The downfall of FTX has underscored the counter-party dangers that exchanges can impose available on the market. As merchants and buyers tread with heightened warning, there’s an evident demand for dependable metrics to guage the well being of those platforms.

Utilizing the FTX information set as a benchmark, Glassnode has rolled out three progressive indicators designed to pinpoint high-risk situations among the many main exchanges: Coinbase, Binance, Huobi, and the now-defunct FTX.

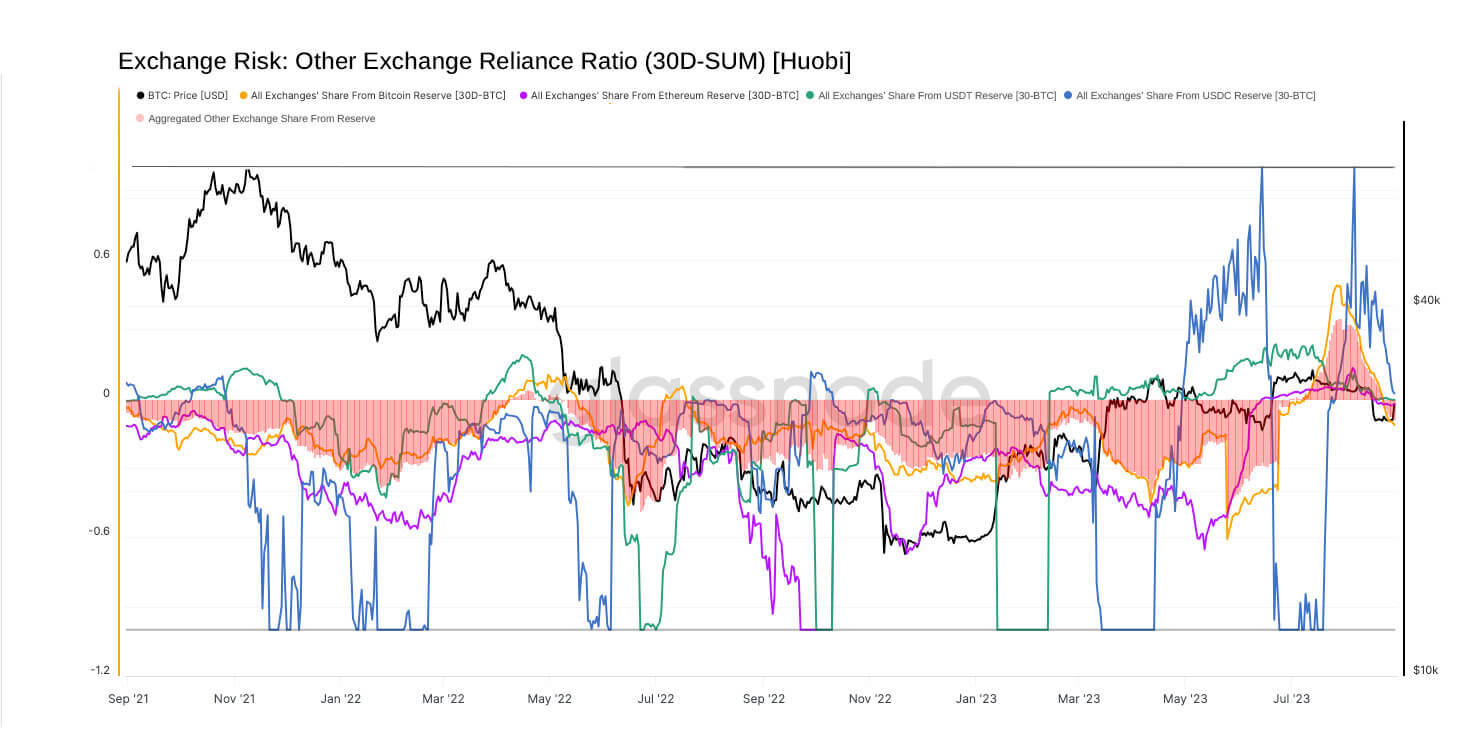

One of many indicators is the alternate reliance ratio, which reveals when a good portion of an alternate’s stability is usually transferred to or from one other alternate. A good portion of an alternate’s stability being persistently moved to or from one other platform would possibly counsel a deep reliance or co-dependence on liquidity.

