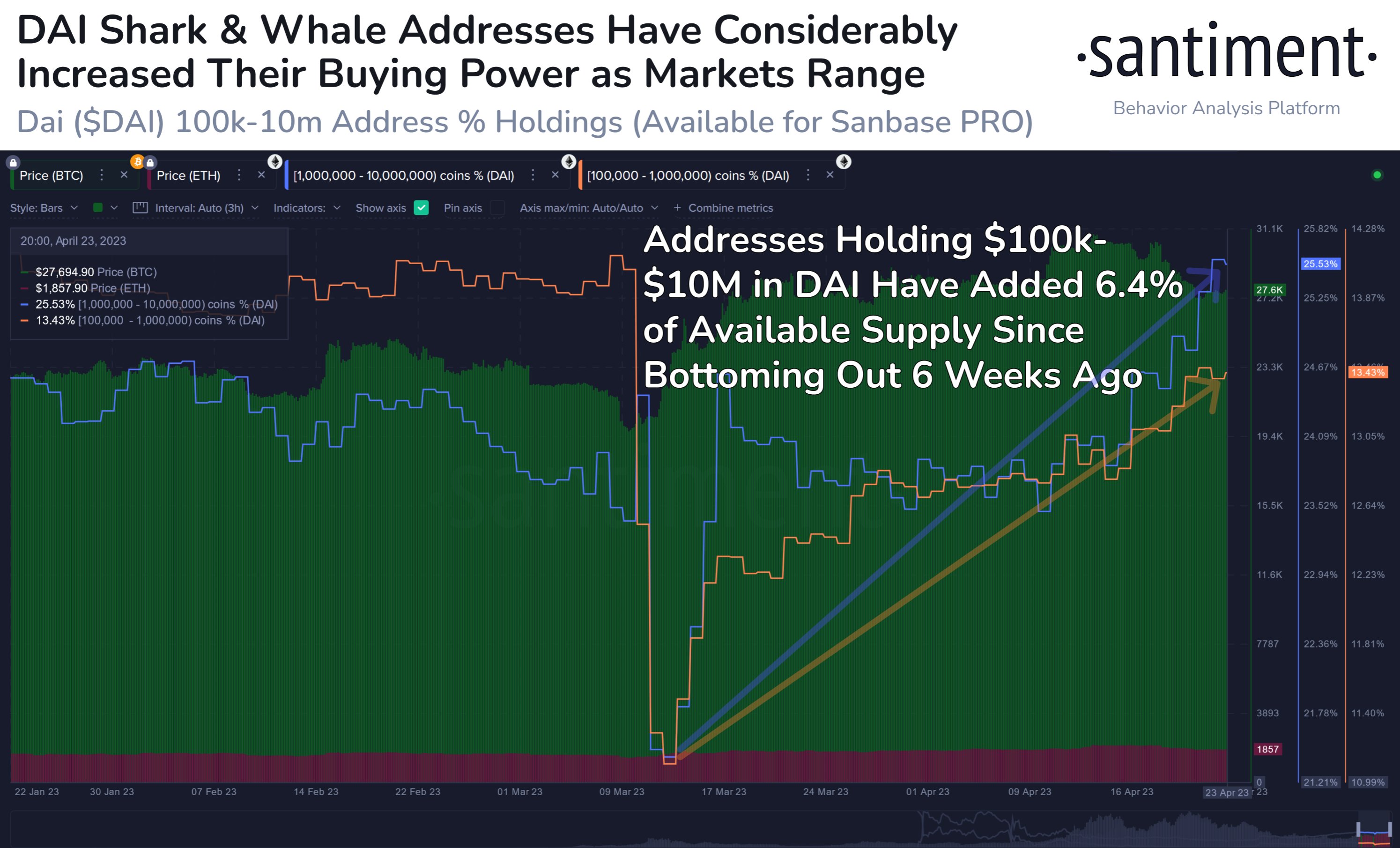

Massive crypto addresses have been accumulating stablecoins amid the crypto volatility in April, in response to the analytics agency Santiment.

Santiment notes that shark and whale wallets, or addresses holding between 100,000 and 10 million of the stablecoin Dai (DAI), have acquired 6.4% of the asset’s provide since their DAI holdings bottomed out six weeks in the past.

In accordance with Santiment, shark and whale addresses are rising their dry powder because the crypto markets enter a interval of consolidation.

DAI, the fourth-largest stablecoin, briefly misplaced its desired $1.00 peg over a three-day interval in March and fell to an all-time low of $0.881.

The stablecoin recovered rapidly and has largely maintained its $1.00 worth since then, although it’s buying and selling at $0.997 at time of writing.

