- A number of funds/establishments poured almost $1.6 billion into the crypto market since 10 February.

- The bears have taken over the market as BTC’s value plummeted.

Bitcoin [BTC] shocked the whole crypto market by registering good points as its value exceeded $25,000 on 16 February. This was excellent news, as BTC reached that mark after an extended wrestle of eight months. Furthermore, as per Santiment, one cause behind the pump was that whales had collected $2.7 billion Tether [USDT] since December 2022.

🐳🦈 Figuring out causes for #Bitcoin having the ability to surge above $25k for the primary time in 8 months, we are able to begin with key #Tether shark & whale shopping for energy that was growing since early December. Key stakeholders proceed loading up for extra buys. https://t.co/zknJcDgf9z pic.twitter.com/o8hbxQyGcv

— Santiment (@santimentfeed) February 16, 2023

Learn Bitcoin’s [BTC] Worth Prediction 2023-24

A number of elements had been at play for Bitcoin

Other than that, Lookonchain additionally identified one other issue that might be attributed to BTC’s surge. As per the evaluation, a number of funds and establishments have poured almost $1.6 billion into the crypto market since 10 February 2023, regardless of the then-bearish market.

As an illustration, almost 1.6 billion USDC was withdrawn from Circle throughout that interval. Furthermore, one other deal with, “0x308F,” withdrew 155 million USDC from Circle and transferred it to exchanges.

1/ Why did the value of $BTC/$ETH all of a sudden rise at the moment?

We discovered that a number of funds/establishments poured almost $1.6B into the crypto market since Feb 10!👇 pic.twitter.com/WRaSv4YtgP

— Lookonchain (@lookonchain) February 16, 2023

The aforementioned developments had a optimistic influence available on the market, leading to a bullish rally. Nevertheless, the northbound breakout was short-lived, because the market witnessed a development reversal quickly.

In line with CoinMarketCap, BTC’s value declined by over 3.8% within the final 24 hours, and on the time of writing, it was buying and selling at $23,713.42 with a market capitalization of over $457.4 billion.

Which metrics are accountable?

A have a look at BTC’s on-chain metrics revealed fairly just a few causes that supported the bears and induced the newest value decline. For instance, as per CryptoQuant, BTC’s alternate reserve was growing, which indicated increased promoting stress. BTC’s aSORP was crimson, suggesting that extra buyers bought their holdings for revenue amidst the bull rally.

One other bearish sign was a decline in BTC’s open curiosity within the final 24 hours because it plummeted by over 9%.

Is your portfolio inexperienced? Examine the Bitcoin Revenue Calculator

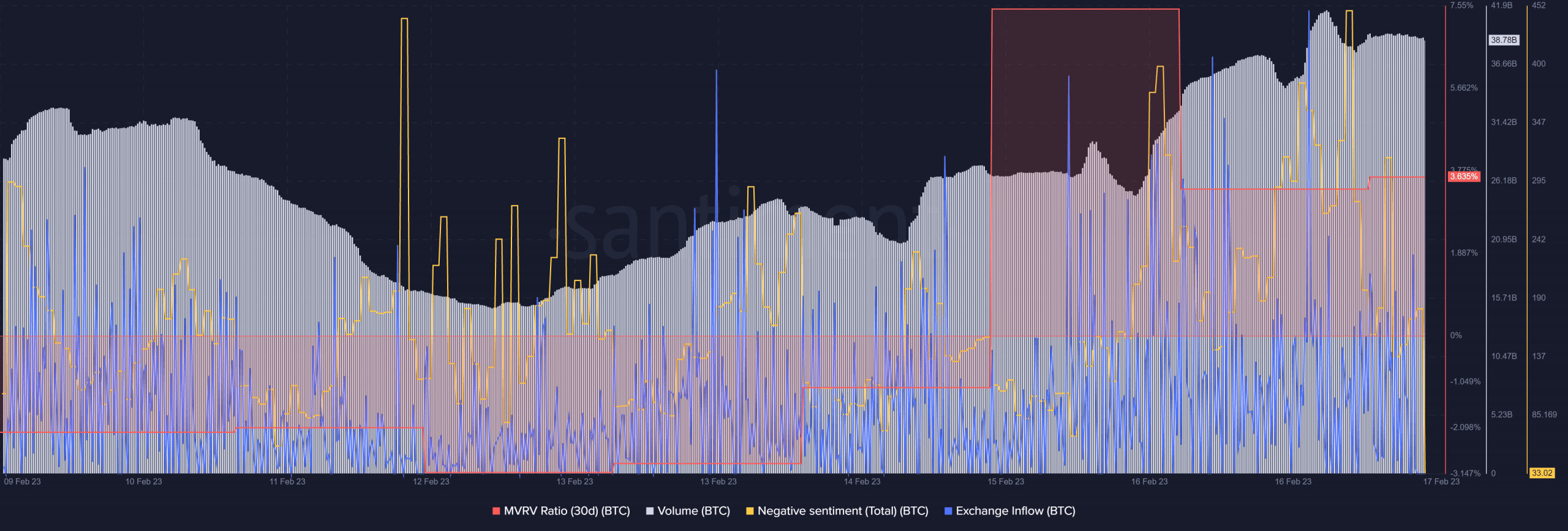

Santiment’s chart additionally identified just a few fascinating metrics. BTC’s current value decline was accompanied by excessive quantity, additional legitimizing the downtrend. Unfavorable sentiments round BTC spiked in the previous couple of days, indicating much less belief amongst buyers within the coin. Furthermore, BTC’s alternate influx elevated significantly.

Curiously, Glassnode’s chart revealed that BTC’s imply transaction quantity simply reached a one-month excessive of 1.869 BTC. After registering a substantial spike, BTC’s MVRV Ratio went down, additional growing the possibilities of a continued downtrend within the coming days.

Supply: Santiment

![Decoding what’s behind Bitcoin’s [BTC] volatility as price touches $25k](https://nomadabhitravel.com/wp-content/uploads/2023/02/Bitcoin-BTC-12.48.22-17-Feb-2023-1536x520.png)