- Filecoin has launched its Filecoin Digital Machine.

- The FVM has led to elevated FIL buying and selling within the final 24 hours.

To offer an execution setting for operating the Ethereum [ETH] Digital Machine (EVM)-compatible sensible contracts on its community, main decentralized storage community Filecoin [FIL] lastly launched its Filecoin Virtual Machine [FVM] on the mainnet on 14 March.

Learn Filecoin’s [FIL] Value Prediction 2023-24

The launch of the FVM fashioned the ultimate step of Filecoin’s Masterplan to convey large-scale computation and the power to energy web-scale apps to the decentralized storage community.

In line with the press launch, the Filecoin Digital Machine will present related skills to Ethereum, permitting for the event and deployment of decentralized functions and the power to attach with different blockchains.

Following the launch of the FVM, main cryptocurrency trade OKX announced the mixing of its web3 pockets with the improve.

Day merchants rally towards FIL

Within the final 24 hours, FIL’s value rallied by 7%. With a surge in FIL buying and selling following the launch of the FVM, buying and selling quantity has climbed by 30% throughout the identical interval, per knowledge from CoinMarketCap. As of this writing, the altcoin exchanged fingers for $6.81 per FIL token.

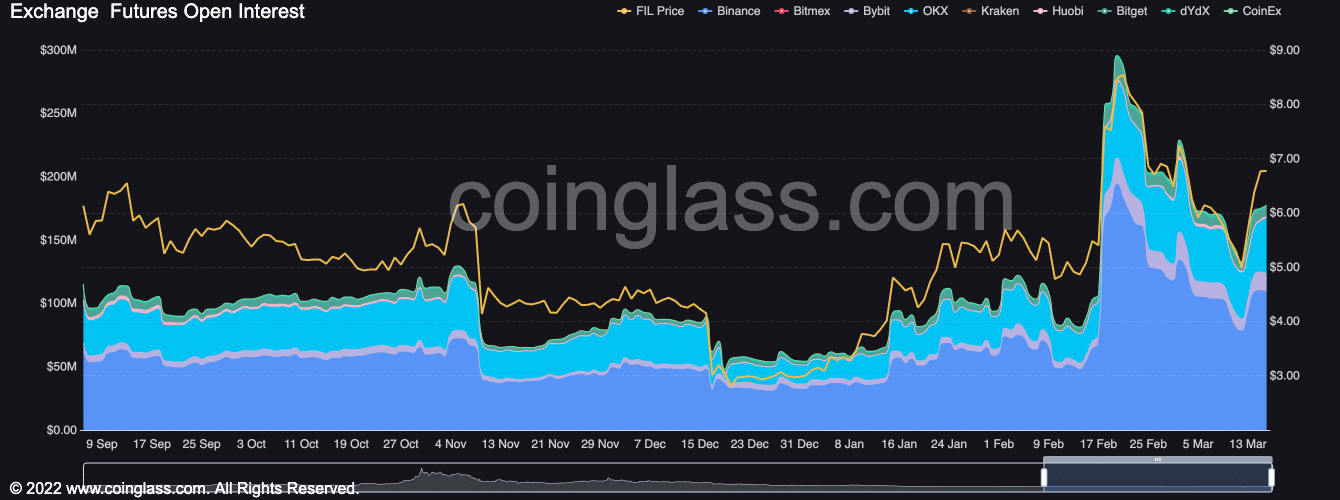

Profiting from the FVM launch, knowledge obtained from Coinglass signifies that there was a rise within the variety of FIL buying and selling positions opened throughout the previous 24 hours. At $177.5 million at press time, FIL’s Open Curiosity has climbed by 2%.

Supply: Coinglass

A soar in an asset’s Open Curiosity indicated that extra merchants have been all for taking positions within the asset. This typically mirrored a rising bullish sentiment towards that asset’s value.

