- HBAR bulls calm down however combined indicators about worth course fog the street forward.

- Hedera secures a strategic partnership resulting in the on-boarding of one other high-profile challenge.

Hedera [HBAR] has been probably the most bullish cryptocurrencies to this point in February 2023, throughout which it constructed on its January good points. This was not like most high digital cash, which noticed vital weak spot and profit-taking. However can it maintain this bullish momentum?

Examine Hedera’s [HBAR] Worth Prediction 2023-24

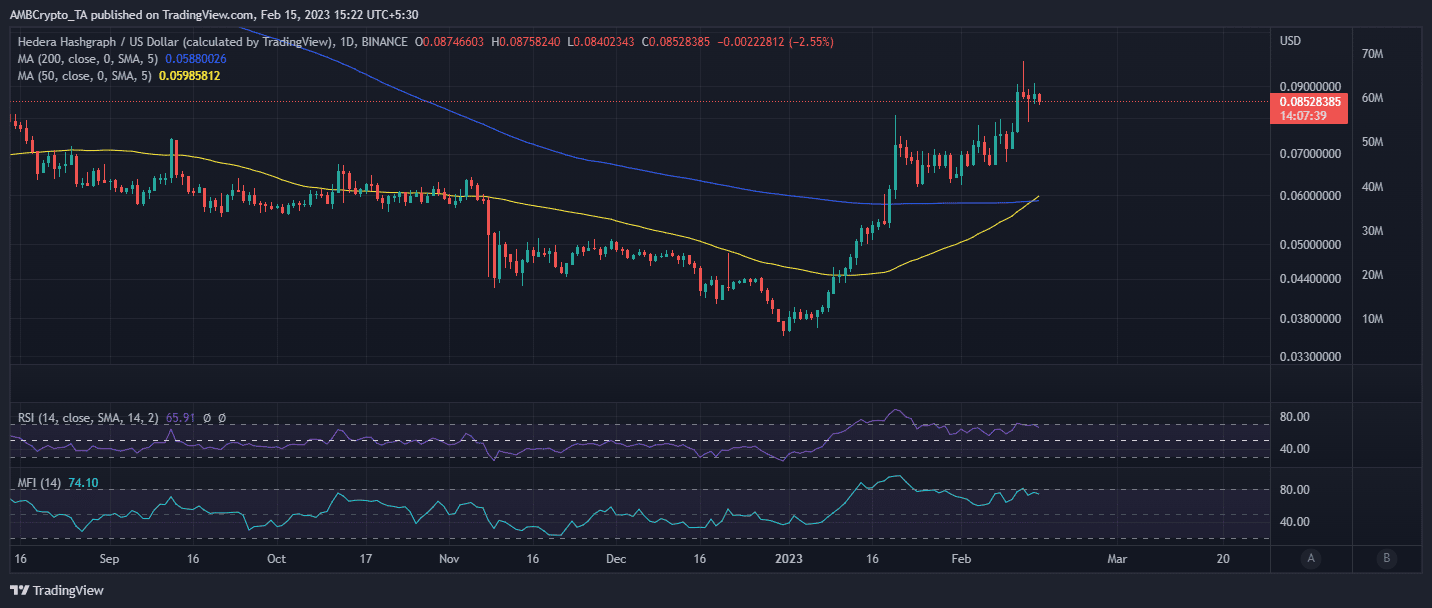

Maybe HBAR’s worth motion might provide some insights into what to anticipate. Bullish exhaustion was evident after the cryptocurrency’s newest peak on 11 February. It has been combating resistance above the $0.090 worth degree, and the bears had been trying to take over at press time. Though expectations had been excessive, the worth motion was displaying combined indicators.

Supply: TradingView

The 50-day shifting common crossed above the 200-day shifting common from under, forming a golden cross at press time. The latter is normally thought of a bullish signal. Alternatively, the current worth peak was accompanied by a decrease RSI degree, forming a worth to RSI divergence, which is normally a bearish signal.

HBAR additionally retested overbought territory, and promote stress is more likely to manifest beneath such circumstances – particularly if the worth was beforehand closely bullish. It is because buyers which can be deep in cash might wish to safe income. Vital outflows of roughly $310 million have already taken place within the final three days.

