Disclaimer: The data offered doesn’t represent monetary, funding, buying and selling, or different kinds of recommendation and is solely the author’s opinion

- The day by day chart was strongly bearish.

- The decrease timeframe charts had been bearish too.

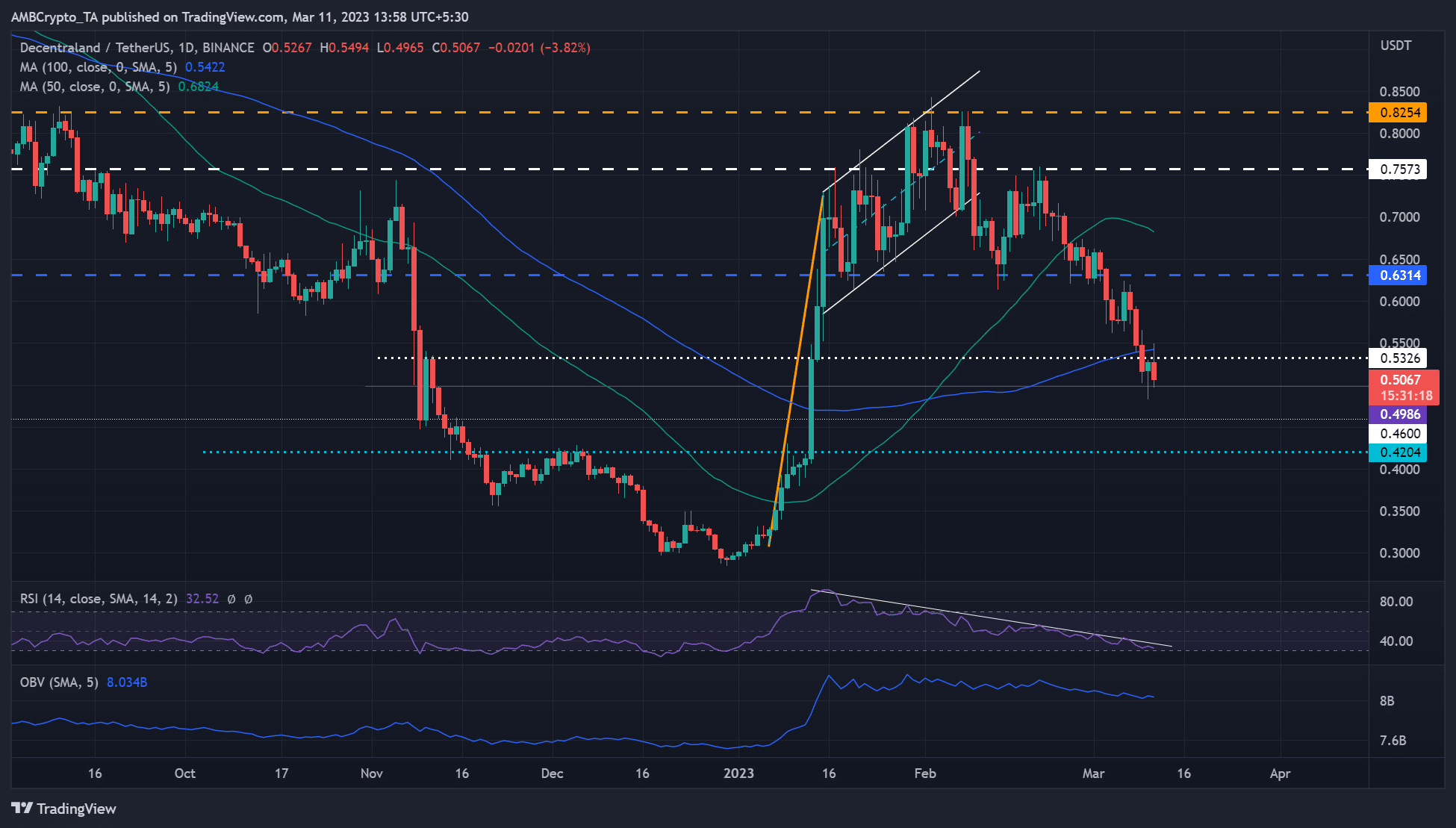

Decentraland [MANA] broke under its consolidation vary of $0.8254 – $0.6314 in early March, attracting aggressive promoting afterward. At press time, the digital actuality blockchain platform’s token struggled to keep up its half-dollar worth.

Learn Decentraland [MANA] Value Prediction 2023-24

Equally, Bitcoin [BTC] struggled to keep up the $20K worth as general market uncertainty endured and will expose MANA to cost fluctuations too.