A constructive ratio signifies internet inflows to the alternate, whereas a destructive one signifies internet outflows. Extended durations of enormous destructive values could be a pink flag, indicating property quickly departing the alternate in favor of one other platform.

Whereas Binance and Coinbase exhibit a comparatively low reliance ratio, indicating minor fund actions in comparison with their huge balances, Huobi’s information paints a unique image. Current figures confirmed pronounced destructive reliance ratios throughout all Huobi property, indicating a marked enhance in transfers from Huobi to different exchanges.

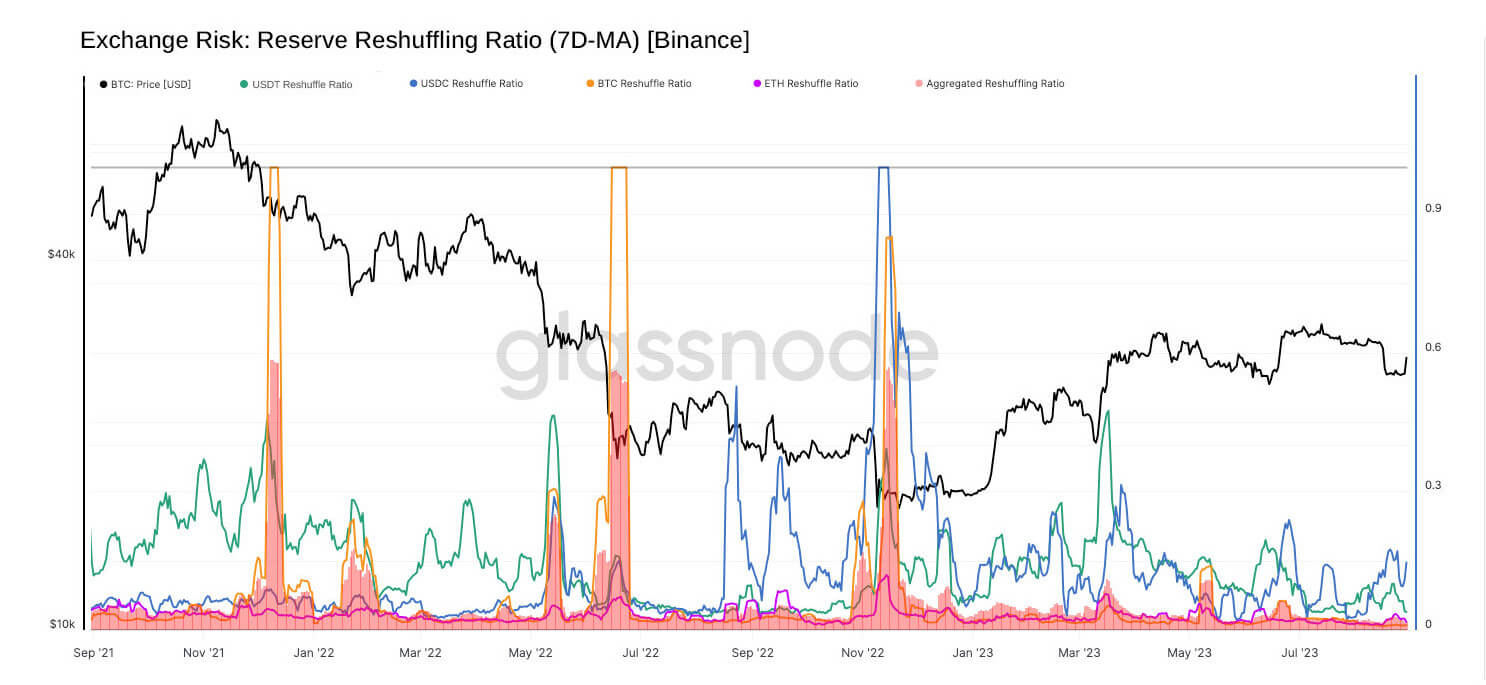

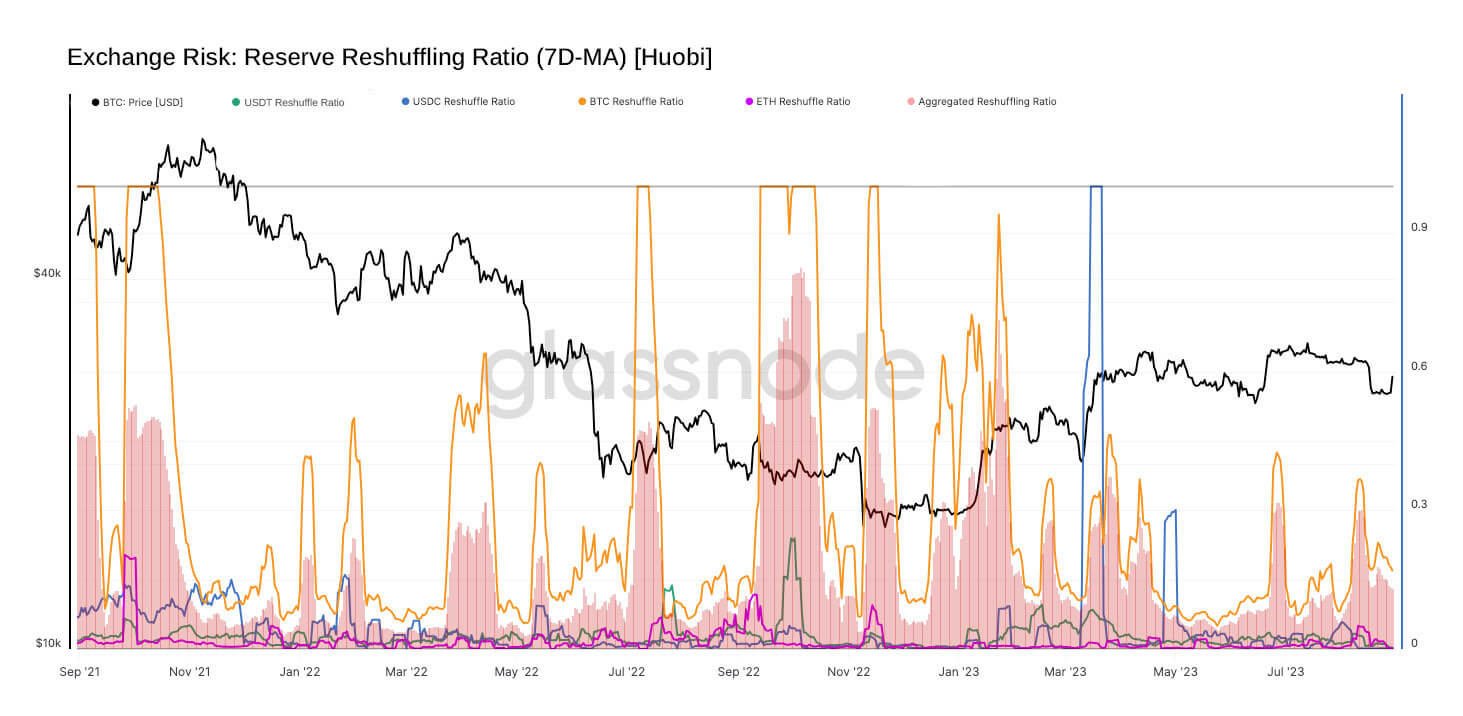

Huobi’s inside reshuffling ratio, which reveals the proportion of an alternate’s stability transacted internally over a set interval, mirrors that of Binance.

