Bitcoin appears to be present process a interval of consolidation and profit-taking after eight weeks of phenomenal worth progress. The world’s largest crypto has had unbelievable progress this 12 months, with a particular surge beginning in the midst of October.

Nonetheless, after hitting a yearly excessive of $44,500 on December 8, the value of Bitcoin has pulled again about 6% as some traders look to be taking income. In keeping with on-chain knowledge supplier Glassnode, a number of of its on-chain pricing fashions recommend Bitcoin’s honest worth is at present between $30,000 and $36,000.

Bitcoin’s Worth Rally Pauses As After A Resistance At $44,500

Bitcoin’s worth appreciation this 12 months led to a 150% acquire which pushed it above $44,500, however on-chain knowledge reveals the recent streak has cooled off a bit after forming a resistance at this worth degree.

This has led to many short-term traders taking revenue from their holdings. In keeping with knowledge from Whale Alerts, there have additionally been numerous situations of enormous BTC transactions into crypto exchanges previously few days, suggesting some whale addresses may also be taking part within the selloff.

🚨 🚨 658 #BTC (26,893,152 USD) transferred from unknown pockets to #Binancehttps://t.co/QzyF0MRiHT

— Whale Alert (@whale_alert) December 13, 2023

A brief-term correction was inevitable, in line with crypto knowledge agency Glassnode’s honest worth fashions. Their evaluation based mostly on the investor value foundation and community throughput suggests the honest worth is lagging behind the present market spike.

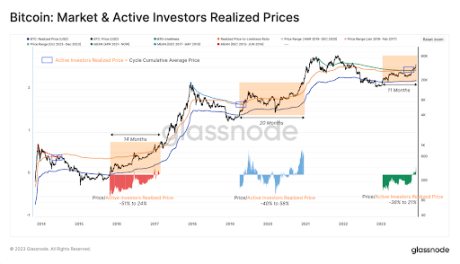

A metric cited was the Energetic Investor Realized Worth, which screens the diploma of HODLing throughout the community. In keeping with this mannequin, Bitcoin’s spot costs are at present buying and selling above its realized worth (honest worth).

Looking at historic developments reveals it has taken between 14 to twenty months between the realized worth and the creation of an all-time excessive. The trail to the creation of a brand new ATH has additionally at all times concerned main spot worth fluctuations of ±50% across the Energetic Traders Realized Worth.

Supply: Glassnode

The crypto asset is now 11 months into the break, with spot costs fluctuating between -38% and 21% of the realized worth. If historical past repeats itself, we may see one other few months of actions across the present honest worth of $36,000.

This worth level correlates with a social media publish by crypto analyst Ali Martinez. Whereas noting IntoTheBlock knowledge, the analyst famous sturdy help between $37,150 and $38,360, backed by 1.52 million addresses holding 534,000 BTC.

In case of a deeper correction, #Bitcoin finds stable help between $37,150 and $38,360. This zone is backed by 1.52 million addresses holding 534,000 $BTC.

Additionally, be careful for 2 resistance partitions that might maintain the #BTC uptrend at bay: one at $43,850 and one other at $46,400. pic.twitter.com/NGm1XpMOLf

— Ali (@ali_charts) December 11, 2023

BTC bulls attempt to get better losses | Supply: BTCUSD on Tradingview.com

One other technical pricing mannequin cited by Glassnode was the Mayer A number of. The Mayer A number of indicator is now at a price of 1.47, near the 1.5 degree which frequently varieties a degree of resistance in prior bull cycles.

Glassnode’s report additionally checked out numerous different pricing fashions, together with the NVT Premium indicator which evaluates the utility of the community throughput when it comes to a USD worth. In keeping with the NVT Premium, the current rally is without doubt one of the greatest spikes since Bitcoin’s all-time excessive in November 2021, suggesting an overvaluation in relation to the community throughput.

What’s Subsequent For Bitcoin?

Bitcoin is buying and selling at $40,963 on the time of writing. Though the crypto is now down by 6% in a 7-day timeframe, it’s nonetheless monitoring positive factors of 8.5% from its December open of $37,731. The $44,500 degree is now a vital degree for the asset, because the trade continues to attend for a bullish run after the approval of spot Bitcoin ETFs within the US.

The crypto market continues to be in bullish sentiment, with Coinmarket’s Concern & Greed Index pointing to a 73 greed. An influence by means of $44,500 would sign the resumption of the bullish pattern for Bitcoin. One other resistance degree to look at after the break can be the $46,400 degree.

Featured picture from Chainalysis, chart from Tradingview.com

Disclaimer: The article is supplied for academic functions solely. It doesn’t symbolize the opinions of NewsBTC on whether or not to purchase, promote or maintain any investments and naturally investing carries dangers. You’re suggested to conduct your individual analysis earlier than making any funding selections. Use info supplied on this web site solely at your individual threat.