- Optimism Goerli nodes halted briefly, enterprise went on as standard for Optimism

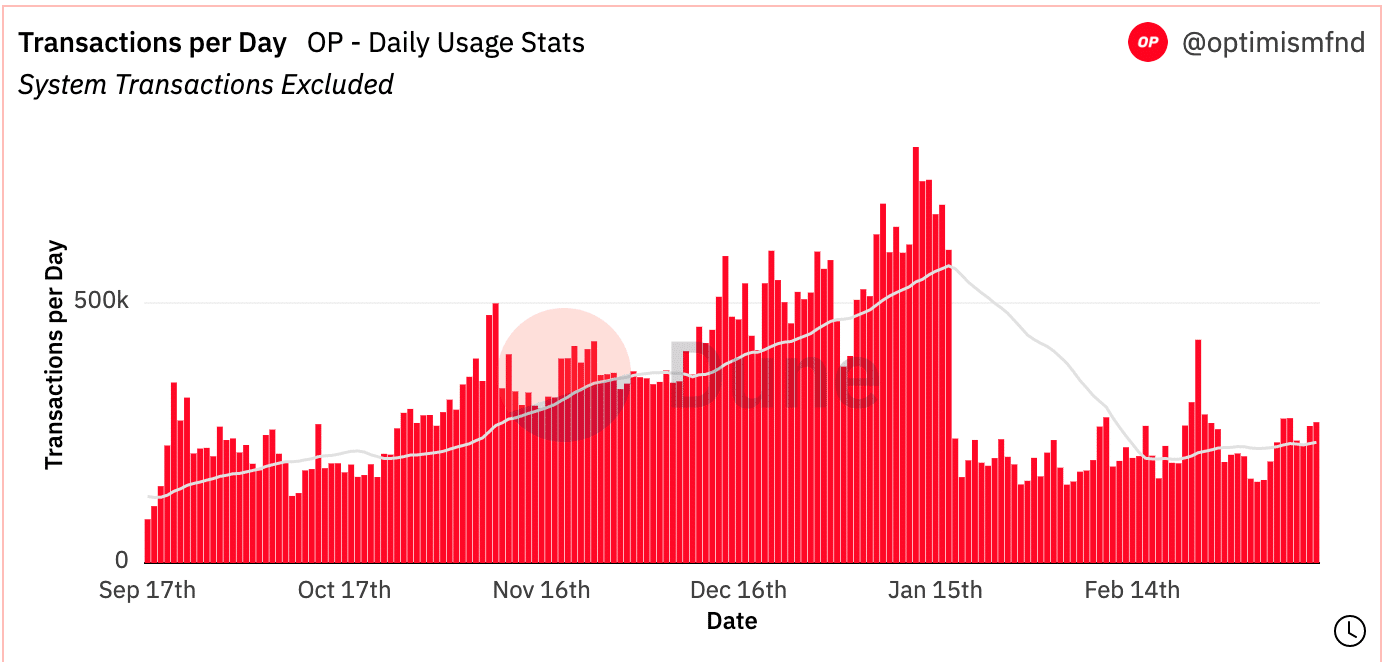

- Spike in day by day transactions noticed whereas charges collected declined on the charts

The implementation of the long-anticipated Shapella arduous fork befell on Ethereum’s Goerli community on March 15. This resulted in a quick pause in Optimism‘s Goerli nodes. Goerli is a community utilized by Ethereum builders for testing functions. Nonetheless, the Optimism protocol persevered, with its ecosystem flourishing regardless of the disruption to the Goerli nodes.

Crucial replace for node operators on Optimism Goerli: Goerli’s Shapella fork precipitated a halt for Optimism Goerli nodes within the default configuration.

Node suppliers might want to add a flag to renew syncing. Full particulars could be discovered on our standing web page: https://t.co/LwPl4ASs38

— Optimism (✨🔴_🔴✨) (@optimismFND) March 14, 2023

Learn Optimism’s Worth Prediction 2023-2024

Glass half full

The expansion of Optimism’s ecosystem is clear within the neck-to-neck competitors for its tenth grant cycle. This cycle obtained a excessive variety of functions, with many builders and functions competing for a grant to construct on the community. The incentives to construct on Optimism may assist the protocol in attracting extra builders and customers to the community.

