- GMX’s whole worth locked elevated by 35% because the FTX debacle.

- The protocol’s native token registered a bounce in value and buying and selling quantity in latest days.

In keeping with a tweet by an on-chain analyst, one of many largest decentralized spinoff exchanges GMX, hit a contemporary all-time excessive (ATH) in its whole worth locked (TVL), underlining its continued dominance within the DeFi panorama.

GMX TVL hitting a brand new all-time excessive nearly each day. pic.twitter.com/eHlBRlB7an

— Patrick | Dynamo DeFi (@Dynamo_Patrick) February 18, 2023

On the time of writing, the TVL of the Arbitrum-based protocol reached $624 million, gaining 20% over the past week and 35% because the FTX contagion hit the cryptocurrency market.

Is your portfolio inexperienced? Test the GMX Revenue Calculator

The age of decentralized staking

The rising curiosity in GMX could possibly be linked to U.S. regulators’ strengthening chokehold on centralized staking choices. Think about this- GMX recorded an ATH in its buying and selling charges and income on 10 February, the day when Kraken stopped all of the staking exercise on its change after being reprimanded by U.S. Securities and Change Fee (SEC).

GMX’s staking resolution ensures a 30% share of the generated buying and selling charges to customers who lock their GMX tokens.

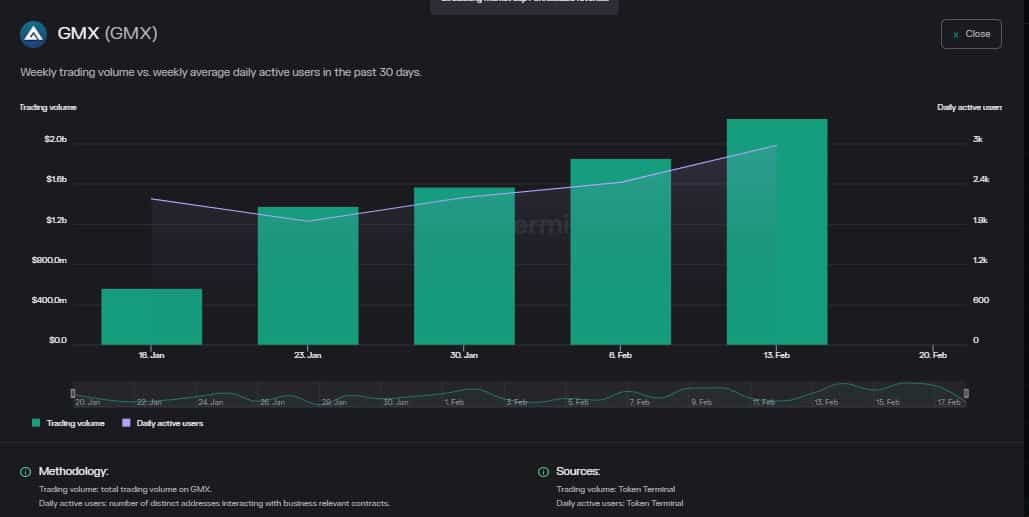

Liquidity suppliers (LPs), alternatively, take a 70% reduce of buying and selling charges. The lucrativeness of this staking coverage was evidenced by the rising variety of each day lively customers and the protocol’s buying and selling quantity, fetched from Token Terminal.

Supply: Token Terminal

Native token absorbs the positive aspects

The sustained development in key metrics resulted in higher motion on the token entrance as effectively. On the time of writing, GMX logged positive aspects of greater than 25% over the past week whereas its buying and selling quantity greater than doubled in the identical time, per knowledge from Token Terminal.

At press time, nonetheless, the token fell by 1.63% within the 24-hour interval, per CoinMarketCap.

Supply: Token Terminal

How a lot are 1,10,100 GMXs price immediately?

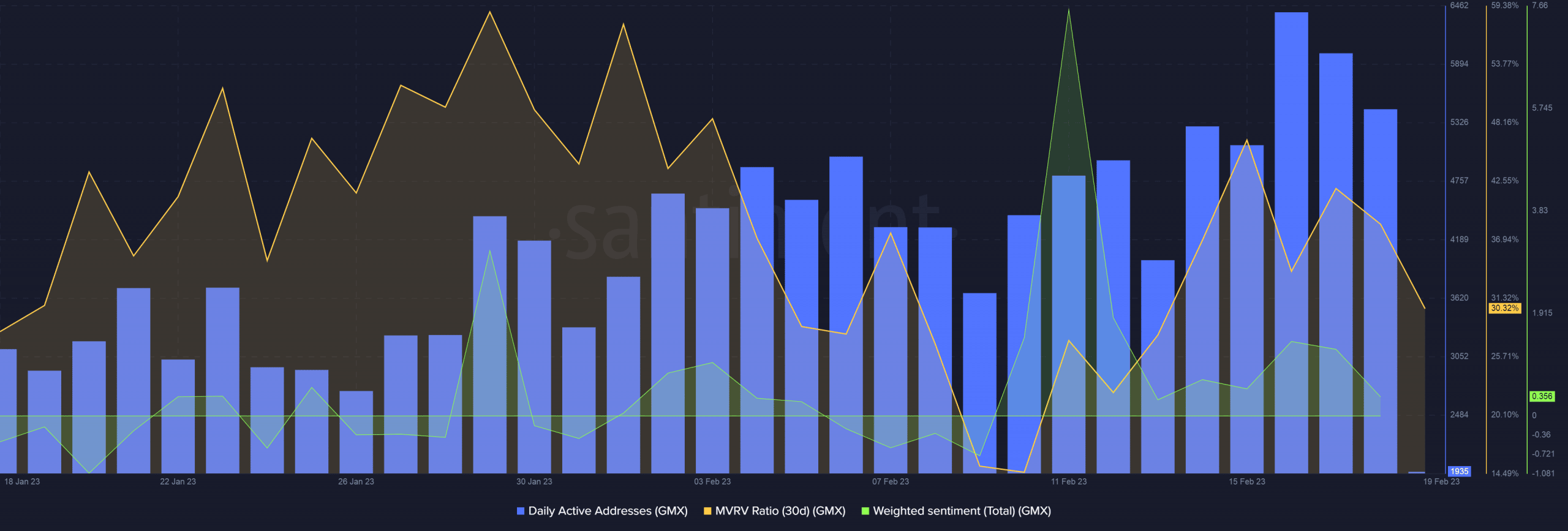

In keeping with Santiment, the each day lively addresses jumped 36% over the past week, including to the bullish narrative of the token. The 30-day MVRV ratio was on the upper facet, indicating that the majority holders will notice earnings in the event that they had been to promote their GMX tokens.

Traders ought to take this studying with a pinch of salt because it had the potential of exerting appreciable promoting strain within the days to come back.

The weighted sentiment was constructive which meant that buyers pinned their hopes on the viability of GMX.

Supply: Santiment