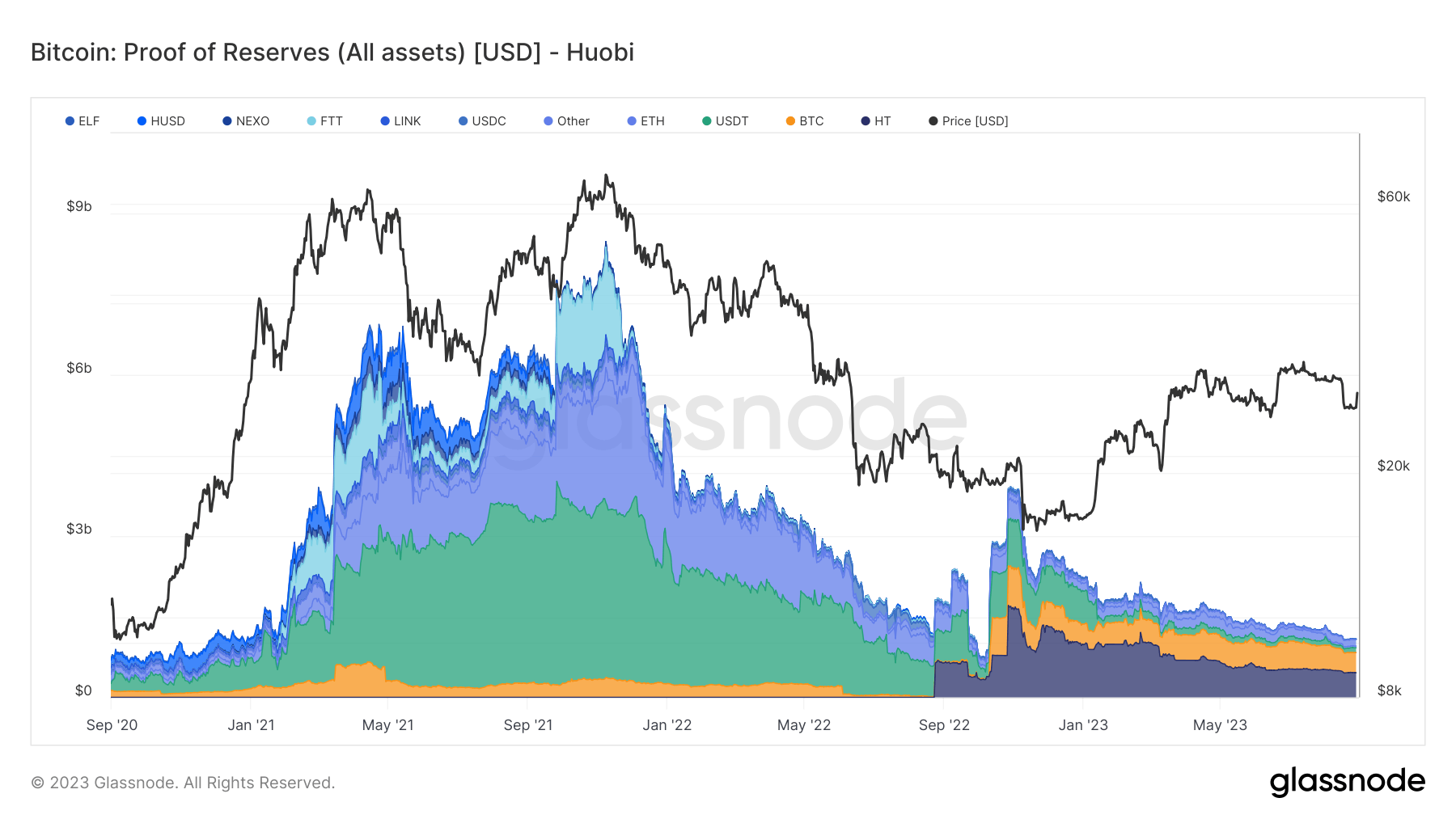

Nonetheless, context is essential right here. Binance, the biggest and hottest alternate available on the market, dwarfs Huobi in each metric. Thus, the reshuffling spikes noticed with Huobi may very well be magnified as a result of its depleting reserves.

This connection between diminishing reserves and pronounced destructive reliance ratios may very well be regarding. It means that property are being moved internally with larger frequency and being transferred out of Huobi at a rising fee.

The correlation between Huobi’s dwindling reserves and its important destructive reliance ratios would possibly point out eroding confidence within the platform. Whereas these metrics don’t definitively label an alternate as high-risk, the approaching months will present if these indicators are passing anomalies or precursors to a extra profound shift.

The put up Huobi seeing elevated outflows to opponents based on new reliance metrics appeared first on CryptoSlate.