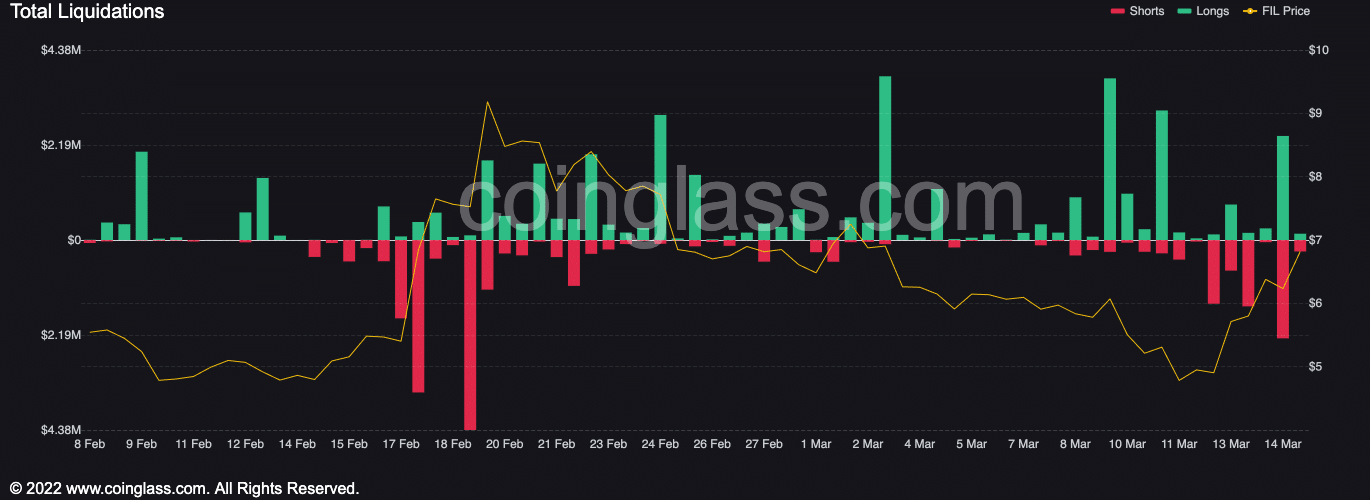

Moreso, there have been a better variety of brief liquidations than lengthy liquidations within the final 24 hours. Because the constructive sentiment towards FIL continued to rise, knowledge from Coinglass revealed.

Supply: Coinglass

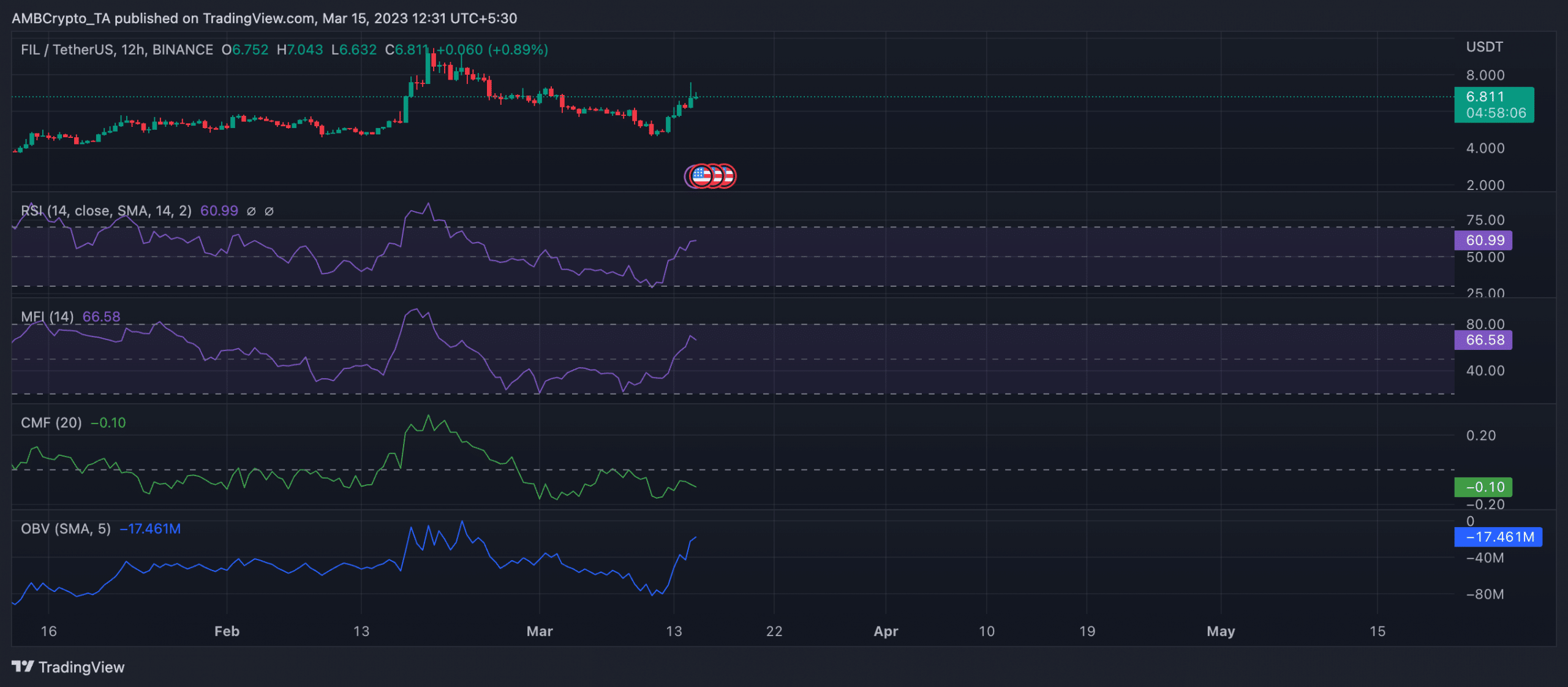

Additional, on a 12-hour chart, FIL accumulation rallied considerably. FIL’s Relative Energy Index (RSI) and Cash Move Index (MFI) approached the overbought area at press time. The RSI was 60.99, whereas the MFI was 66.58. With weighted sentiment nonetheless within the constructive territory per knowledge from Santiment, this accumulation momentum is anticipated to be sustained. Due to this fact, extra value progress ought to be on the horizon for FIL.

Life like or not, right here’s FIL market cap in BTC’s phrases

Additionally, FIL’s On-balance quantity (OBV) maintained an uptrend at press time, suggesting rallying token accumulation. When an asset’s OBV is trending upwards, it signifies that the quantity of trades is heavier on the purchase facet, indicating that traders are extra all for shopping for the asset than promoting it.

Supply: FIL/USDT on TradingView