Ethereum has seen the worth of its native token ETH drop alongside Bitcoin because the bear market continues to realize group. This has triggered worry amongst buyers, resulting in excessive promoting stress on the digital asset. Even the Ethereum whales at the moment are dancing to the tune of the bear market as they’ve begun to ship giant quantities of ETH to centralized exchanges.

Ethereum Whales Push Towards Promoting

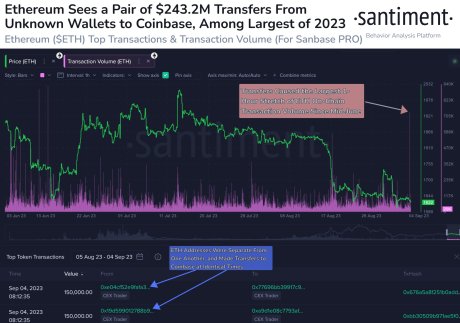

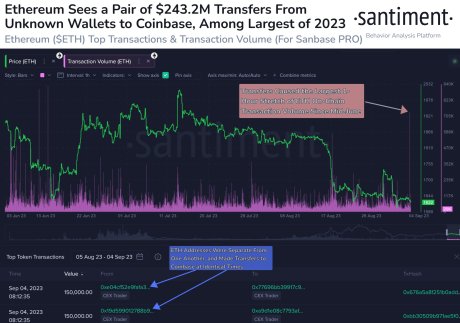

A current Santiment report posted on the X (previously Twitter) platform has proven that Ethereum whales could also be trying to exit stage left right now. The chart which was posted by the on-chain information tracker exhibits that whales have been transferring 300,000 ETH to centralized alternate Coinbase.

The switch occurred throughout two transactions carrying 150,000 ETH every. On the time, every of the transactions was carrying ETH price $243 million to the alternate. So in whole, each transactions noticed a complete of $486 million in ETH moved to Coinbase.

Whales ship 300,000 ETH to Coinbase | Supply: Santiment on X

Regardless of being such intently watched transactions, there have been no indications of what the whales intend to do. Often, cash transferring towards centralized exchanges means sell-offs, particularly for big buyers, who accomplish that to reduce the affect of their promoting as a lot as doable.

Nevertheless, the worth of Ethereum continues to be buying and selling near the place it was on Monday, and if these whales have been trying to promote, then such actions would’ve led to a quick plunge within the worth of ETH.

There may be additionally the truth that as soon as the ETH was transferred to Coinbase’s scorching pockets, they might be additional damaged down into smaller chunks of 4,282 ETH, which have been then moved to different wallets. However even this doesn’t paint a transparent image of why the ETH was moved to Coinbase within the first place.

Bears Take Over With Destructive Sentiment

The promoting stress that the Ethereum worth has been beneath not too long ago has not come out of nowhere. The Crypto Concern & Greed Index had moved into the worry territory following the market crash. This meant that buyers have been extra more likely to promote their holdings than put new cash into the market.

Associated Studying: On-chain Sleuth Probably Unveils Shiba Inu Founder With Surprising Associates

For ETH, it has now change into a battle for the bulls on condition that the bears have efficiently dragged the worth under the 50-day transferring common. This factors towards extra bearish momentum for the asset within the quick time period. Nevertheless, it isn’t all unhealthy.

ETH worth maintains $1,600 regardless of giant transactions | Supply: ETHUSD on Tradingview.com

Often, when indicators have dropped so low, it could possibly typically be a bounce-off level for a restoration. So whereas ETH could also be wanting towards extra bear motion for the close to time period, the digital asset could possibly be shut to a different rally, probably pushing its worth above $1,700 as soon as extra.

ETH’s worth is altering fingers at $1,624 on the time of this writing. It’s down 0.90% and 1.31% on the day by day and weekly charts, respectively.