- Convex Finance dominated Curve Finance’s governance.

- Protocol struggled whereas whales continued to purchase CRV.

In response to Delphi Digital, Convex Finance, a Curve [CRV] staking platform, dominated 45% of the general governance on the community.

vlCVX holders can vote on the swimming pools they need to incentivize or vote for particular swimming pools and earn bribes paid by different protocols.

A Have a look at Convex’s Enterprise Mannequin and a Looming Catalyst is dwell now for PRO members⬇️https://t.co/akrMZYuE8M

— Delphi Digital (@Delphi_Digital) February 28, 2023

Real looking or not, right here’s CRV’s market cap in BTC’s phrases

The dominance was created as Convex Finance held most veCVX and veCRV tokens. Holders of those tokens can vote on the swimming pools they need to incentivize or vote for particular swimming pools and earn bribes paid by different protocols.

Nevertheless, one space the place the protocol may make enhancements could be when it comes to quantity.

Curve faces the warmth

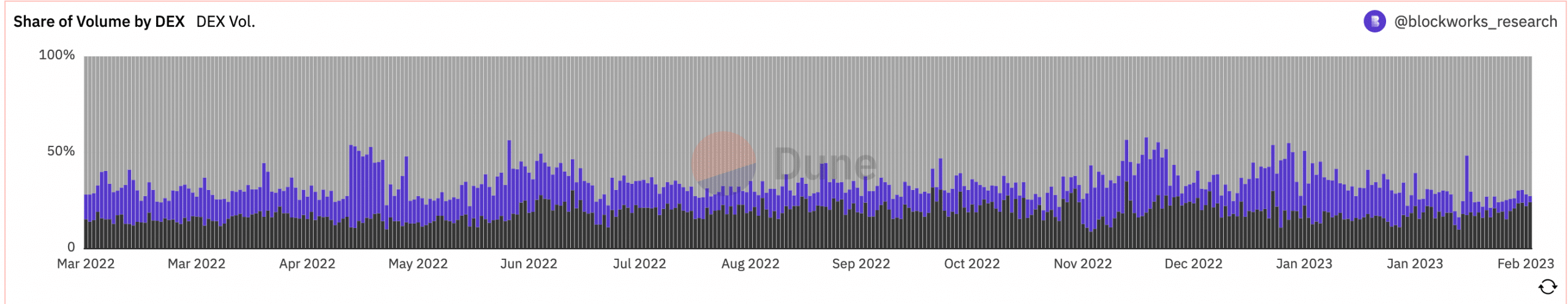

Over the previous few months, Curve Finance’s share of DEX quantity declined materially. Based mostly on Dune Analytics’ knowledge, the general DEX quantity of the protocol fell from 15.2% to 4.4% because the starting of this 12 months. A big a part of the share was misplaced to different DEX’s corresponding to Uniswap [UNI].

Supply: Dune Analytics

Regardless of the decline in quantity, the Curve protocol generated ample income and elevated its treasury holdings. In response to Token Terminal, these holdings elevated by 37.3% over the previous month. The DAO may put these treasury holdings to good use in the event that they use the holdings to make developments on the protocol.

It appeared that there have been efforts being made by the DAO to enhance the protocol, as indicated by the growing variety of energetic builders. Based mostly on Token Terminal, the variety of energetic builders on the Curve protocol elevated by 8.6% within the final week.

Whales present curiosity

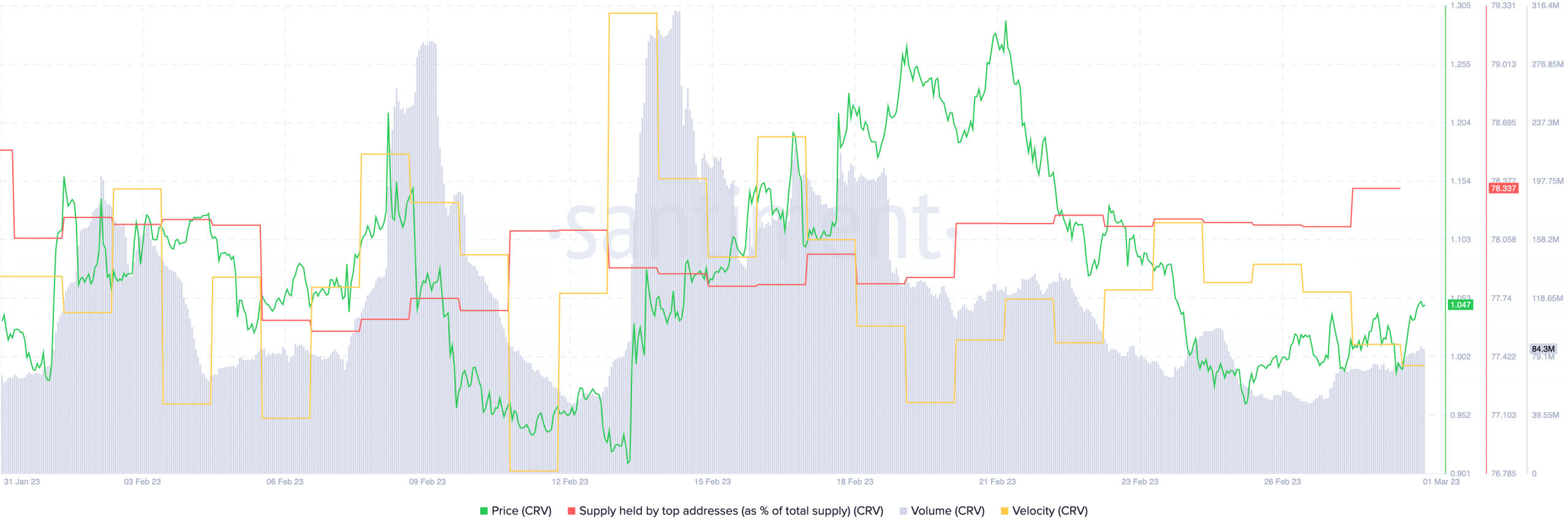

Regardless that the protocol was doing poorly, it didn’t cease whales from investing closely in CRV. Santiment’s knowledge confirmed that the share of enormous addresses holding the CRV token elevated over the previous week.

Learn Curve’s [CRV] Value Prediction 2023-2024

This curiosity from whales may very well be one purpose why CRV’s costs surged. Nevertheless, regardless of the growing costs, the quantity of the token declined. Together with that, the general velocity of the token fell, suggesting that the frequency with which CRV was being traded had plummeted.

Supply: Santiment

Solely time will inform whether or not the whales are appropriate of their evaluation of the Curve token.