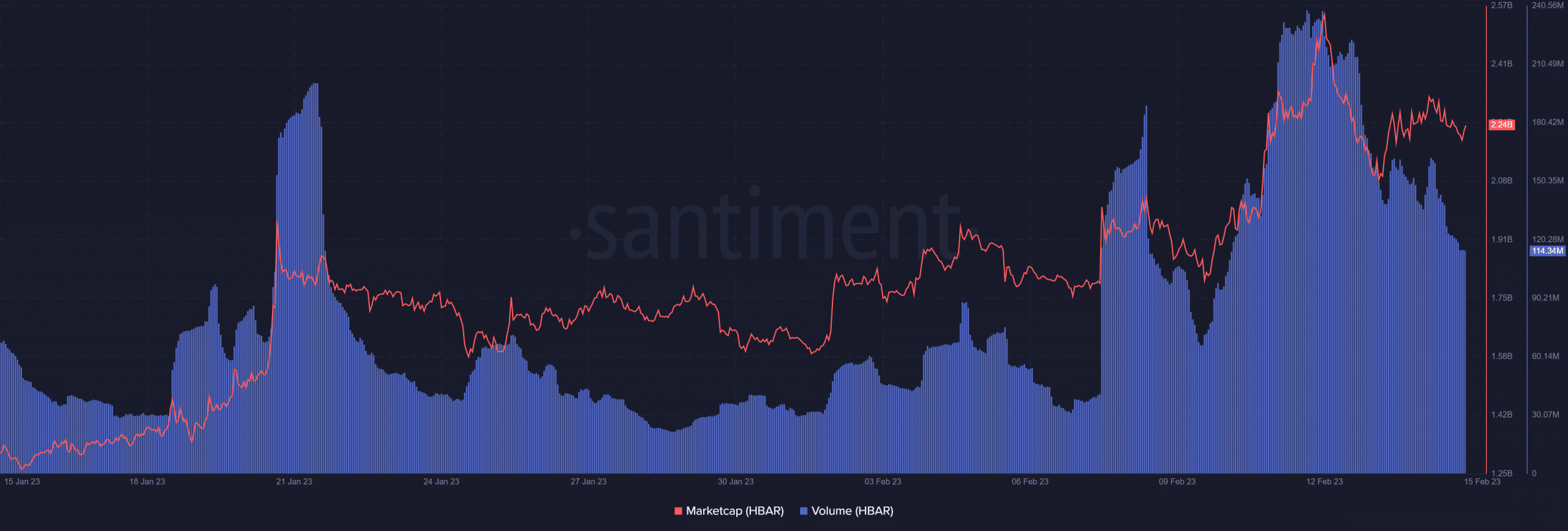

Supply: Santiment

HBAR’s quantity additionally tanked considerably throughout the identical interval, confirming that the bullish sentiment is now not in management. This mirrored the weighted sentiment which dropped within the final three days in favor of the bears.

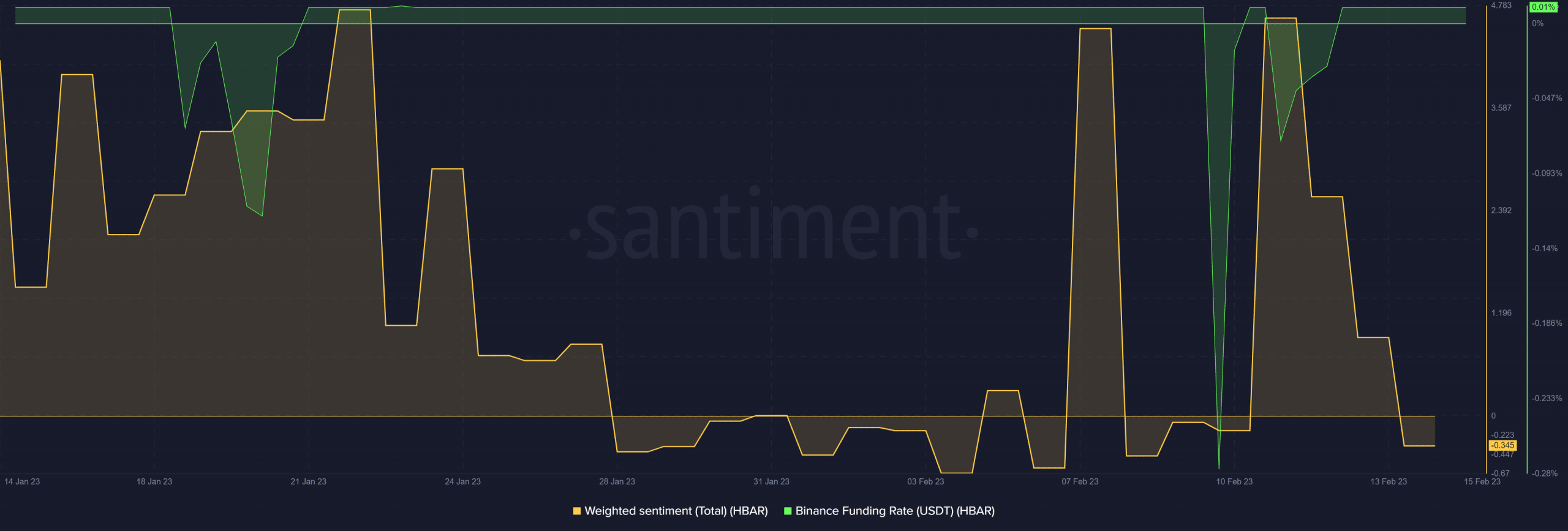

Supply: Santiment

Regardless of the bearish sentiment, HBAR’s Binance funding price maintained consistency throughout the identical interval. This recommended that there was nonetheless a wholesome demand within the derivatives market.

Is your portfolio inexperienced? Try the Hedera Revenue Calculator

What ought to HBAR buyers anticipate?

Each the worth and metrics evaluation pointed in the direction of contrasting indicators. Whereas the metrics and the price-RSI divergence highlighted a probably bearish consequence for the following few days, the golden cross recommended in any other case. However this isn’t the one bullish signal. The HBAR Basis simply introduced a strategic partnership between Hedera and the Digital Energy Trade (VPE).

We’re excited to announce that the Digital Energy Trade (VPE), a three way partnership between @Securrency and @BOSSControls, has chosen @Hedera #ReFi to create a primary of its form digital vitality change platform for retail market members 🌎 pic.twitter.com/Psnz4LrvgG

— HBAR Basis (@HBAR_foundation) February 14, 2023

The partnership will enable Hedera to host the primary digital change platform. This got here amid the decision for more healthy environmental practices, permitting for brand spanking new industries to be fashioned round such points. However is that this sufficient to curtail profit-taking? That is still to be seen, however it provides to the listing of Hedera’s newest achievements that contribute to community development.

![Hedera [HBAR] at a crossroads as these opposing metrics raise questions](https://nomadabhitravel.com/wp-content/uploads/2023/02/hbar-michael-1-1000x600.jpg)