- ETH could be vulnerable to extra promote strain as Voyager liquidates its holdings.

- Lengthy positions shift in favor of shorts as bearish market circumstances prevail.

The ghost of 2022’s crypto contagion is but to be exorcised. A wave of ETH promote strain could be on the best way courtesy of distraught crypto agency Voyager.

Reasonable or not, right here’s Ethereum’s market cap in BTC’s phrases

Crypto analysis firm Arkham just lately confirmed that voyager has commenced the method of liquidating its digital property.

The corporate filed for chapter after a sequence of unlucky market occasions that led to heavy losses. Preliminary information reveal that Voyager has barely over 100,000 ETH in its addresses which will probably be liquidated to pay collectors.

Voyager is within the strategy of liquidating their on-chain property.

They’re presently sending 7-8 figures of crypto to Wintermute and Coinbase addresses day by day.

They’ve over 100K ETH remaining to unload – that is over $150M!

Arkham will probably be dropping a deep-dive at 12:00 EST. pic.twitter.com/XhACb5wlxa

— Arkham (@ArkhamIntel) March 9, 2023

The quantity of ETH to be liquidated is price over $150 million. The report additional revealed that the funds will probably be despatched to Coinbase and Wintermute addresses.

These liquidations could translate to a considerable amount of promote strain throughout the subsequent few days. Such an end result may set off a deeper bearish transfer under $1,500.

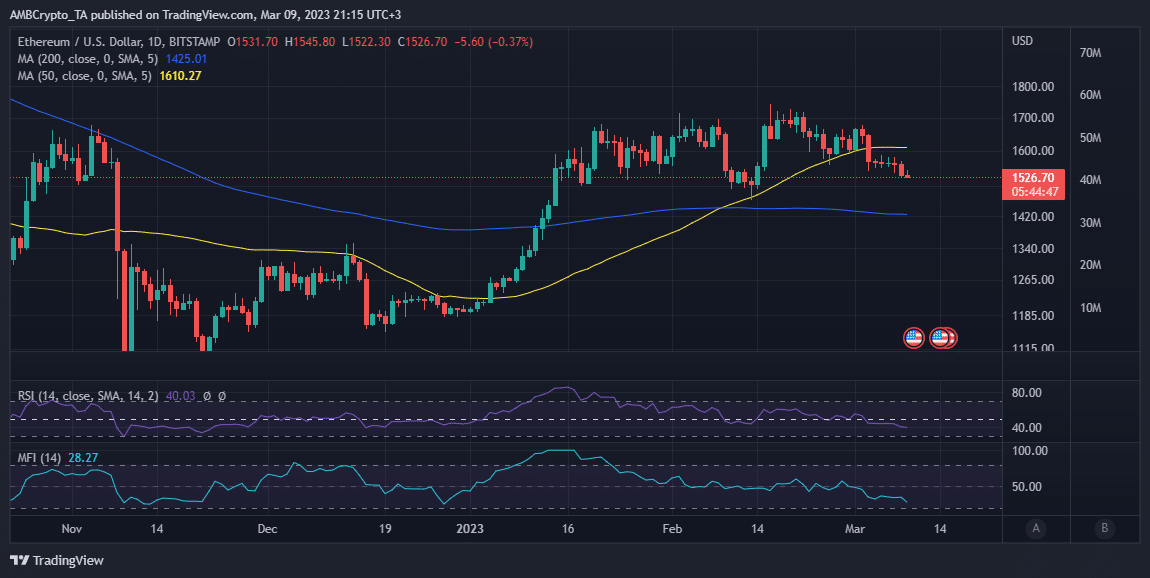

ETH bears have to this point pushed the value down by roughly 12% from its February highs to its $1,527 press time value. Nevertheless, the Voyager liquidations are usually not the one bearish considerations for bullish merchants.

Supply: TradingView

Bullish expectations dimmed for the previous few weeks courtesy of anticipated charge hike will increase. Federal Reserve chairman Jerome Powell just lately reignited these bearish expectations throughout a current Senate listening to. He revealed that the FED may need to extend charges to have a greater likelihood at combatting inflation.

Is your portfolio inexperienced? Take a look at the Ethereum Revenue Calculator

Are ETH derivatives merchants taking benefit?

