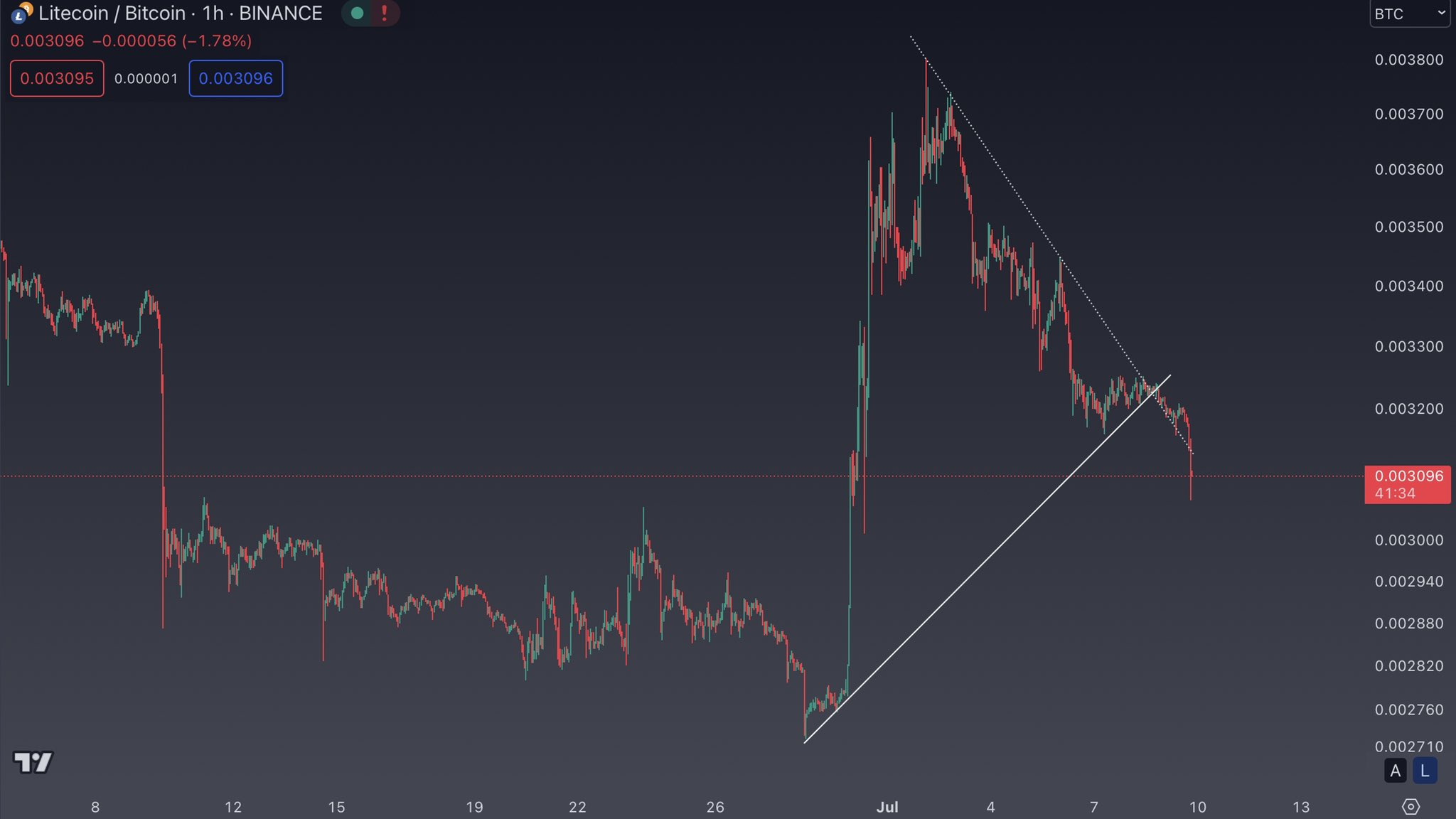

Kaleo can also be watching the efficiency of the Litecoin versus Bitcoin pair (LTC/BTC). The dealer says LTC/BTC is flashing bearish alerts on the decrease timeframe after shifting under diagonal assist.

“3) Low timeframe we’ve seen a transparent breakdown of assist in LTC vs. BTC.”

Going again to the LTC/USD chart, Kaleo predicts a short-lived rally for Litecoin earlier than the altcoin resumes its downtrend.

“4) Zooming in, LTC is at the moment hanging on to assist vs USD, however I wouldn’t rely on something greater than a lifeless cat bounce right here.”

At time of writing, Litecoin is price $96.91.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your personal threat, and any loses you could incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please observe that The Day by day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney