Crypto analyst Jamie Coutts highlights that blockchain know-how sees adoption regardless of the cryptocurrency market’s positivity or negativity.

“5 million every day crypto customers in the present day, is prone to be 100m in lower than 5 years,” he famous.

Blockchain Forges Its Distinctive Path

Coutts asserts that blockchain adoption charges stay constantly excessive, whatever the prevailing market cycle within the crypto area, be it a bull or bear market.

“Bear market/Bull market adoption of blockchain know-how continues unabated. Not having publicity to one of many largest structural tendencies of the subsequent decade might be expensive.”

In the meantime, a latest PwC report emphasised the rising significance of blockchain know-how in addressing the increasing difficulty of monetary inclusion.

The report underlines the urgency of adopting blockchain on a broader scale to fight this difficulty.

Study extra: What Is Market Capitalization? Why Is It Necessary in Crypto?

Main Monetary Establishments’ Blockchain Challenges

PwC’s statistics reveal the rising problem of restricted entry to conventional banks and the power to save cash for a good portion of the worldwide inhabitants, making it extra crucial than ever to embrace blockchain know-how at a bigger scale.

Not too long ago, Sergey Nazarov, Chainlink co-founder, highlighted the obstacles presently dealing with banks of their efforts to undertake blockchain know-how.

Nazarov identified that the substantial monetary and temporal investments made by banks worldwide within the conventional SWIFT cost system will make it difficult for them to transition away from it.

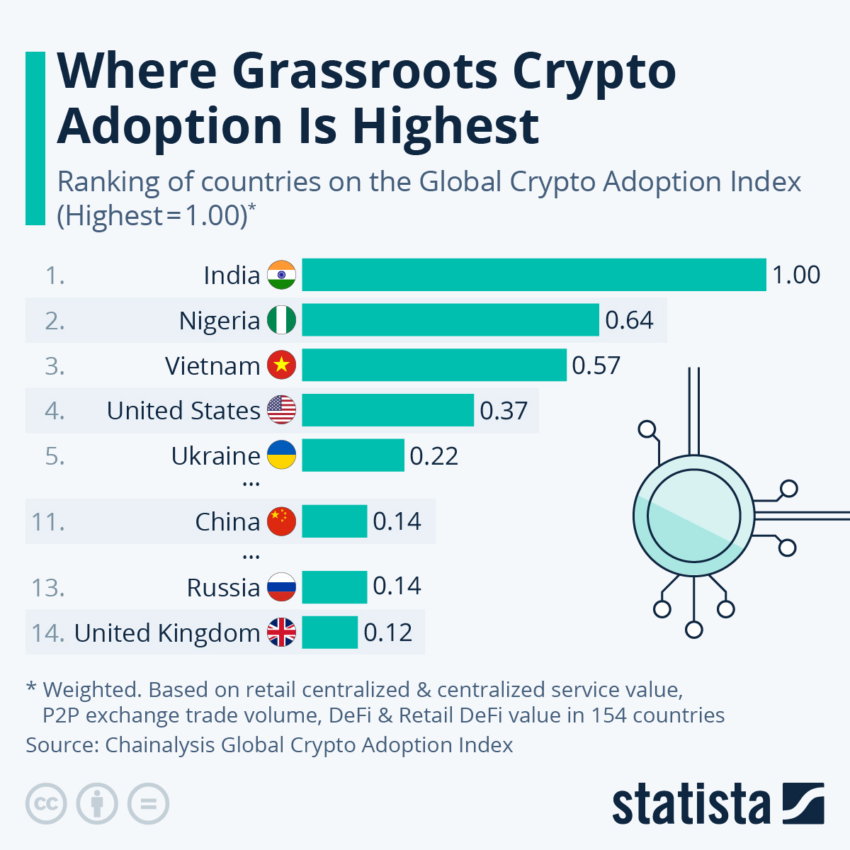

Conversely, the main hotspots for world crypto adoption aren’t essentially the obvious selections.

Grassroots world crypto adoption by nation. Supply: Statista

India holds the primary place on the worldwide crypto adoption index, with Vietnam, the Philippines, Ukraine, and Kenya intently following go well with.

Study extra: Deploying Blockchain Infrastructure: Challenges and Solutions