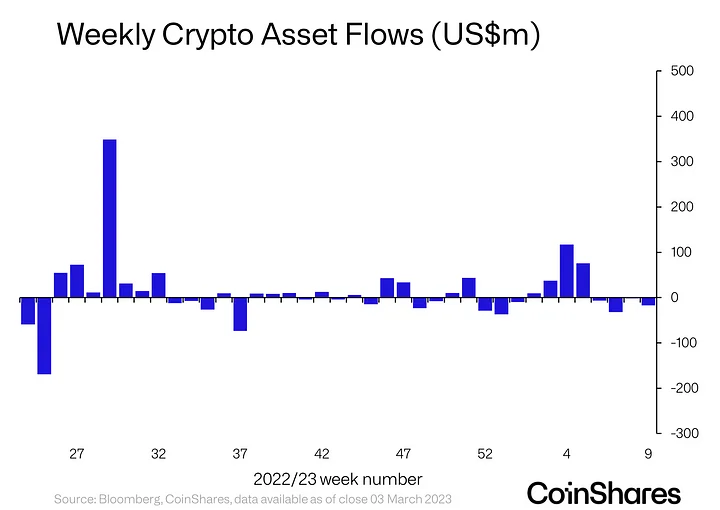

Digital belongings supervisor CoinShares says institutional crypto funding merchandise suffered their fourth consecutive week of outflows final week.

In its newest Digital Asset Fund Flows Weekly Report, CoinShares finds that institutional crypto funding merchandise suffered outflows of almost $20 million final week, together with minor inflows into quick funding merchandise.

“Digital asset funding merchandise noticed minor outflows totaling US$17m final week, marking the 4th consecutive week of adverse sentiment.”

Bitcoin (BTC) merchandise took the heaviest hit of outflows at $20.1 million. In the meantime, short-Bitcoin merchandise noticed minor inflows of $1.8 million. Quick-BTC merchandise have loved the second highest year-to-date inflows, about $50 million to Bitcoin’s $126 million.

Coinshares says it believes regulatory uncertainty could also be the reason for buyers speeding to short-BTC merchandise.

“Regardless of the current inflows into short-bitcoin, whole belongings beneath administration (AuM) have risen by solely 4.2% YTD [year-to-date] in comparison with long-bitcoin AuM having risen by 36%, suggesting quick positions haven’t delivered the returns some buyers anticipated this 12 months thus far. Nonetheless, it seemingly represents continued investor considerations over regulatory uncertainty for the asset class.”

Most altcoin funding merchandise loved minor inflows final week. Multi-asset funding automobiles, these investing in a basket of digital belongings, raked in $0.8 million in inflows final week. Ethereum (ETH) merchandise took in $0.7 million, whereas Solana (SOL) automobiles took in $0.3 million. Binance (BNB) and Cosmos (ATOM) merchandise each suffered minor inflows, $0.4 million and $0.2 million, respectively.

Do not Miss a Beat – Subscribe to get crypto e-mail alerts delivered on to your inbox

Test Worth Motion

Comply with us on Twitter, Facebook and Telegram

Surf The Each day Hodl Combine

Disclaimer: Opinions expressed at The Each day Hodl are usually not funding recommendation. Traders ought to do their due diligence earlier than making any high-risk investments in Bitcoin, cryptocurrency or digital belongings. Please be suggested that your transfers and trades are at your individual danger, and any loses chances are you’ll incur are your accountability. The Each day Hodl doesn’t advocate the shopping for or promoting of any cryptocurrencies or digital belongings, neither is The Each day Hodl an funding advisor. Please notice that The Each day Hodl participates in internet affiliate marketing.

Featured Picture: Shutterstock/Aleksandr Kukharskiy