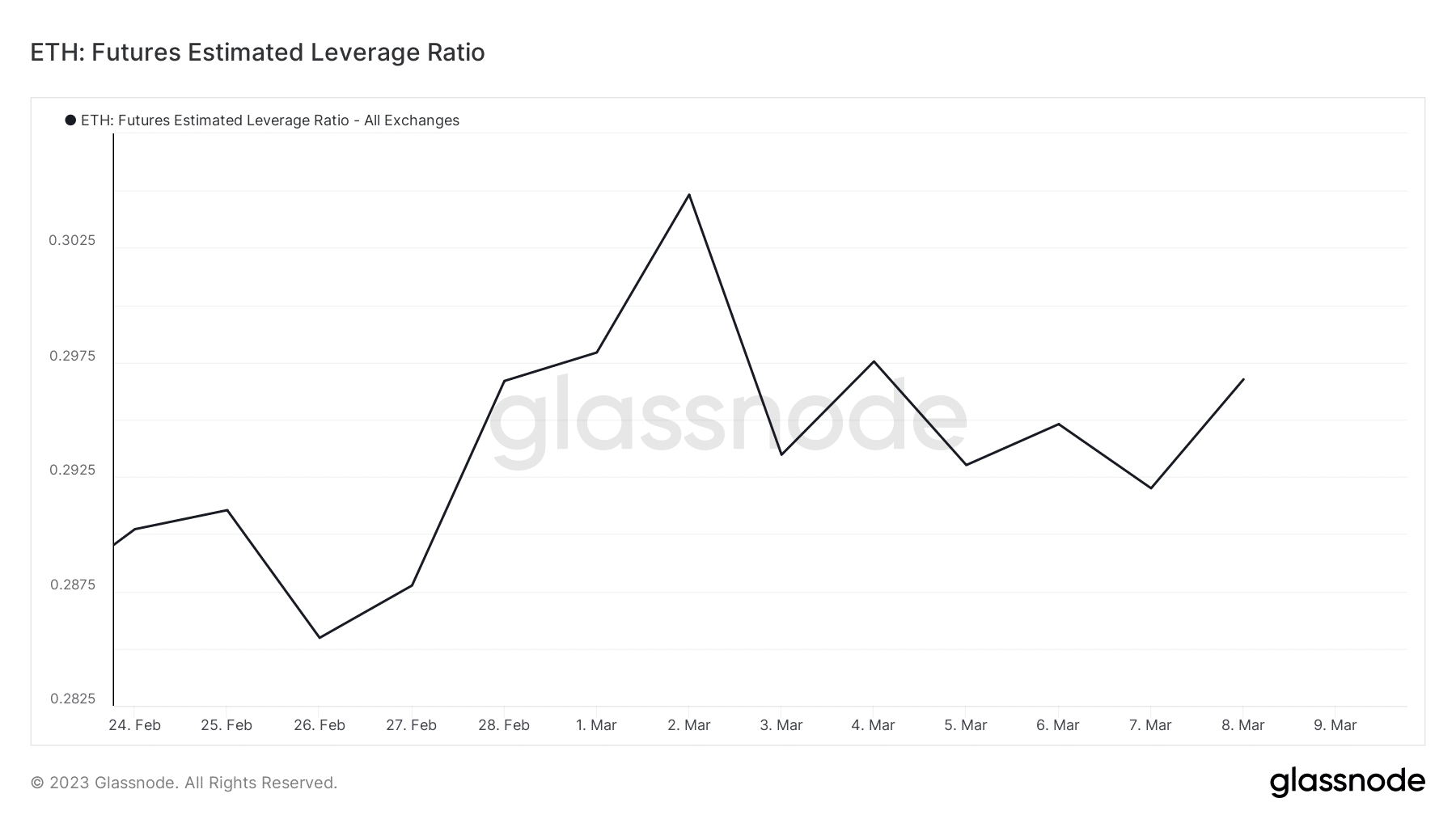

With the aforementioned issues taking heart stage, shorts merchants will probably be trying to take benefit. That’s doubtless the case in accordance with a number of metrics together with the futures estimated leverage ratio. The latter has improved during the last two weeks as costs dropped.

Supply: Glassnode

The surge within the futures estimated leverage ratio is especially evident within the final two days confirming wholesome demand for leverage.

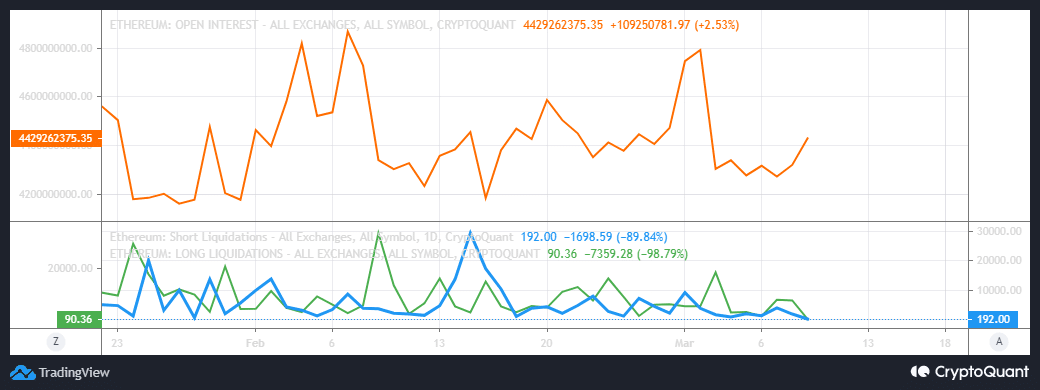

The value has been bearish throughout the identical time. Additionally, ETH’s open curiosity metric is on the rise this week and particularly within the final two days. A possible signal that there’s demand for shorts.

Supply: CryptoQuant

One other noteworthy commentary relating to the state of derivatives is that buyers have shifted from lengthy positions doubtless in favor of shorts.

The longs liquidation metric exhibits a drop in liquidations courtesy of the bearish market circumstances.