Because the U.S. heads into the following election 12 months, crypto issues have begun to seep into mainstream American politics—particularly, the terrifying prospect of a United States central financial institution digital foreign money (CBDC).

U.S. politicians equivalent to Ted Cruz, Tom Emmer, Robert F. Kennedy Jr., and Ron DeSantis have all steered, both explicitly or by way of proposed laws, that the Federal Reserve System should be prevented from growing, issuing, and even researching CBDCs as a matter of coverage. The implication, amplified by voices on social media, is that the Federal Reserve is actively working towards growing a CBDC as an instrument of state management.

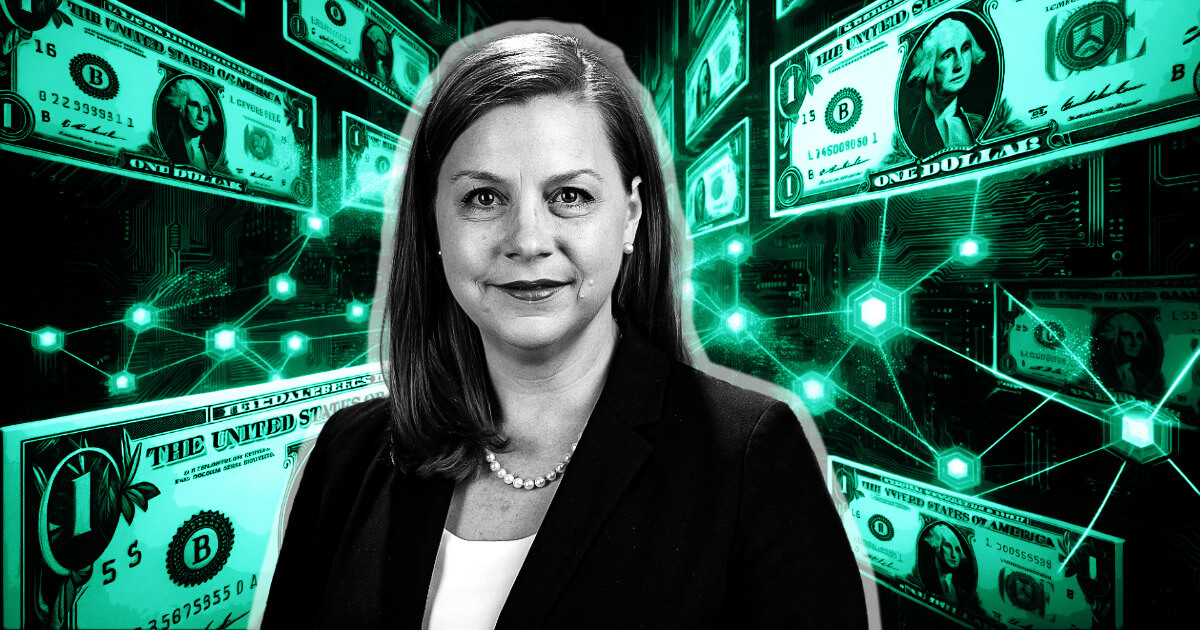

The documented actuality, nonetheless, exhibits that the Fed is something however wanting to introduce CBDCs to the U.S. financial system. Talking at a roundtable dialogue in Washington, D.C. this morning, Fed governor Michell Bowman reiterated the Fed’s reluctance to embrace CBDC tech and criticized its capability for fixing actual issues in international finance.

No compelling argument

Bowman’s speech centered round ongoing curiosity in digital belongings, together with crypto-assets, stablecoins, CBDCs, and programmable fee platforms. She particularly critiqued the thought of a U.S. CBDC, questioning whether or not it might resolve monetary issues extra successfully or effectively than present options.

Highlighting the significance of accountable innovation in cash and funds, Governor Bowman underlined the necessity to handle frictions throughout the fee system, promote monetary inclusion, and supply the general public with entry to secure central financial institution cash. Nonetheless, she is unpersuaded {that a} central financial institution digital foreign money is suited to the duty, saying:

These are all essential points. I’ve but to see a compelling argument {that a} U.S. CBDC might resolve any of those issues extra successfully or effectively than options, or with fewer draw back dangers for customers and for the economic system.

She additional famous that the U.S. fee system continues to evolve with improvements like FedNow, the Federal Reserve’s new interbank system for immediate funds. This technique permits taking part banks, companies, and customers to make and obtain immediate funds, with speedy fund availability always.

Governor Bowman additionally harassed that the introduction of a CBDC might pose vital dangers and tradeoffs for the monetary system, together with appreciable shopper privateness issues. She argued that the U.S. intermediated banking mannequin, wherein business banks concern credit score to customers and establishments whereas managing reserves by way of the Federal Reserve System, can be the extra appropriate mannequin for future monetary innovation. A CBDC might disrupt this method, probably hurting customers and companies whereas presenting broader monetary stability dangers.

The Fed and web3

The Federal Reserve’s lively engagement with the nuances of the crypto-asset panorama, together with improvements like stablecoins, CBDCs, DeFi, and tokenization, not solely demonstrates that it takes the sector significantly however that it shares among the similar issues.

It doesn’t, nonetheless, imply that the Fed is bounding towards digital greenback dominance. Whereas theoretically unnerving, the thought of an imminent U.S. CBDC has change into the topic of largely unfounded anxieties, in no small half as a result of it merely will not be within the Fed’s curiosity—or certainly, that of the USA—to take action.

As market individuals, commentators, attorneys, lobbyists, and politicians proceed to fumble their manner towards a workable, complete crypto coverage framework, it’s essential to keep in mind that our collective focus ought to be on constructive dialogue and collaboration moderately than sowing seeds of unwarranted worry, uncertainty, and doubt.

The publish Fed Governor Michelle Bowman expresses central financial institution’s skepticism of CBDCs appeared first on CryptoSlate.