Intently adopted crypto analyst Jason Pizzino is laying out a timeline for when Bitcoin (BTC) might see its subsequent all-time excessive above the $69,000 stage.

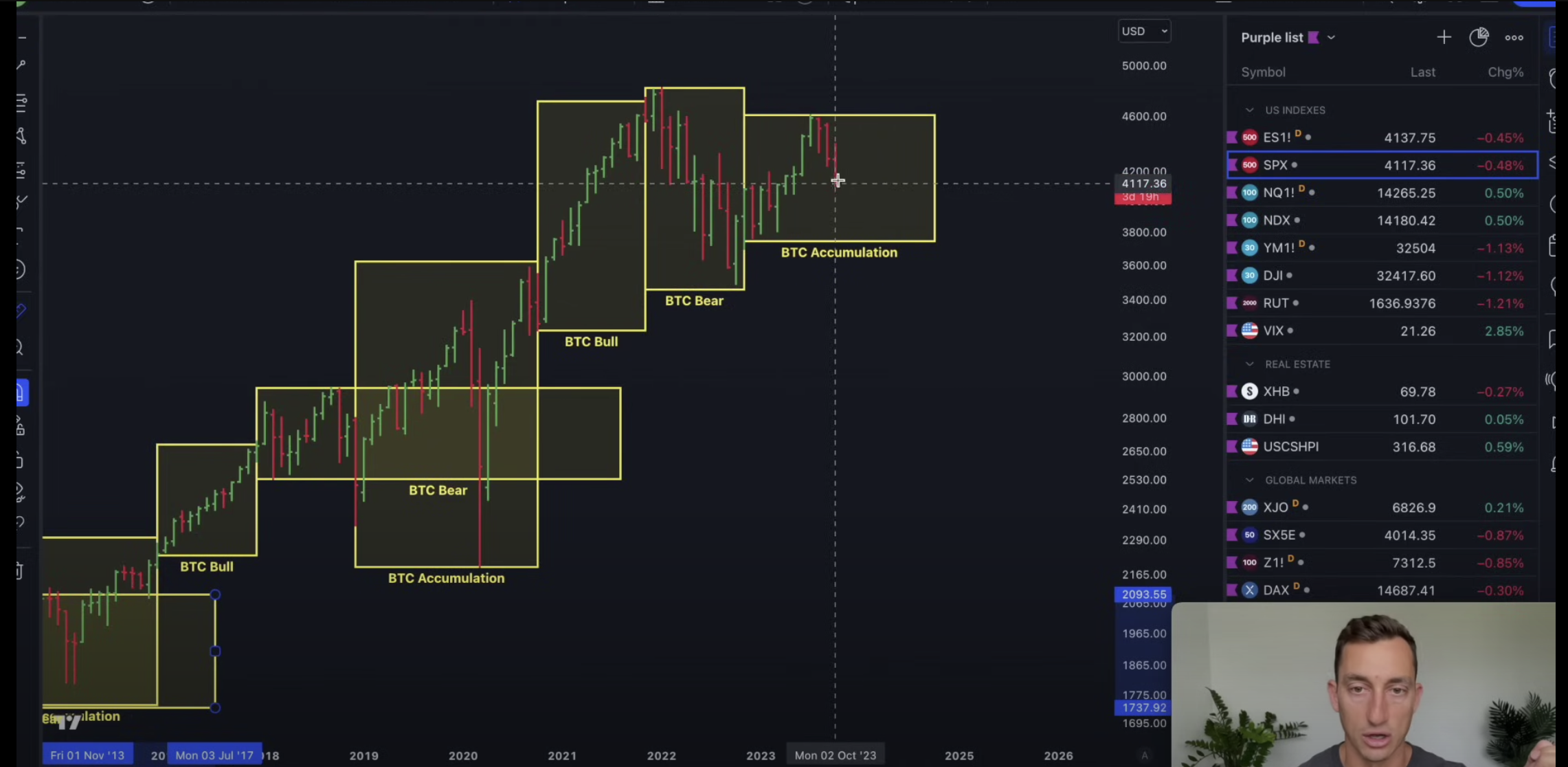

In a brand new technique session, Pizzino tells his 292,000 YouTube subscribers that Bitcoin has traditionally entered its personal bear markets and accumulation phases after the S&P 500 has topped out.

With the S&P500 nicely beneath its all-time excessive and doubtlessly consolidating between the 4,400 and three,700 vary, Pizzino says that someday within the subsequent eleven months, the S&P could get better to new highs, bringing Bitcoin up with it.

He estimates that by September of 2024, the S&P500 could have already made new highs and Bitcoin could also be concentrating on the $70,000 stage as soon as once more.

“In every of these events, the S&P500 has made a brand new all-time excessive whereas Bitcoin has been beneath its personal all-time excessive. We’re nonetheless beneath the all-time excessive, and we nonetheless have roughly 11 months to go to the top of this accumulation – after all, give or take a month or two on both aspect. These are macrocycles and we have to have some tolerance to the numbers themselves, however roughly talking we’re most likely about midway by way of that accumulation interval or a minimum of we’ve acquired half the time to go earlier than Bitcoin breaks out off its earlier all-time excessive of $69,000.

With that in thoughts, we will then begin to throw a few numbers or a few dates on the market. We take a look at roughly 11 months from now. It takes us out to September of 2024, so doubtlessly someday within the second half of 2024 is when Bitcoin can be above $60,000 or $70,000.”

At time of writing, Bitcoin is buying and selling at $34,318.

I

Do not Miss a Beat – Subscribe to get e-mail alerts delivered on to your inbox

Examine Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Every day Hodl Combine

Disclaimer: Opinions expressed at The Every day Hodl are usually not funding recommendation. Buyers ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual threat, and any loses chances are you’ll incur are your accountability. The Every day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Every day Hodl an funding advisor. Please word that The Every day Hodl participates in online marketing.

Generated Picture: Midjourney