A Bloomberg exchange-traded fund (ETF) analyst says that the market may very well be inundated by Ethereum (ETH) futures ETFs beginning on October 2nd.

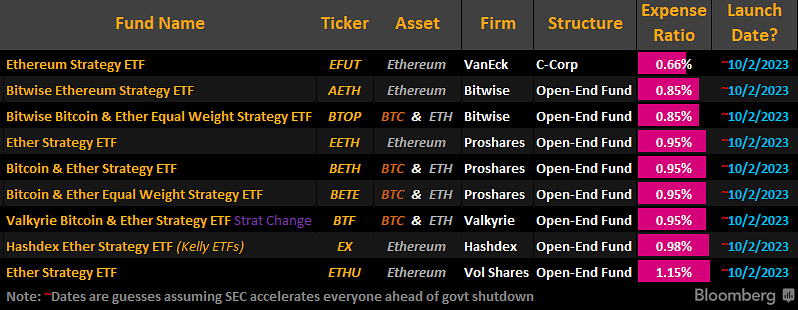

In a brand new thread on the social media platform X, Bloomberg ETF analyst James Seyffart notes that 9 totally different ETH-based futures ETFs are set to probably launch on Monday, including that it will likely be a “loopy day.”

The monetary companies on Seyffart’s record which can be gearing as much as concern Ethereum futures ETFs embrace VanEck, Bitwise, Proshares, Vol Shares, Hashdex and Valkyrie.

The analyst goes on to say that different companies taken with issuing Ethereum ETFs, comparable to Grayscale, have but to submit up to date filings and are probably not going to.

“The one potential issuers that haven’t but submitted up to date filings are Direxion, Roundhill, and Grayscale. It’s probably that some or all of them are simply not going to trouble.”

Based on Seyffart, the explanation the ETFs are probably launching early is because of the worry of a looming authorities shutdown.

Final month, international funding supervisor VanEck introduced that it’s getting ready to roll out its ETH futures ETF, which the corporate acknowledged wouldn’t be investing in Ethereum itself however reasonably in standardized, cash-settled ETH futures contracts traded on registered commodity exchanges.

On the time, VanEck stated that the fund – which will probably be listed on the Chicago Board Choices Trade (CBOE) – intends solely to put money into ETH futures traded on the Chicago Mercantile Trade.

Additionally in September, VanEck released an announcement saying that they anticipate “effectiveness to happen upon the sooner of October 3, 2023, or the time at which the U.S. Securities and Trade Fee (SEC) accelerates [the] effectiveness of the registration assertion.”

Do not Miss a Beat – Subscribe to get electronic mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl aren’t funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital property. Please be suggested that your transfers and trades are at your personal danger, and any loses you could incur are your accountability. The Every day Hodl doesn’t suggest the shopping for or promoting of any cryptocurrencies or digital property, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in affiliate marketing online.

Generated Picture: Midjourney