- Whales added 400,000 ETH regardless of a current value increment

- Extra ETH is being circulated though the present vault could possibly be overpriced

Like a ton of belongings within the crypto-market, Ethereum’s [ETH] value jumped over the weekend. Even at press time, the second-largest cryptocurrency in market worth maintained a 5.11% hike within the final 24 hours. Evidently, this has introduced some calm to the market. Particularly since a lot of it was flashing purple over the weekend.

Learn Ethereum’s [ETH] Worth Prediction 2023-2024

Nonetheless, regardless of the beneficial properties registered on the charts, whales didn’t appear to be content material. As identified by Ali_charts, a crypto-analyst on Twitter, addresses holding 1000 to 10000 ETH added $600 million to their holdings.

The knowledge, derived from Glassnode, revealed that the whales took the motion when ETH was nonetheless hovering above $1,680 on the charts.

#Ethereum whales with 1,000 to 10,000 $ETH added round 400,000 #ETH to their holdings within the current #crypto market dip, value round $600,000,000. pic.twitter.com/OMfebJoPVh

— Ali (@ali_charts) March 14, 2023

On the other facet of ETH

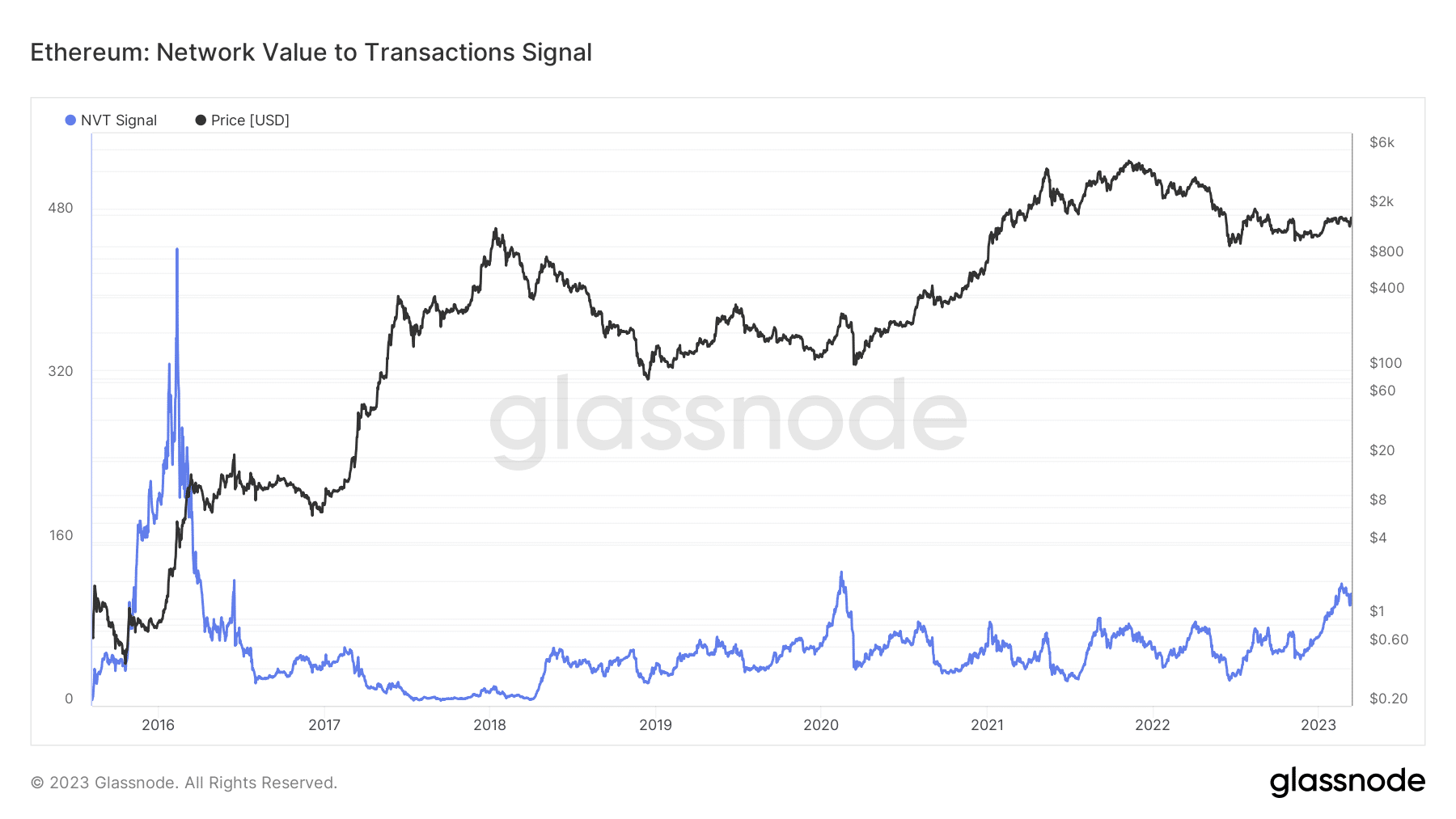

So, does the buildup imply ETH nonetheless tends to climb additional? Nicely, based on Glassnode, the Community Worth to Transaction (NVT) sign had a studying of 98.45, at press time. The metric usually displays the 90-day shifting common pattern of the each day transaction quantity, relatively than a day-to-day valuation.

In comparison with its worth in current instances, the aforementioned NVT signal is a excessive one. And, the final time it was as excessive was again in February 2020. Therefore, it appeared to substantiate that buyers had been pricing ETH at a premium whereas the market cap’s development outpaced its on-chain transaction quantity.

Supply: Glassnode

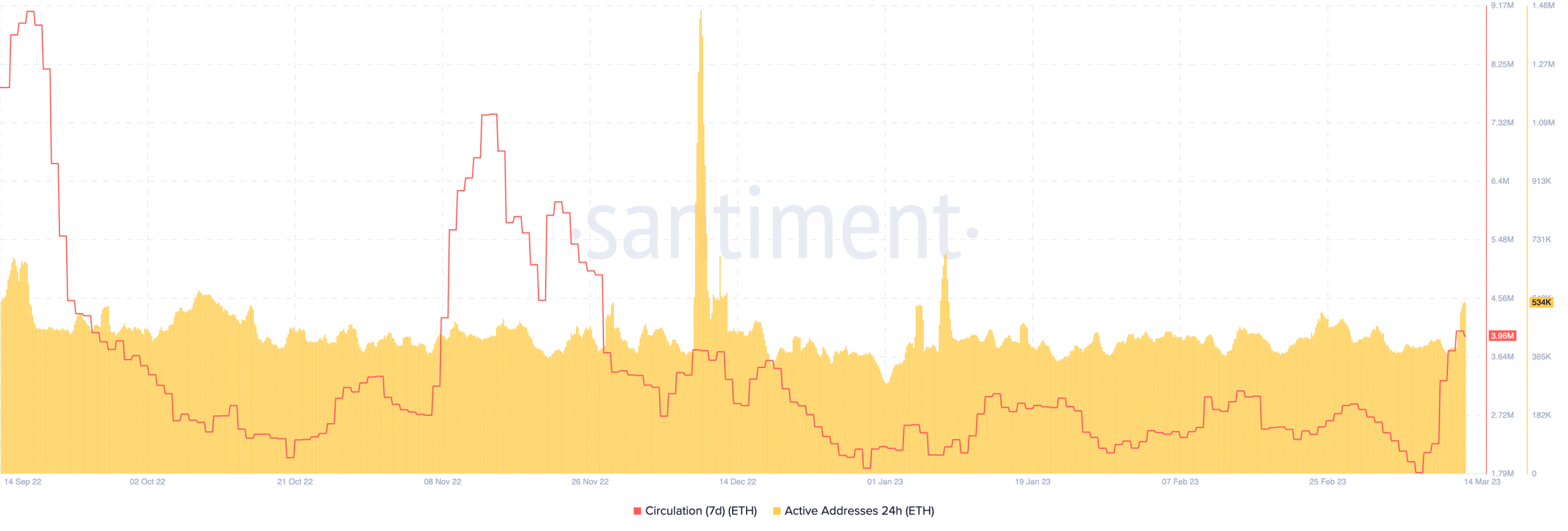

Whereas the aforementioned metric thought-about ETH as being presently overpriced, extra of the altcoin has been in circulation during the last seven days. The circulation exhibits the variety of distinctive cash which have been used for transactions inside a particular interval.

