- Eurler Finance was focused by a flash mortgage assault on 13 March, with the attacker profitable in stealing property price $197 million.

- The continuing assault has already develop into the most important hack of this yr.

Ethereum-based noncustodial lending protocol Euler Finance was focused by a flash mortgage assault on 13 March. The attacker was profitable in stealing virtually $197 million in Dai, USD Coin (USDC), staked Ether (StETH), and wrapped Bitcoin (WBTC).

Euler Finance acknowledged the exploit on Twitter and said that it’s at present working with cyber safety and legislation enforcement professionals to resolve the difficulty.

We’re conscious and our group is at present working with safety professionals and legislation enforcement. We’ll launch additional info as quickly as we’ve it. https://t.co/bjm6xyYcxf

— Euler Labs (@eulerfinance) March 13, 2023

In line with the latest update, the exploiter stole almost $197 million in a number of transactions.

Crypto analytic agency Meta Sleuth shared on Twitter that the assault was associated to the deflation assault from a month in the past. The hacker launched the assault as we speak through the use of a multi-chain bridge to switch funds from the BNB Good Chain (BSC) to Ethereum.

One other outstanding on-chain safety knowledgeable, ZachXBT, noted that the motion of funds and nature of the assault seems to be similar to black hats who exploited a BSC-based platform in February. The funds have been transferred to Twister Money after exploiting a protocol on BSC a number of weeks in the past.

Final yr, Euler Finance raised $32 million from San Francisco-based VC agency Haun Ventures in a funding spherical through which FTX, Coinbase, Leap, Jane Road, and Uniswap participated.

Euler Finance has develop into well-known over the yr for its liquid staking derivatives (LSDs) companies. These tokens permit traders to spice up their potential returns by unlocking liquidity for staked cryptocurrencies resembling Ethereum.

LSDs at present account for as much as 20% of the entire worth locked in centralized finance protocols.

Largest crypto hack of 2023

The continuing assault has already develop into the most important hack of this yr.

Decentralized finance (DeFi) exploits happen when hackers benefit from an open-source platform’s code to achieve unauthorized entry to its property and exploit them. DeFi assaults are probably the most critical points confronting the crypto business.

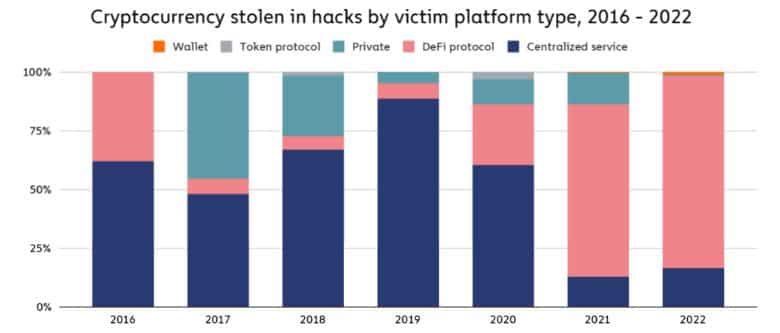

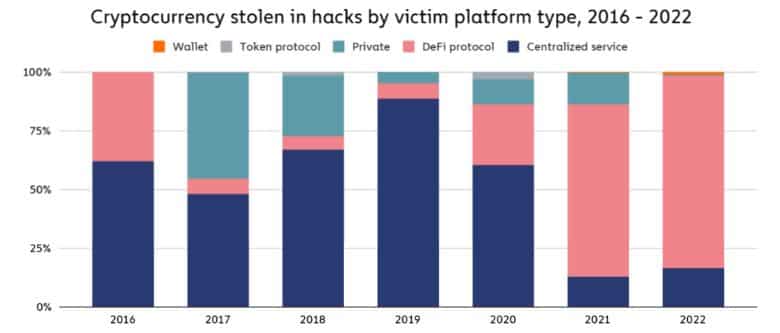

In 2022, over $3 billion was stolen from DeFi protocols through hacks or exploits, according to blockchain analytics agency Chainalysis. 2022 was the most important yr ever for crypto hacking, with $3.8 billion stolen from cryptocurrency companies.

DeFi protocols as victims accounted for 82.1% of all cryptocurrency stolen, that’s, a complete of $3.1 billion, by hackers in 2022.

Supply: Chainalysis