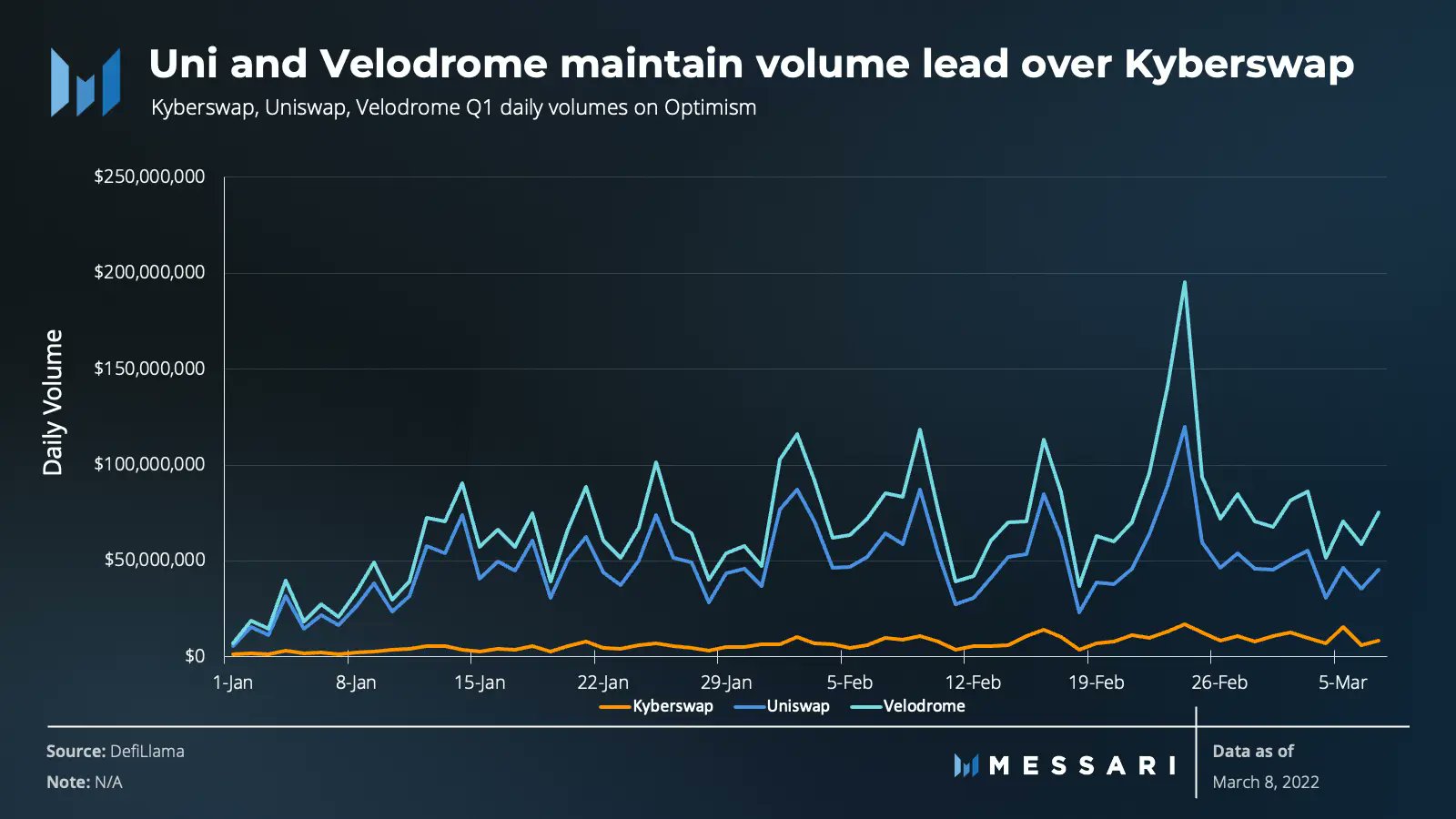

One of many candidates is a dApp known as KyberSwap, which has seen its Optimism-based volumes develop by 9 instances over the previous 12 months. Whereas Uniswap and Velodrome nonetheless maintain a lead over KyberSwap when it comes to quantity, the incentives to construct on Optimism are attracting extra builders and customers to the community.

