A well-liked analyst says that cryptocurrencies may quickly go on a parabolic run as a uncommon technical indicator flashes inexperienced for less than the third time in historical past.

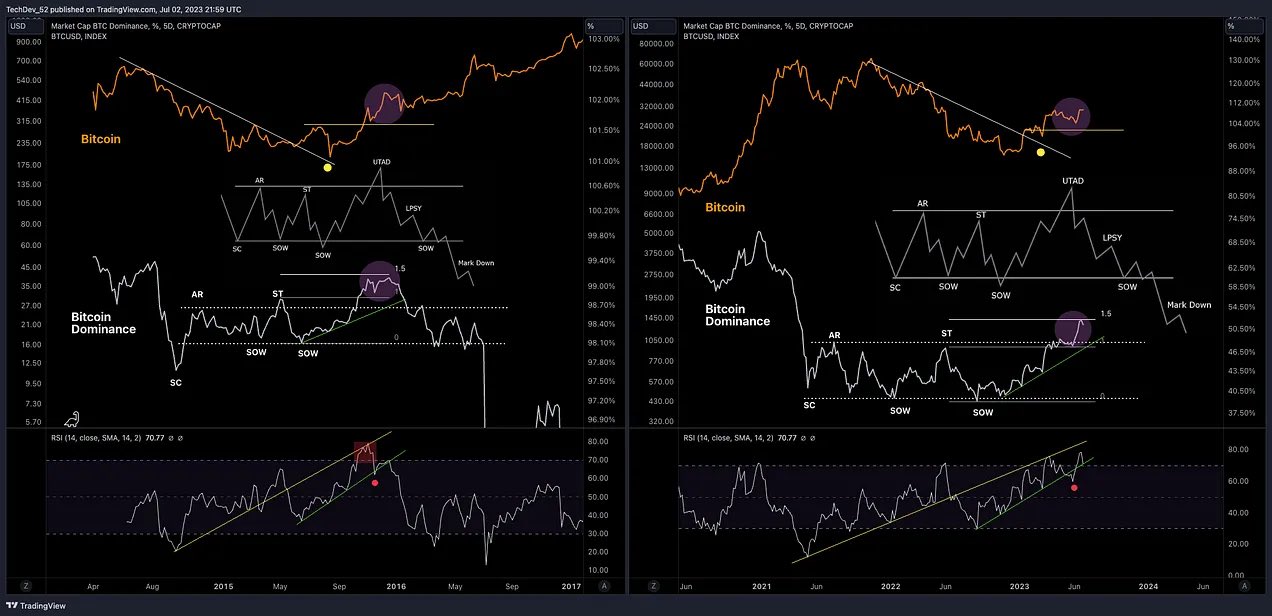

The pseudonymous analyst often known as TechDev tells his 415,000 Twitter followers that the overall crypto market cap is beginning to increase in a similar way that led to the beginning of large bull runs in late 2015 and 2020.

In accordance with TechDev, the overall crypto market cap has consolidated for 3 weeks plus moved over the 20-day shifting common (MA). He additionally factors out that BTC’s Bollinger bands, which measure volatility, have compressed into extraordinarily tight ranges, suggesting {that a} risky transfer is close to.

“Crypto market cap is starting to increase with value above 20-day MA, after the tightest three-week compression in historical past.

Solely twice earlier than did it even come shut.

Neither was 2019, and each started a serious parabolic transfer.”

The dealer notes that some analysts are predicting a powerful altcoin market within the aftermath of the historic XRP ruling. He says Bitcoin (BTC) may rally alongside with altcoins whereas its dominance goes down, much like 2016.

“I heard some landmark ruling with bullish altcoin implications simply occurred to return in close to a possible main high in Bitcoin dominance.

And sure, Bitcoin can go parabolic on the identical time.”

In accordance with the dealer, the catalyst for Bitcoin’s bull cycles just isn’t the halving occasions, which occur each 4 years, however market liquidity cycles. TechDev depicts international liquidity cycles by pitting the Chinese language 10-year bond towards the greenback index (DXY), portraying the ebb and circulate of {dollars} into Bitcoin and threat belongings.

“Doesn’t seem like it’s ever been the halving.

Intelligent if Satoshi tried to line it up although.

It’s a liquidity cycle world. Bitcoin lives in it.”

Bitcoin is buying and selling for $30,170 at time of writing, down 0.7% over the past 24 hours.

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Examine Value Motion

Observe us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl aren’t funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses you might incur are your duty. The Day by day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Day by day Hodl an funding advisor. Please word that The Day by day Hodl participates in internet online affiliate marketing.

Generated Picture: Midjourney