A consolidation, sustained dump, or restoration for MANA

Supply: MANA/USDT on TradingView

MANA curved a bullish flag sample, however a possible bullish rally was undermined by rising market uncertainty. Bulls misplaced essential leverage after bears breached the $0.6314 assist on March 3.

The aggressive promoting afterward has additional sunk MANA under one other key assist at $0.5326. On the time of writing, MANA oscillated between the 100-day MA (Transferring Common) of $0.5422 and $0.4986.

If BTC fluctuations persist, MANA might enter a sideways market construction. As such, traders might goal the higher and decrease boundaries of the $0.5422 – $0.4986 vary for positive aspects.

Nonetheless, a breach of the vary will invalidate the above sideway construction. Notably, a bearish breakout might settle at $0.4600 or $0.4200.

Then again, a bullish breakout and a day by day candlestick shut above $0.5326 might inflict restoration with an instantaneous goal at $0.6314.

Is your portfolio inexperienced? Examine the MANA Revenue Calculator

The RSI has declined considerably, whereas the OBV (On Stability Quantity) additionally dipped, exhibiting restricted shopping for stress and buying and selling volumes.

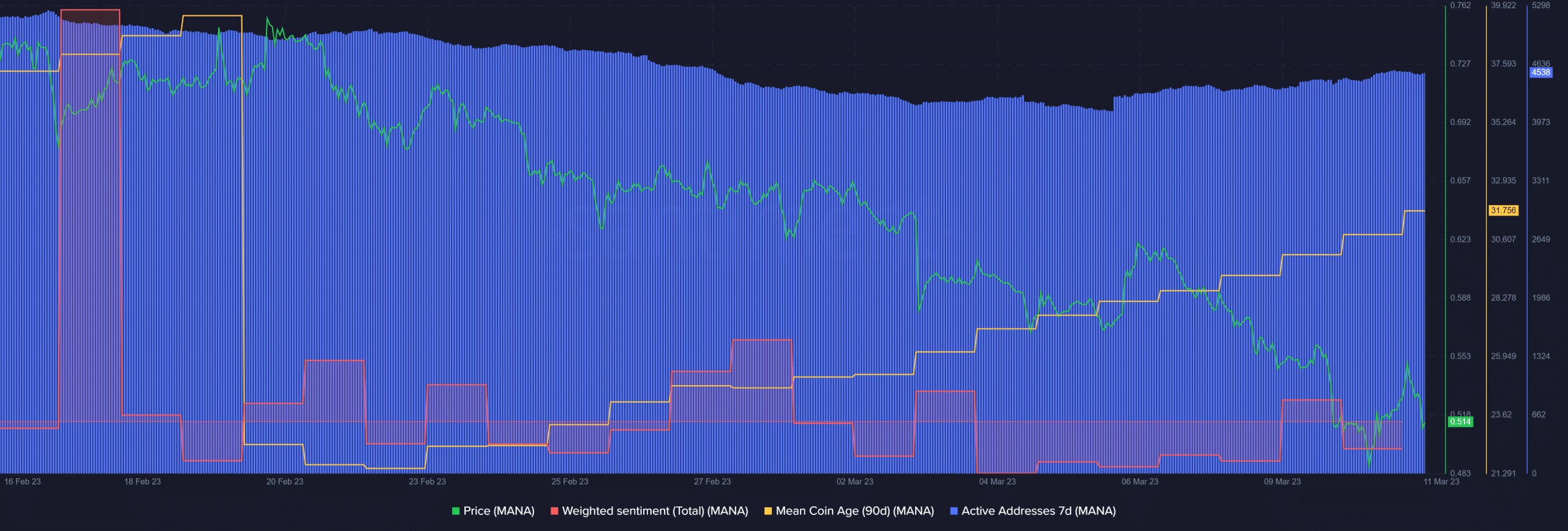

Imply Coin Age and weekly lively addresses elevated

Supply: Santiment

In keeping with Santiment, the 90-day Imply Coin Age rose steadily, suggesting a doable bullish rally. Equally, an uptick in weekly lively addresses up to now few days might enhance the buying and selling volumes wanted to inflict a restoration.

Nonetheless, the weighted sentiment remained within the destructive territory, exhibiting that traders’ confidence within the asset declined. As well as, the uncertainty round BTC might delay a robust restoration. Subsequently, BTC and traders ought to monitor the king coin’s value motion earlier than making strikes.

![Decentraland [MANA] falls to half-dollar value- Can bulls prevail?](https://nomadabhitravel.com/wp-content/uploads/2023/03/pasted-image-0-58-1536x874.png)