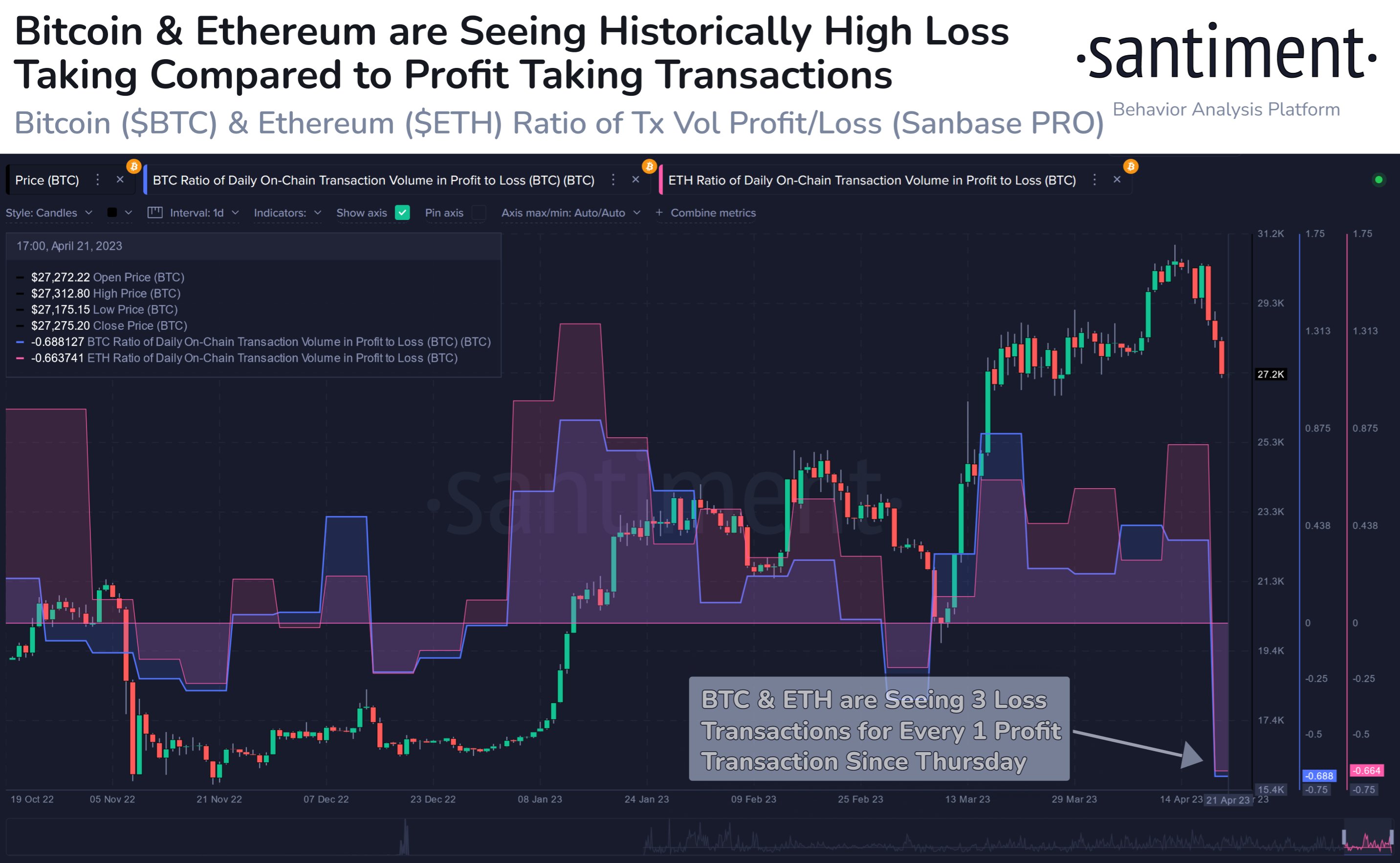

Santiment additionally notes that Bitcoin (BTC) and Ethereum (ETH) merchants who had been late to the rally are consuming up losses as the 2 main crypto property strikes beneath $30,000 and $2,000, respectively.

In accordance with the analytics agency, BTC and ETH are witnessing “traditionally excessive” loss transactions, which it says may mark an area backside for the crypto markets.

“Since Thursday, merchants are shifting cash beneath costs they obtained them at 3 times as usually as above. Traditionally, when this ratio is beneath breakeven, it’s a good signal of capitulation that may usually mark (no less than momentary) worth bottoms.”

Bitcoin is buying and selling at $27,529 at time of writing. The highest-ranked crypto asset by market cap is down 0.65% up to now day.

Ethereum is buying and selling at $1,841 at time of writing. The second-ranked crypto asset by market cap is down 1.4% up to now 24 hours.

Do not Miss a Beat – Subscribe to get crypto electronic mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Day by day Hodl Combine

Disclaimer: Opinions expressed at The Day by day Hodl will not be funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your individual threat, and any loses it’s possible you’ll incur are your duty. The Day by day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Day by day Hodl an funding advisor. Please be aware that The Day by day Hodl participates in internet affiliate marketing.

Generated Picture: Midjourney