- Q2 noticed almost an 8% enhance within the day by day Distinctive Energetic wallets from the earlier quarter.

- TVL within the sensible contracts of varied DeFi functions fell 7%.

Because the Web3 ecosystem continues to develop and evolve, the position of decentralized functions (dApps) has change into more and more essential. Lovers have been striving to develop disruptive dApps that serve to extend the potential of the decentralized net.

dApps, for the uninitiated, are software program packages that run on a blockchain and are exterior the management of a single dominant authority. The concept behind their improvement is to handle urgent points linked with Web2 functions within the present period, comparable to safety of consumer privateness and censorship.

Because of this, the rise of dApps is tightly linked to Web3 adoption and is actively monitored by business analysts.

State of dApps in Q2 2023

International dApps monitoring platform DappRadar revealed a report not too long ago, revealing fascinating insights into the evolution of the dApp panorama within the second quarter of 2023.

The largest spotlight was the almost 8% enhance within the day by day Distinctive Energetic wallets (dUAW) from the earlier quarter. UAWs work together or carry out a transaction with a dApp’s sensible contract and are thus an necessary measure of the latter’s development.

The expansion in engagement underlined the resilience and restoration of the market, which grappled regulatory hostilities for essentially the most a part of Q2.

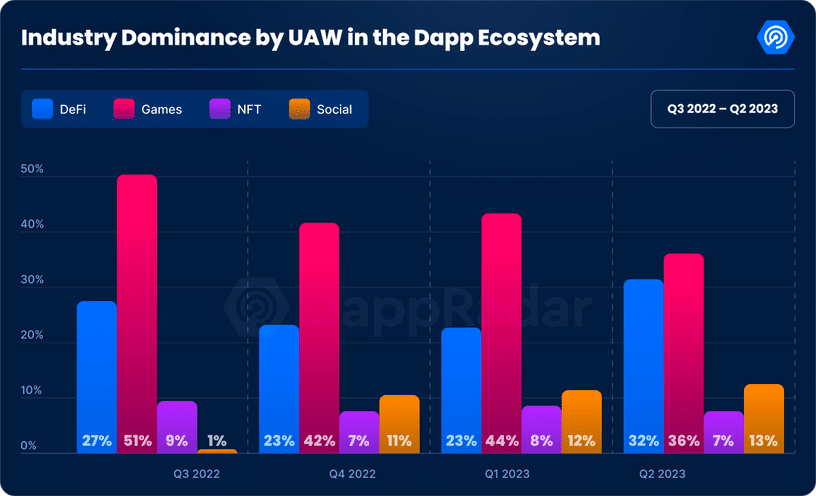

Supply: DappRadar

The gaming business retained its place as essentially the most dominant vertical within the dApp business, capturing 36% of the market. Nevertheless, this was a marked decline from the earlier quarter when its dominance was 44%.

Evidently, a lot of this pie was grabbed by the decentralized finance (DeFi) sector, which elevated its market share from 23% to 32%. The report acknowledged that the memecoin frenzy in April-Might and the elevated exercise by AirDrop hunters contributed to the rise of DeFi protocols.

Nevertheless, a more in-depth examination revealed that not the whole lot was hunky-dory within the DeFi business.

DeFi panorama faces headwinds

The full worth locked (TVL) within the sensible contracts of varied DeFi functions fell 7% from the earlier quarter. This after witnessing a outstanding restoration of 38% in Q1, coming from the lows of the 2022 bear market.

The TVL is a very powerful indicator of a DeFi protocol’s development and displays the general sentiment out there. The upper the TVL, the extra reliable the platform is perceived to be.

Supply: DappRadar

One of many main causes behind the drop in TVL may very well be the rising regulatory clampdown by U.S.-based regulatory businesses. In line with the report, BNB Chain suffered a major 19% drop in its TVL, essentially the most amongst all blockchains.

The lawsuit concentrating on the mum or dad firm Binance [BNB] clearly created a belief deficit amongst BNB Chain’s consumer base and so they may have withdrawn their belongings.

One other facet which may very well be factored in was prolonged durations of low volatility out there throughout Q2. The absence of bullish and bearish forces compelled customers to keep away from buying and selling actions like lending and borrowing.

In line with DeFiLlama, the volumes throughout decentralized exchanges (DEX) stagnated within the second quarter, recording a month-to-month common of simply round $71 billion.

Distinction this with Q1 when the month-to-month common DEX quantity was $96 billion and witnessed an increase in every successive month.

Supply: DeFiLlama

State of NFT sector

The NFT market was additionally not insulated from the market downturn. The full buying and selling quantity registered a considerable drop of 38% in Q2 to land at $2.9 billion. Nevertheless, the drop in gross sales was not as extreme. In contrast with Q1, the overall gross sales depend decreased by somewhat over 9%.

Supply: DappRadar

Analyzing the above two knowledge units, the report highlighted that although large-volume trades, together with skilled, may have declined, the person merchants didn’t wither away. This was a sign that there was sustained curiosity in NFTs.

Ordinals explosion

The report additionally traced the expansion trajectory of Ordinals, the protocol powering the minting of fungible and non-fungible tokens on the Bitcoin [BTC] community. Ordinals took an enormous leap in Q2, exploding 2834% in buying and selling quantity.

There was rising curiosity amongst new retail merchants for the expertise, seen in the course of the BRC-20 token mania in Might, which resulted in record-breaking visitors on the Bitcoin community.

As per the most recent knowledge from Dune, greater than 15 million Ordinals inscriptions have been minted. Nevertheless, as seen from the graph under, the speed of minting got here down drastically in June.

Supply: Dune