Supply: Messari

One other signal of the community’s enlargement is the rise in its transaction quantity. The identical has elevated from 159,600 transactions to 269,700 transactions over the previous few months.

Nevertheless, regardless of this hike, the charges generated by the protocol have declined. This, possible as a result of better competitors amongst layer-2 options, one thing that has pushed down charges generated by the community.

Supply: Dune Analytics

And the state of OP is…

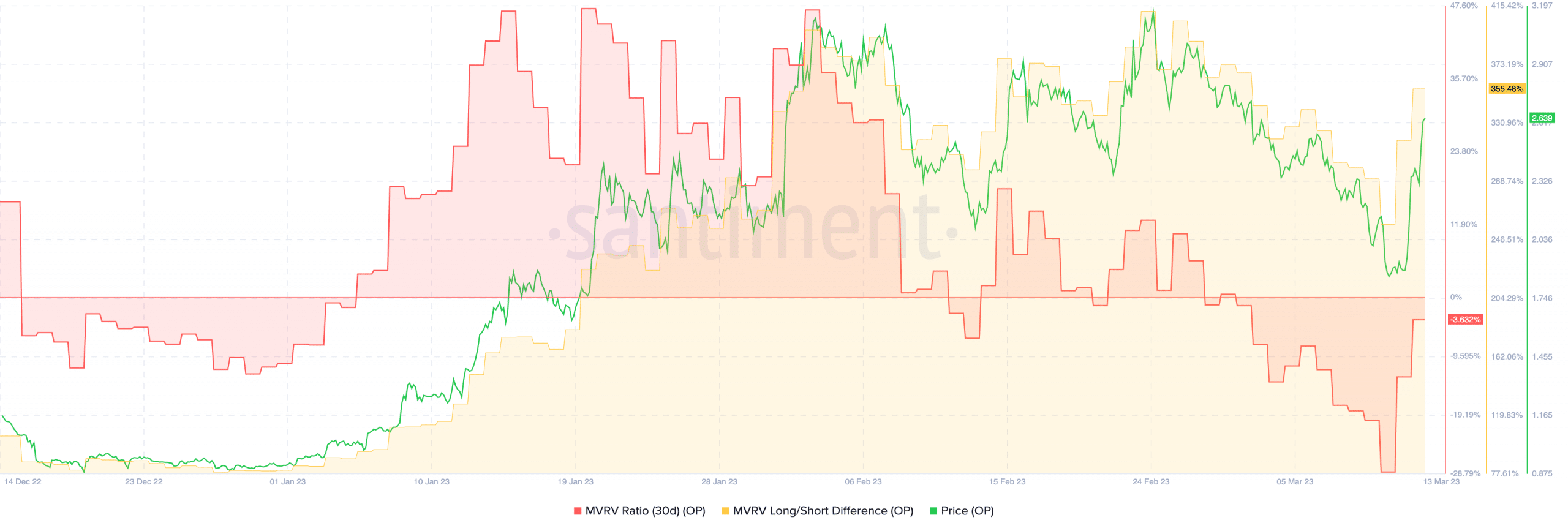

Regardless of the decline in charges, the worth of the OP token has continued to rise. This can be a signal that buyers think about the long-term potential of the Optimism community. Coupled with that, the MVRV ratio for OP declined, indicating that the majority holders wouldn’t revenue in the event that they offered their holdings. This can be a signal that there’s low promoting stress on OP at this level.

Reasonable or not, right here’s OPs market cap in BTC’s phrases

Moreover, the lengthy/quick distinction for the OP token has been extremely constructive too. That is proof that many holders are long-term buyers who’re unlikely to promote their holdings.

Supply: Santiment