At press time, the seven-day circulation was 3.96 million. This implied that many models of ETH had been swirling across the market, regardless of their numbers falling when in comparison with the day gone by.

That being stated, one metric that has consistently moved north is Energetic Addresses. This metric measures the variety of distinctive addresses energetic on a community. With 24-hour energetic tackle rely of 534,000, the studying implied that many wallets had both obtained or despatched ETH during the last 24 hours.

Supply: Santiment

Is your portfolio inexperienced? Examine the Ethereum Revenue Calculator

Nearly equal change circulate reactions

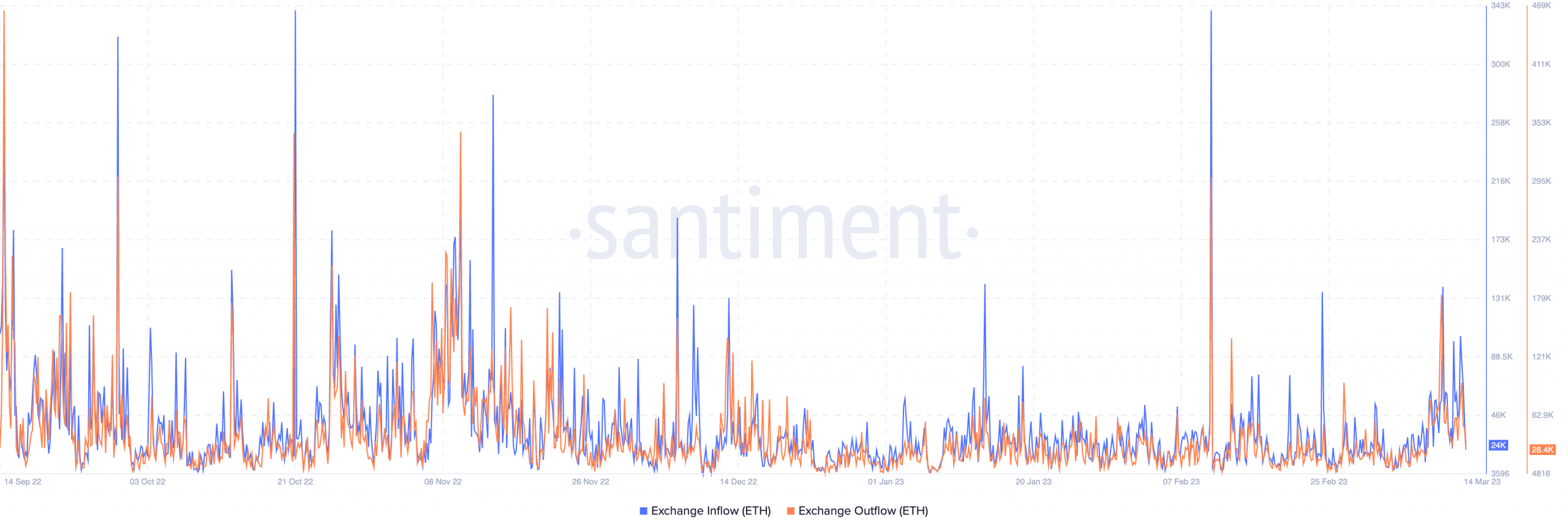

Whereas ETH stays on whales’ radar, activities on exchanges revealed that it has been a detailed contest for outflows and inflows.

The truth is, based on Santiment, change outflows had been as excessive as 28,400. This appeared to underline merchants’ momentary market scarcity and contribution to an asset’s appreciation.

Supply: Santiment

However, the change inflows had been 24,000. With the distinction in favor of the outflows, it implies that ETH has a slight probability of foregoing depreciation within the brief time period.

Nonetheless, merchants would possibly nonetheless must be cautious of projection. This, due to a number of unfavorable developments and contrasting market reactions.