Information reveals the crypto futures market has noticed massive liquidations prior to now day as Bitcoin has recorded a pointy surge in direction of $28,000.

Crypto Futures Noticed $78 Million In Liquidations In Final 24 Hours

A crypto futures contract is alleged to be “liquidated” when the spinoff change with which mentioned contract is open forcefully closes it up. This occurs when the contract has amassed losses of a sure proportion, the precise worth of which can differ between platforms.

On this sector, it’s not too uncommon to see a flood of such liquidations occurring inside a brief span of time. The rationale behind that’s the excessive volatility that many of the belongings show on common.

Numerous traders additionally wish to play with excessive quantities of leverage, as a result of it being readily accessible in lots of platforms. Leverage alone can increase the danger of liquidation manyfold, so it mixed with the excessive volatility could make it straightforward for contracts to be flushed down.

Throughout the previous day, the crypto market has as soon as once more seen some notable volatility, which has led to a different mass liquidation occasion on the futures aspect, as the info beneath from CoinGlass reveals.

Seems to be just like the market has seen some excessive liquidations prior to now day | Supply: CoinGlass

As is seen from the desk, the crypto market as a complete has seen liquidations of greater than $78 million within the final 24 hours. Out of those, $61.88 million concerned the brief contracts, equal to virtually 80% of the full.

This naturally is sensible, as this newest liquidation squeeze has been led by a rally in Bitcoin’s value.

The worth of the asset has shot up at present | Supply: BTCUSD on TradingView

As displayed above, Bitcoin has loved a pointy surge prior to now day. On the peak of this rally, the coin had retested the $28,000 degree however has since seen a little bit of pullback.

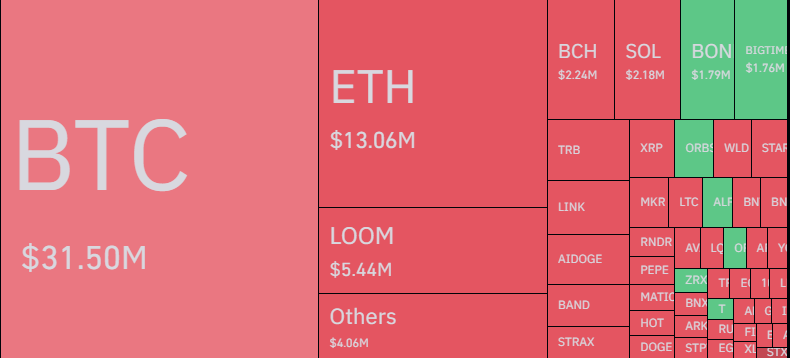

The remainder of the sector additionally adopted the unique crypto on this rally (as is normally the case), which is why shorts across the sector have taken a beating at present. The beneath desk reveals what the person contribution in direction of this liquidation squeeze has regarded like for the completely different symbols within the sector.

The breakdown of the liquidations by asset | Supply: CoinGlass

As anticipated, Bitcoin occupies the biggest share of liquidations with $31.5 million, whereas Ethereum is second at $13.06 million. Apparently, Loom Community (LOOM) is third on this record, regardless of the asset being simply the 71st largest within the sector by market cap.

The altcoin has loved a pointy rally of greater than 113% prior to now week, which is probably why the crypto has had such robust curiosity behind it on the futures market.

Bitcoin Open Curiosity Has Rebounded Since The Squeeze

As CryptoQuant analyst Maartunn has identified, the Bitcoin open curiosity, a measure of the full quantity of contracts related to the asset presently open on the futures market, has jumped again because the liquidation flush occurred.

The metric has climbed again up from its lows | Supply: @JA_Maartun on X

It could seem that extra speculators have jumped available on the market even after seeing a considerable amount of merchants getting liquidated. Usually, the open curiosity being excessive can result in volatility, so the indicator retracing again to its ranges from earlier than the plunge might imply BTC would quickly see extra sharp value motion within the close to future.

Featured picture from Shutterstock.com, charts from TradingView.com